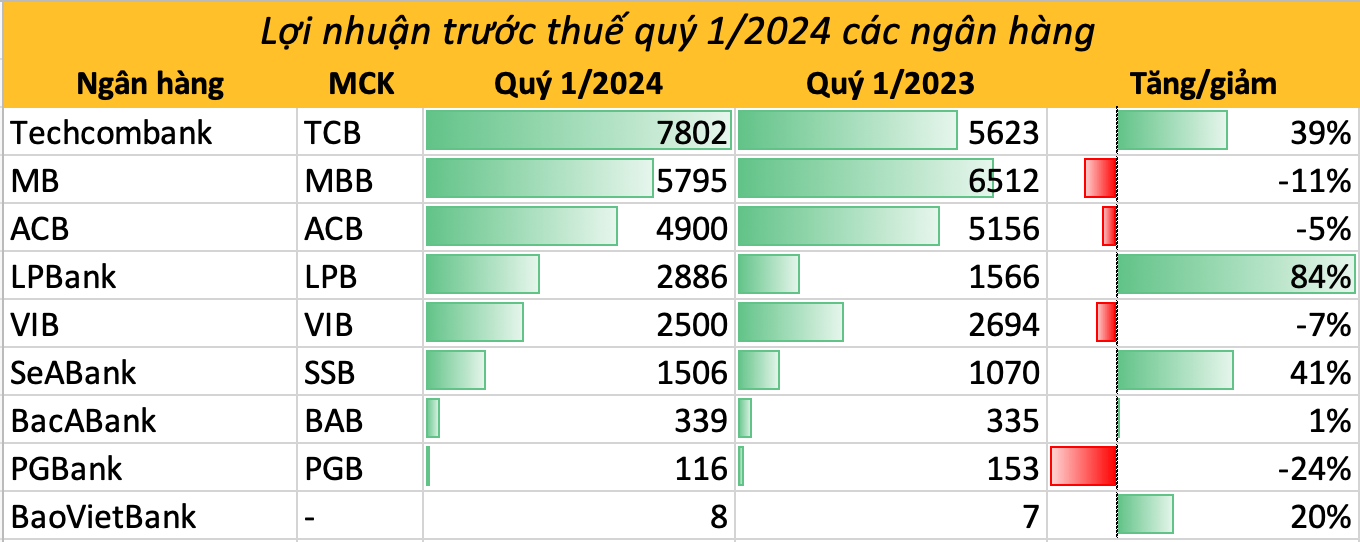

Among them, six banks have published their financial reports, namely Techcombank, MB, LPBank, PGBank, BacABank, and BaoVietBank. In addition, some banks have announced their preliminary business results, such as SeABank, ACB, and VIB.

Techcombank: Pre-tax profit reached VND 7,802 billion, up 38.7%

According to the consolidated financial statement, TCB’s pre-tax profit in Q1/2024 reached VND 7,802 billion, an increase of 38.7% compared to the same period in 2023. The cost-to-income ratio (CIR) decreased sharply from 33.8% in the same period to 26.5%.

At the end of Q1/2024, Techcombank’s total assets increased by 4.3% compared to the end of 2023, to VND 885.7 thousand billion. For the parent bank alone, credit growth was 6.4% compared to the beginning of the year, reaching VND 563.9 thousand billion. Notably, Techcombank’s outstanding debt outside the real estate sector increased by 38%.

Techcombank’s customer deposits grew by an impressive 18.3% year-on-year and remained stable compared to the beginning of the year, reaching VND 458 thousand billion. In which, demand deposits (CASA) increased by 49.4% year-on-year and 2% compared to the end of 2023, helping the ratio of demand deposits to total deposits increase to 40.5%, the highest in the system.

The loan loss provisioning ratio increased to 106% from 102% at the end of last year.

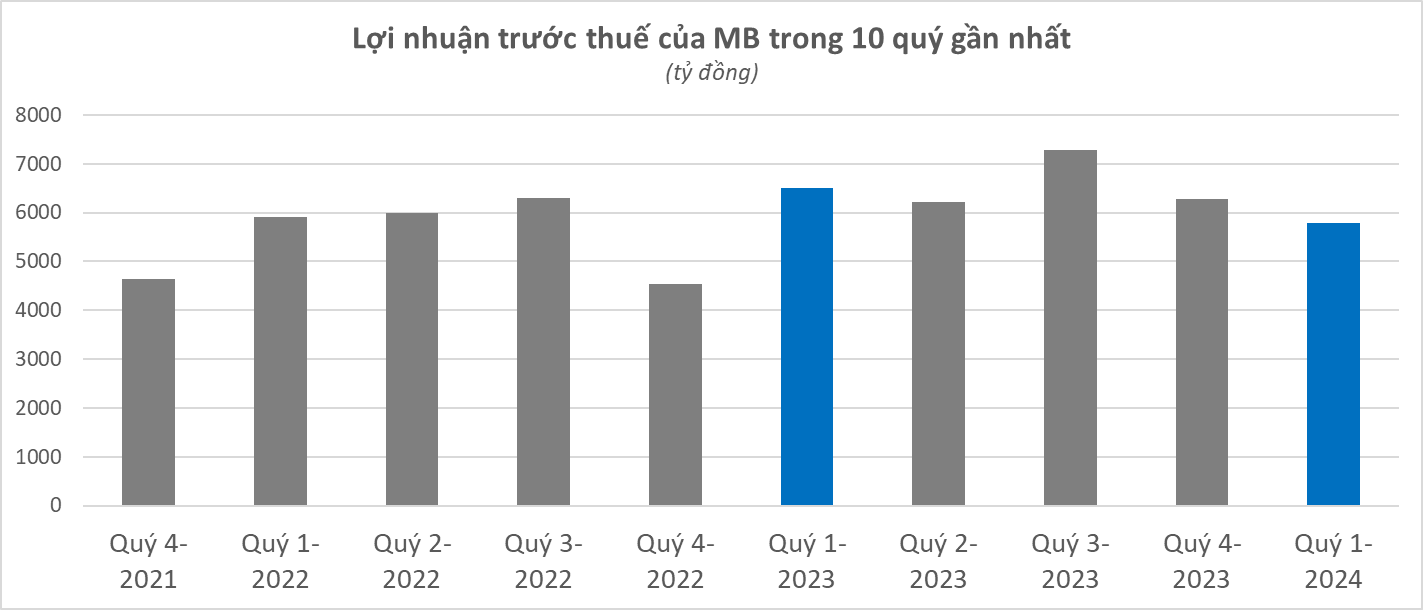

MB: Pre-tax profit close to VND 5,800 billion, down by 11%

The bank’s consolidated pre-tax profit in Q1/2024 reached VND 5,795 billion, down 11% compared to the same period in 2023. In which, the pre-tax profit of the parent bank was VND 5,258 billion, down 10%.

The bank’s net interest income in the first quarter was only VND 9,062 billion, down 11.4% year-on-year. Meanwhile, non-credit business segments had positive results. In which, profit from trading in government securities reached VND 965 billion, 26 times higher than the same period last year.

MB significantly increased its risk provision expenses by 46.4% to VND 2,707 billion.

MB’s outstanding customer loans grew slowly, increasing by only 0.7% in the first 3 months of 2024. Although in 2023, MB was one of the banks with the highest credit growth rate (nearly 29%). Regarding loan quality, bad debts at MB increased by 56% in 3 months to VND 15,294 billion. Accordingly, the ratio of bad debts to outstanding loans increased from 1.6% to 2.49%.

Customer deposits at MB decreased by 1.5% in the first quarter to VND 558,826 billion. The CASA ratio dropped from 40.2% (end of 2023) to 36.6% (end of March 2024).

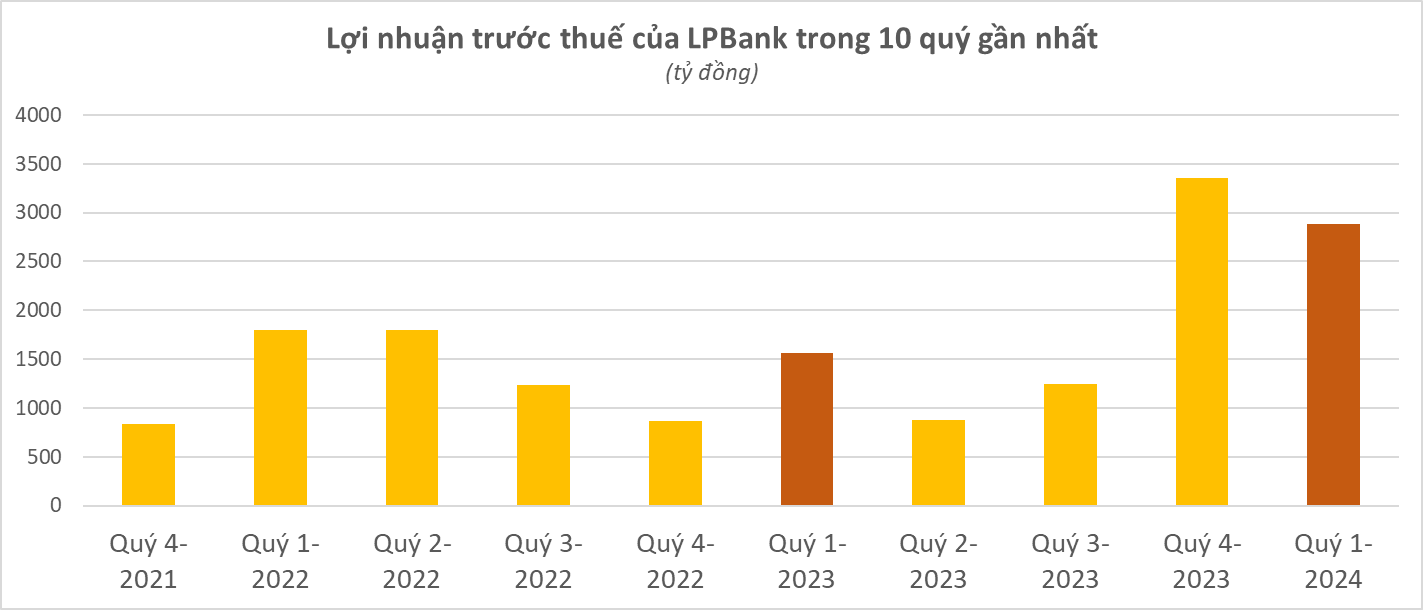

LPBank: Pre-tax profit close to VND 2,900 billion, up 84%

According to the newly released financial report of LPBank, pre-tax profit in Q1/2024 reached VND 2,886 billion, an increase of 84.36% year-on-year, completing 27.49% of the annual plan. Profit after tax reached VND 2,299 billion, up 84.88% year-on-year.

LPBank’s profit accelerated thanks to a sharp increase in net interest income from the service segment, nearly 4 times higher than the same period in 2023. In addition, the increase in net interest income along with the reasonable control of operating expenses are also factors contributing to LPBank’s strong profit growth.

As of March 31, 2024, LPBank’s total assets reached nearly VND 409,764 billion, an increase of over 7% compared to the beginning of the year. In which, the outstanding loans to customers increased by more than 11.7% to nearly VND 307,687 billion with a bad debt ratio of 1.39%. Customer deposits reached over VND 261,994 billion, an increase of nearly 10.4%.

BacABank: Pre-tax profit of VND 339 billion, up 1%

BacABank announced its financial report for Q1/2024 with pre-tax profit reaching VND 338.6 billion, up 1% compared to the same period last year. The bank’s after-tax profit was VND 270.9 billion, up 0.7%.

In the first quarter of the year, Bac A Bank’s growth momentum came from net interest income, while other business segments of Bac A Bank all declined compared to the same period last year.

As of March 31, 2024, Bac A Bank’s total assets reached VND 149,353 billion, down 1.9% compared to the end of last year. Loans to customers increased by 0.7% to VND 100,543 billion. Customer deposits at Bac A Bank also decreased by 0.3% to VND 118,125 billion.

In Q1, Bac A Bank’s bad debt balance increased by 22.1% to VND 1,118 billion. This pushed the bad debt ratio up to 1.11%, compared to 0.92% at the end of last year.

PGBank: Pre-tax profit of VND 116 billion, down 24%

According to the report, the bank’s pre-tax profit in the first quarter reached VND 116 billion, down 24% compared to the same period in 2023. After-tax profit was VND 93 billion, down 24%.

The main reason for the decline in PGBank’s profit comes from the reduction in non-credit revenue sources and the increase in operating expenses.

As of March 31, 2024, PGBank’s total assets were VND 58,764 billion, an increase of 5.9% compared to the beginning of the year. Outstanding customer loans decreased by 0.4% to VND 35,185 billion. Customer deposits increased by 4.2% to VND 37,244 billion. Bad debt at the end of Q1 was VND 1,033 billion, an increase of 2.4% compared to the beginning of the year. The ratio of bad debts to total outstanding customer loans increased from 2.85% to 2.93%.

VIB: Pre-tax profit of more than VND 2,500 billion