Yesterday’s trading session’s recovery efforts were short-lived as a large volume of sell orders flooded the market today, triggering significant selling pressure. The index had no chance of breaking above the reference point and ended the session down nearly 13 points to 1,177 points. It was a harrowing trading session for accounts that had reduced their holdings in the previous session, but there was also significant pressure on positions that had been bought at the bottom yesterday.

The market breadth was negative, with 360 stocks declining compared to 117 gaining. Securities fell by 2.43%; Real estate fell by 2.51%; Oil and gas fell by 1.63%; Banking fell by 0.68%; Seafood fell by 1.49%; Construction materials fell by 1.72%; Chemicals fell by 2.08%.

Top stocks that dragged down the index today included VHM (-1.33 points), GVR (-1.08 points), CTG (-1.05 points), BID (-0.98 points), and VIC (-0.94 points). Others included MBB and MSN. On the other hand, TCB, with strong first-quarter earnings, pushed the index up by 0.82 points; FPT pushed it up by 0.62 points, and MWG contributed a further 0.43 points.

Trading volume across the three exchanges increased to VND 19,300 billion today, with foreign investors selling a net VND 286.2 billion, and VND 368.7 billion in the order-matching session alone.

Foreign investors were net buyers in order-matched transactions in the Basic Materials and Retail sectors. Top order-matched net purchases by foreign investors included HPG, MWG, SSI, VCB, KDH, DGC, CMG, CTD, PVT, and SCS.

Foreign investors were net sellers in order-matched transactions in the Real Estate sector. Top order-matched net sales by foreign investors included VHM, DIG, MSN, VND, SHB, DXG, PDR, NLG, and LPB.

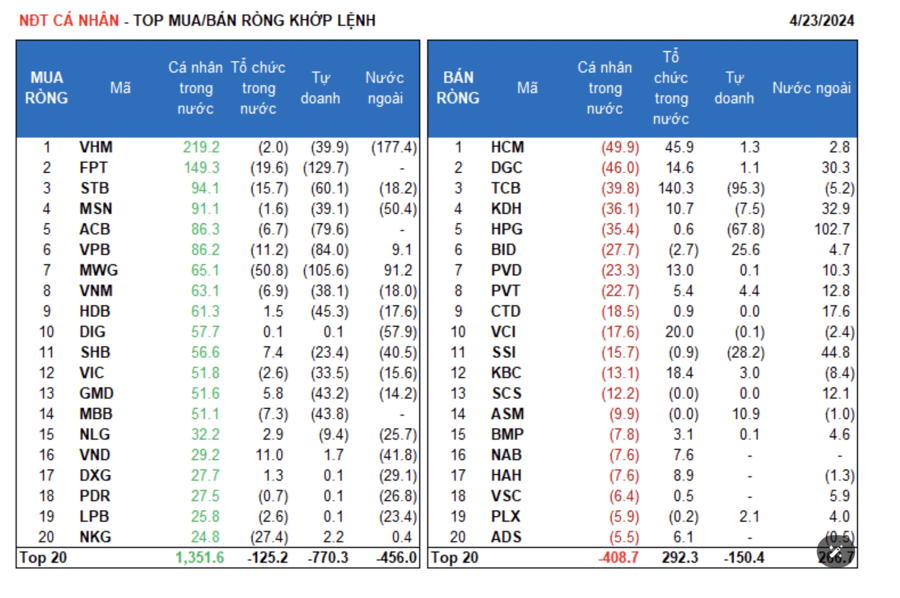

Domestic individual investors were net buyers of VND 1,121.6 billion, of which VND 1,271.8 billion was in order-matched transactions. In order-matched transactions alone, they bought 12 out of 18 sectors, mainly the Banking sector. Top net purchases by domestic individual investors included VHM, FPT, STB, MSN, ACB, VPB, MWG, VNM, HDB, and DIG.

They were net sellers in order-matched transactions in 6 out of 18 sectors, mainly in the Oil and Gas and Financial Services sectors. Top net sales included HCM, DGC, TCB, KDH, HPG, BID, PVT, CTD, and VCI.

Proprietary investors were net sellers of VND 1,078.2 billion, with VND 1,142.5 billion in order-matched transactions alone. In order-matched transactions alone, proprietary investors bought in 3 out of 18 sectors. The strongest buying sector was Oil and Gas, followed by Construction and Materials. Top order-matched net purchases by proprietary investors today included BID, ASM, E1VFVN30, PVT, NVL, KBC, VGC, VTP, NKG, and PLX. The top net sales were in the Banking sector, with FPT, MWG, TCB, VPB, ACB, HPG, STB, HDB, MBB, and GMD.

Domestic institutional investors were net buyers of VND 251.0 billion, with VND 239.4 billion in order-matched transactions alone.

In order-matched transactions alone, domestic institutions sold a net 7 out of 18 sectors, with the largest value being in the Information Technology sector. Top net sales included MWG, CMG, NKG, FPT, STB, VCB, BCM, VPB, VRE, and BWE. The largest net purchase value was in the Banking sector, with TCB, HCM, PNJ, FUEVFVND, VCI, KBC, CTG, VIB, DGC, and PVD.

Negotiated transactions today totalled VND 2,036.8 billion, down 6.4% from the previous session and accounting for 10.6% of total trading value.

Some noteworthy negotiated transactions in Bank stocks included EIB, VPB, OCB, and SHB.

The proportion of capital flows increased in Banking, Retail, Steel, Food, Software, Oil and Gas Equipment and Services, Warehousing, Logistics and Maintenance, and Telecommunications, while decreasing in Real Estate, Securities, Construction, Agriculture and Fisheries, Chemicals, and Oil and Gas Production and Exploitation.

In order-matched transactions alone, the proportion of trading value continued to increase in the large-cap VN30 group, while decreasing in the mid-cap VNMID and small-cap VNSML groups.