Online

TLG organizes 2024 annual general meeting of shareholders on the morning of April 23, 2024

|

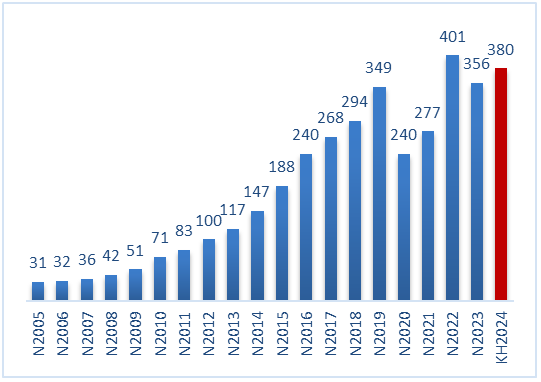

2024 profit after tax target increases by 7%, reaching 380 billion VND

|

2024 profit after tax plan of TLG. Unit: billion VND

Source: VietstockFinance

|

In 2024, TLG aims for a net revenue of 3,800 billion VND and profit after tax of 380 billion VND, respectively increasing by 10% and 7% compared to the implementation in 2023. The company also plans to keep the dividend ratio at 35%/par value as in 2023.

In January 2024, the company estimated net revenue of 241 billion VND, an increase of 10% compared to the same period, equivalent to a revenue of about 7.8 billion VND/day. Profit after tax is estimated to reach 18 billion VND, an increase of 57%. With the achieved results, TLG has implemented more than 6% of the revenue target and nearly 5% of the annual profit target.

2023 dividend payment at a rate of 35%

TLG said that 2023 was a year of great difficulty and challenges for the domestic business sector. In addition to the trend of consumer spending cuts, the Vietnamese stationery market has also witnessed the penetration and competition of many foreign rivals.

On the other hand, the export of processed products was also severely affected by the monetary tightening policies in the American and European markets. Major retailers in the US and Europe prioritize clearing inventory over placing new orders, causing most of Thien Long’s large processing customers to reduce orders over the past year, leading to a 38% decrease in export revenue in the processing sector compared to the same period. That is the reason why Thien Long’s export revenue in 2023 modestly reached 813 billion VND, a decrease of about 2% compared to the same period in 2022.

| TLG‘s business results over the years |

Due to the above reasons, in 2023 TLG achieved 3,461 billion VND of net revenue and nearly 359 billion VND of net profit, respectively decreasing by 2% and 11% compared to the previous year. Compared to the plan set out, the company only achieved 87% of the revenue target and 90% of the profit target.

With the achieved results, TLG submitted to the General Meeting of Shareholders for approval a dividend ratio of 35% in 2023, of which the cash dividend ratio is 25%, lower than the 35% in 2022.

From 2019-2021, TLG consecutively paid cash dividends to shareholders at a rate of 20% and suddenly surged to 35% in 2022.

In July 2023, TLG disbursed an interim dividend for 2023 at a rate of 15% in cash, equivalent to nearly 117 billion VND. For the remaining dividends, the company proposed to divide into 2 forms, including 10% in shares and 10% in cash.

Accordingly, TLG plans to issue a maximum of nearly 7.9 million shares to pay dividends from retained earnings after tax as of December 31, 2023, according to the audited consolidated financial statements for 2023. Expected in the second and third quarters of 2024.

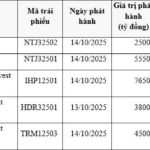

Issue 864,538 ESOP shares at a price of 10,000 VND/share

To motivate and increase the solidarity of employees with the company, the Board of Directors proposed to seek the opinion of the General Meeting of Shareholders to issue shares under an employee stock ownership plan (ESOP) with conditions and divided into two stages:

Stage 1: Based on the business results of 2024, the consolidated net revenue reaches a minimum of 4,000 billion VND, TLG will issue a maximum of 864,538 ESOP shares, equivalent to 1% of the shares outstanding (including shares to pay dividends in 2023). The expected offering price is 10,000 VND/share – 79% lower than the market price of TLG at the end of the trading session on April 22 (47,800 VND/share).

These shares will be restricted from transfer within 2 years from the end date of the issuance. The eligible participants include members of the Board of Directors, the General Management Board; Chief Accountant and management positions of TLG and subsidiaries belonging to the group.

The total proceeds from the issuance are estimated to be nearly 9 billion VND, which will be used by TLG to supplement working capital for business operations. The implementation time is after the State Securities Commission announces the receipt of all necessary issuance report documents.

|

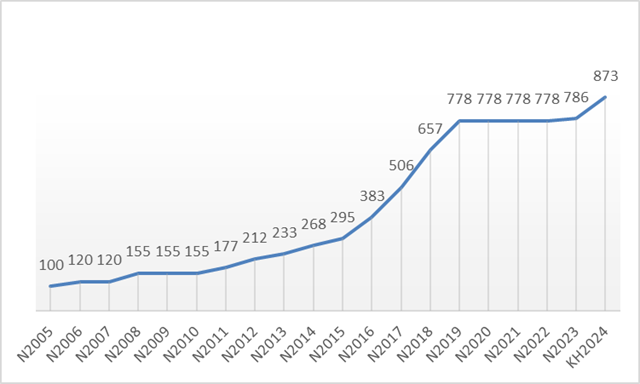

Capital increase process of TLG. Unit: billion VND

Source: VietstockFinance

|

If the above plan is completed, TLG‘s charter capital will be increased from nearly 865 billion VND to more than 873 billion VND.

Stage 2: Based on the business results of the period 2025-2026, the consolidated net revenue reaches a minimum of 5,000 billion VND and a minimum of 6,000 billion VND, respectively, TLG will submit to the General Meeting of Shareholders a plan to issue additional shares at each achieved revenue level, which is 1% of ESOP shares based on the number of shares outstanding at the time of issuance that meets legal regulations.

On the other hand, TLG plans to remove the printing business line (specifically tampon printing, screen printing, flexo printing, etc.).

Stay tuned for updates…