Illustrative photo

Vietnam holds a commodity dubbed a lifesaver for China’s animal husbandry industry – animal feed and raw materials. With an output of nearly 27 million tons, our country currently ranks 8th globally, with the largest importer being our neighbor China. The demand for animal feed for the meat industry in this nation is massive, forcing the world’s number one meat producer to rely on imports, including from Vietnam.

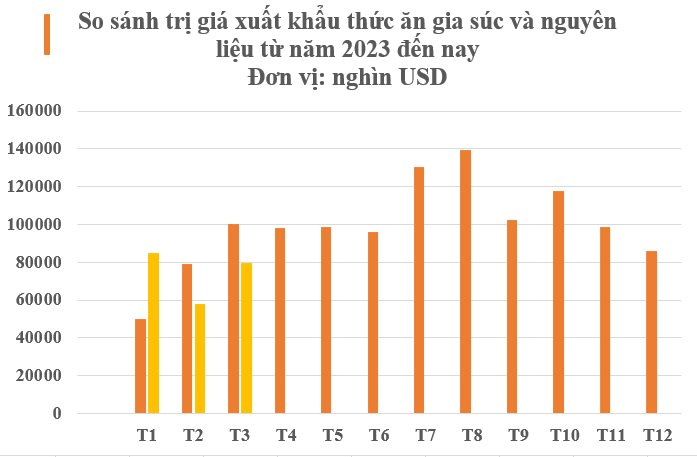

According to preliminary statistics from the General Department of Customs, in March 2024, exports of animal feed and raw materials brought in over 79.5 million USD, a robust increase of 36.7% compared to the previous month. For the first three months of the year, our country earned over 222 million USD from exports of this commodity, a slight decrease of 3.14% compared to the same period in 2023.

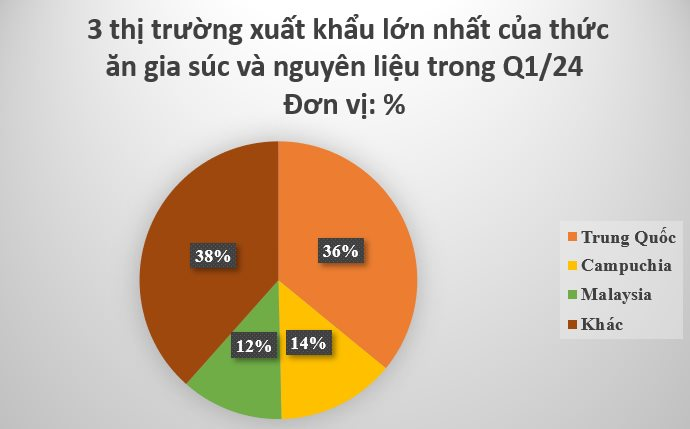

In terms of markets, China continues to hold the position as the largest import market for animal feed and raw materials from Vietnam, with over 79 million USD; however, a 20% reduction compared to the same period last year. In March 2024 alone, exports to this market increased by a substantial 47% compared to the previous month, reaching over 31 million USD.

Cambodia is the second largest market for Vietnam, with over 30.5 million USD, accounting for 13.7%. The US ranks third with over 27 million USD, representing 12.5%, and exports to the US have also witnessed a strong growth of 154% compared to the same period last year.

Besides the three major markets, Asian countries are increasing imports of this commodity from Vietnam, including the Philippines, Taiwan (China), Thailand, India, and others.

The Department of Animal Husbandry (Ministry of Agriculture and Rural Development) said that the country currently has 269 factories producing compound industrial animal feeds with a total designed capacity of 43.2 million tons. Of which, 90 factories are owned by FDI enterprises (accounting for 33.5% in terms of quantity; 51.3% in terms of designed capacity) and 179 factories belong to domestic enterprises (66.5% in terms of quantity and 48.7% in terms of designed capacity).

The animal husbandry industry in Vietnam is currently witnessing strong growth potential. Mordor Intelligence pointed out that the size of Vietnam’s mixed animal feed market is expected to increase from 11.54 billion USD in 2023 to 15.30 billion USD in 2028.

The market assessment report on animal feed by the Vietnam Market Research Company (VIRAC) also indicated that with strong growth potential in recent years, the Vietnamese animal feed market is attracting many businesses to participate, including many businesses with foreign direct investment expanding their production businesses. Such names include: Cargill Group (USA), Haid (China), CP Group (Charoen Pokphand Group – Thailand), De Heus (Netherlands), BRF (Brazil), Mavin (France), Japfa (Singapore), CJ (South Korea), etc.

However, currently, the biggest difficulty in the animal feed industry is the limited capacity of domestic raw material production for the industry, which heavily relies on imported raw materials. It is estimated that imported animal feed raw materials account for about 65% of the total demand for animal feed raw materials in the country.