ANV Q1 2024 Business Results

|

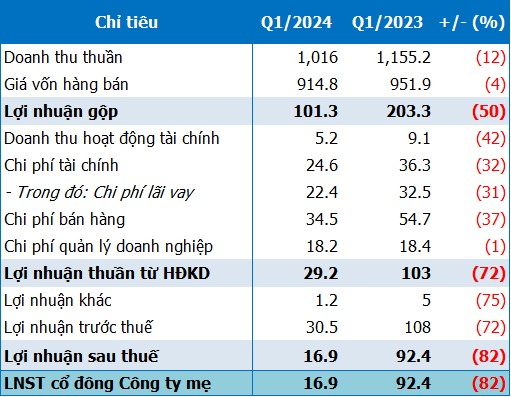

ANV Q1/2024 Business Results (Unit: Billion VND)

Source: VietstockFinance

|

|

|---|---|

|

Revenue

1,016.0 (-12.0%)

|

Gross Profit

101.0 (-50%)

|

|

Net Financial Income

5.2 (-42%)

|

Net Income

17.0 (-82%)

|

Key Highlights

Revenue decreased by 12% YoY to VND 1,016 billion, primarily driven by a decline in finished goods sales.

Gross profit margin narrowed to 10% from 18% in the same period last year.

Net financial income dropped by 42% due to a significant decline in interest income from time deposits.

Net income plunged by 82% to VND 17 billion, representing only 5.6% of the company’s annual target.

Total assets declined slightly by 1% to VND 5,062 billion as of March 31, 2024.

Liabilities decreased by 3% to VND 2,198 billion, with short-term borrowings and lease liabilities declining.

ANV’s stock price has witnessed a drop of over 4% YTD.

Outlook

ANV aims to achieve an eight-fold increase in net income for 2024 compared to 2023. However, the company faces challenges in executing this ambitious plan amidst declining revenues and margins.

Disclaimer:

This financial summary is based on publicly available information and should not be construed as investment advice.