Sir, recently, the real estate price in Ha Noi has increased significantly. The market has heated up sooner and exceeded all previous forecasts. In your opinion, what is the main reason for this?

The real estate market is now moving faster than all previous forecasts. If we look at the macro economy, the global situation, and even politics, we all thought that the stimulus packages and new policies would only have a clear impact on real estate by the end of this year or early next year. However, at present, I see that the market is reacting faster than all of these forecasts.

There are many reasons for this, but the main one is that the amount of money deposited by customers in banks has been accumulating for a very long time, around 8 million billion VND. Meanwhile, for more than a year, the State Bank has continuously directed commercial banks to reduce interest rates, and as of now, the short-term mobilization interest rate has reached its lowest level in history at 1.7%.

There is a lot of pressure from the money that is being withdrawn from savings and poured into the market. However, it takes a long time for the economy to absorb such a large amount of money, just like after planting rice we have to take care of the grass before we can harvest.

So, to make the quickest profit, where will the money flow from the bank? If you deposit your savings at such low rates as they are now, you will lose money after deducting inflation. With the need to preserve assets, i.e., keep money safe, gold and the dollar are no longer good investment channels as their prices have increased tremendously. Thus, real estate remains the channel that attracts capital as prices are still at their lowest after two years of decline.

The unusual surge in apartment prices has led to many opinions that the real estate bubble is returning, do you agree?

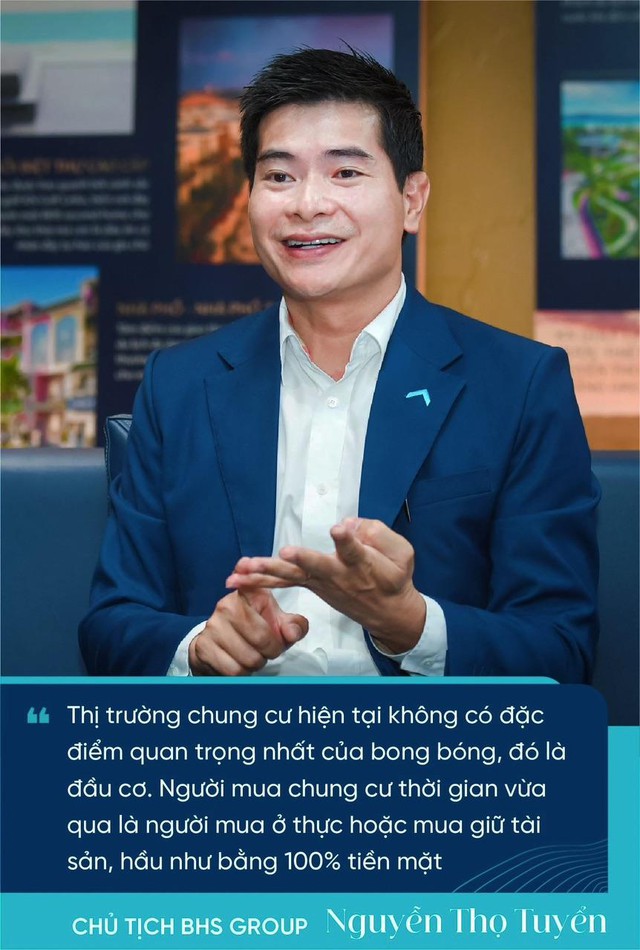

Many people believe that there is a speculative phenomenon with apartments in Hanoi, and that the bubble is returning to the market. The Ministry of Construction has even requested that Hanoi rectify and handle speculative behavior, as well as price gouging in the apartment market. However, I deny the opinion that the apartment market is being manipulated.

The reason is that the current market lacks the most important characteristic of a bubble, which is speculation. Speculation is when investors use financial leverage to buy property, and then when the price turns around, they sell everything off. When you buy a lot of property, it creates a big bubble, and when you sell it off, the bubble bursts.

However, in the recent past, almost 100% of the people who bought apartments in Hanoi were either actual buyers or people who were buying to hold onto the asset, using 100% cash. In recent times, no one has spent money to buy apartments for speculation. If they were speculating, they would have to go to areas far from the center of Hanoi where prices are still low.

If it’s not speculators, then who is the typical real estate buyer in the current market, sir?

I believe that this is not a return of old investors, but rather a new behavior from a new class of customers. The flow of money from this class of investors has ignited the real estate market right in the center of Hanoi. The evidence is that recently, houses in alleys in Hanoi have had very high liquidity, increasing continuously by 20-30%. Then came apartments and low-rise buildings in suburban urban areas, which also increased significantly.

And when the money flows out into the market and prices rise, there will be buyers and there will also be sellers. When prices are high, sellers can get rid of their inventory and collect the proceeds. The question is, after the flow of money has caused Hanoi real estate to explode, where will the next explosion be?!

After Hanoi apartments, what do you think the next explosive segment will be?

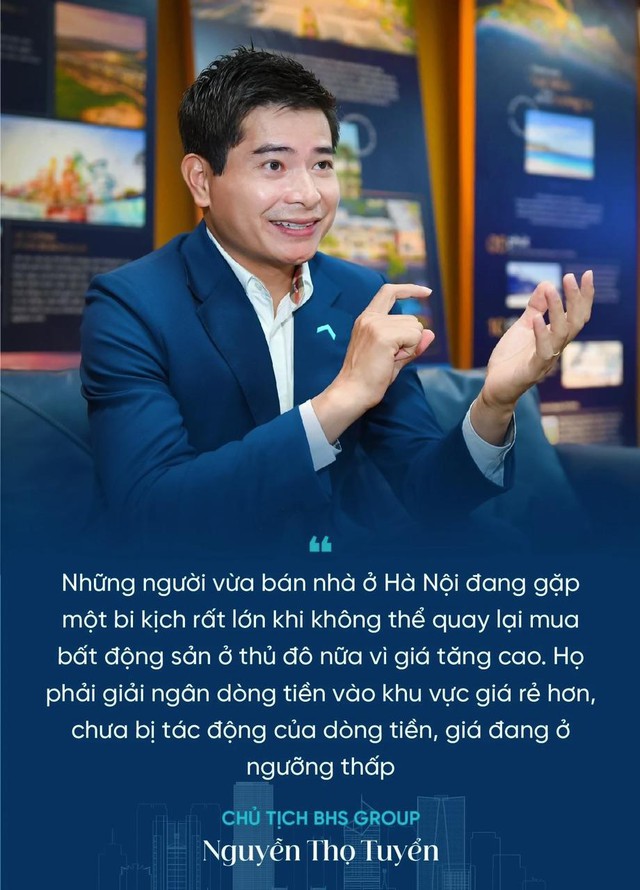

With interest rates as they are now, keeping money in the bank means “losing money”, and buying real estate in Hanoi means losing even more money because prices have continued to rise since the last sale. Investing in gold is really not a game for everyone because the price of gold fluctuates erratically, and the dollar is heavily influenced by imports and exports, as well as politics. That’s why people who have just sold their homes in Hanoi are facing a huge tragedy. They have to disburse their money into real estate in cheaper areas that have not yet been affected by the new flow of money, where prices are still low.

The product they are looking for must have solid legal status. They cannot sell an apartment with a red book and buy a property elsewhere that does not have sufficient legal prerequisites. That is why real estate with a red book is the best, and especially those with the potential for price increases.

In addition, auctioned land products in the provinces will also be very good because they are located in central locations and have clear legal status. In particular, over the past two years, the provinces have hardly had any successful auctions, and according to the principle, the prices of subsequent auctions will decrease. Thus, the auction prices in the provinces are also very reasonable.

Therefore, I think that sooner or later, after the real estate boom in Hanoi, it will spread to other provinces. These could be land auction products or products located in the center of the provinces.