VN-Index started the week’s trading with a “dark” Monday, losing nearly 60 points and piercing through the psychological marks of 1,250 and 1,230 points. Tuesday’s session was seen as the most positive of the week, but the VN-Index continued to decline further in the following two sessions, closing the week at 1,174 points. In just one week, the benchmark index

plummeted 8%

, equivalent to a drop of 101.75 points.

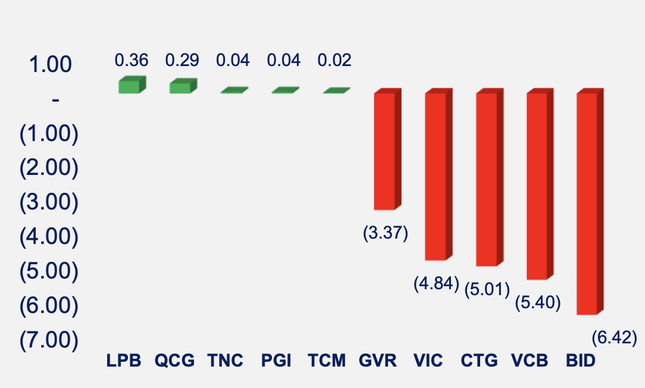

All industry groups declined in unison, with the

banking sector

having the greatest impact on the index, namely BID, CTG, and VCB. Foreign investors net sold more than VND1,500 billion, with VHM and FUEVFVND (VN-Diamond fund certificates) being the most heavily sold stocks with net sell values of VND677 billion and VND384 billion, respectively.

The banking sector had the strongest impact on the index, particularly BID, CTG and VCB.

According to Mr. Pham Binh Phuong – a specialist from Mirae Asset Securities, there are many negative developments on the macro front, therefore, the VN-Index is generally in a state of risk.

During the week, investors were continuously bombarded with

negative news

of a macroeconomic nature, such as: the USD/VND exchange rate continuously hitting record highs;

Middle East tensions

; and foreign investors net selling.

In the short term, according to Mr. Phuong, the 8% decline in one week may stimulate bottom-fishing sentiment among investors with high cash positions. Therefore, the VN-Index is expected to have a technical recovery rally.

With the VN-Index continuously losing points, the analysis team of Saigon – Hanoi Securities (SHS) is concerned that the risk of the index falling to deeper levels is increasing. Short-term investors should take advantage of the

recovery rallies

to reduce their portfolio weight to a safe level. For medium- and long-term investors, the market is moving back into a wide accumulation channel of 1,150 points – 1,250 points, and this process may be prolonged. Therefore, medium-term investors should not disburse funds in the current context and should patiently wait for a more reliable accumulation rhythm.

According to SHS, among the macro parameters, the noteworthy point is weak credit growth, indicating that the economy’s ability to absorb capital is low.

Exchange rates

are still high, the difficulties with the real estate market, especially corporate bonds, have not yet taken a fundamental turn.

The good and bad macro situation, and the increasing uncertainty in the world, are partly the reason why the stock market is under pressure to adjust.

Bao Viet Securities (BVSC) believes that the market is facing

exchange rate pressure

, and fear of

interest rate hikes

. This pressure is likely to cause the market to continue its downward trend in the trading sessions next week. The next support zone of the VN-Index is around 1,140 – 1,160 points. Investors with a high stock weight or using margin can take advantage of intraday rallies to reduce their weight.

Vietcombank Securities (VCBS) believes that the market, at present, does not show any signs of a clear recovery. With this scenario, VCBS recommends that investors continue their portfolio

risk management

measures, keeping their stock weight at a low level (below 30%), taking the opportunity to restructure their portfolios when there is a recovery rally, and avoiding using margin and bottom-fishing early at this time.