Vietnam Airlines (Vietnam Airlines Corporation JSC, ticker symbol HVN-HOSE) has released its 2023 Annual Report, highlighting significant milestones as the airline recovers strongly and achieves notable results.

Specifically, the Vietnam Airlines Group carried over 24.6 million passengers and 223,800 tons of cargo, representing increases of 14.8% and 5.1%, respectively, year-over-year. The improved operating performance has significantly boosted Vietnam Airlines’ financial results.

Accordingly, Vietnam Airlines recorded consolidated revenue of VND 93,048 billion, 29.8% higher than in 2022 and approaching the peak level of 2019. Consolidated pre-tax loss was halved compared to 2022, decreasing from VND 10,945 billion to only VND 5,363 billion.

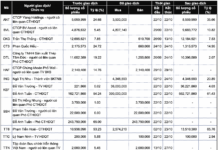

Vietnam Airlines currently has 15 subsidiaries with ownership ratios ranging from 51% to 100%, four associated companies, and investments in two other companies: Cambodia Angkor Air and Saigon Postel JSC (SPT).

According to statistics, VAECO, wholly owned by Vietnam Airlines, provides line maintenance, base maintenance, interior maintenance, and spare parts supply services to Vietnam Airlines’ entire fleet and over 80 other civilian airlines worldwide. It recorded total revenue of VND 2,403 billion, pre-tax profit of VND 142.6 billion, and ROE of 10.4%;

– VACS, wholly owned by Vietnam Airlines, recorded total revenue of VND 826.1 billion, pre-tax profit of over VND 115.1 billion, and ROE of 74%;

– Pacific Airlines, 98.84% owned by Vietnam Airlines, had total revenue of VND 4,389 billion, while pre-tax profit was a loss of VND 1,499 billion;

– VINAKO, 65% owned by Vietnam Airlines, recorded total revenue of VND 160 billion, with pre-tax profit of VND 32 billion and ROE of 283%.

– NCS, 60% owned by Vietnam Airlines, operates in the production of prepared food and beverages. It recorded total catering output of 10,741,509 meals; total revenue of VND 603.5 billion; pre-tax profit of over VND 39.1 billion; and ROE of 21.8%.

– NCTS, 55.13% owned by Vietnam Airlines, had total revenue of VND 724.1 billion, pre-tax profit of VND 272 billion, and ROE of 82.5%.

– TCS, 55% owned by Vietnam Airlines, recorded cargo handling volume of 211,814 tons and total revenue of VND 702.3 billion. TCS achieved pre-tax profit of VND 393.9 billion, resulting in an ROE of 335.9%.

– ALSIMEXCO, 55.13% owned by Vietnam Airlines, primarily operates in the supply, leasing, and import-export of labor within and outside the aviation industry. Notably, the supply of flight attendants to airlines accounts for 90-80% of the company’s revenue. ALSIMEXCO recorded revenue of VND 498 billion, pre-tax profit of VND 5 billion, and ROE of 36%;

– AITS, 52.73% owned by Vietnam Airlines, operates in the provision of information technology and telecommunications services. AITS recorded total revenue of VND 302.54 billion, pre-tax profit of VND 11 billion, and ROE of 12.23%;

– VFT, 51.52% owned by Vietnam Airlines, trains pilots for airlines in the region. It reported total revenue of VND 46.51 billion, pre-tax profit of VND 4.39 billion, and ROE of 5.1%.

– SABRE VN, 55% owned by Vietnam Airlines, operates in the establishment of reservation systems and related services through the global GDS distribution system SABRE. The company recorded revenue of VND 114 billion, pre-tax profit of VND 9.5 billion, and ROE of 131%;

– TECS, 51% owned by Vietnam Airlines, recorded cargo handling volume of 35,150 tons. TECS achieved total revenue of VND229.6 billion, pre-tax profit of VND 96.6 billion, and ROE of 149.7%.

– NASCO, 51% owned by Vietnam Airlines, primarily provides direct support services for air transport and other related support services at Noi Bai International Airport. It recorded total revenue of VND 363.48 billion, pre-tax profit of VND 11.79 billion, and ROE of 9.4%.

Regarding the financial performance of Vietnam Airlines’ four associated companies, VALC had the most favorable results, while APLACO’s figures are not yet available.

Specifically: VALC, 32.48% owned by Vietnam Airlines, operates in the purchase, sale, lease, and sub-lease of aircraft. In 2023, the company continued to lease 10 A321 aircraft to Vietnam Airlines. With the disposal sale of ATR aircraft during the year, VALC’s 2023 results include revenue of USD 76 million, pre-tax profit of USD 16.8 million, and ROE of 21%;

– MASCO, 65.05% owned by Vietnam Airlines, recorded total catering output of 1,005,161 meals in 2023. It achieved total revenue of VND 148.3 billion, pre-tax profit of over VND 3.88 billion, and ROE of 9%;

– AIRIMEX, 41.31% owned by Vietnam Airlines, primarily imports, distributes machinery, equipment, supplies, spare parts, and provides import-export services for the aviation industry. The company recorded total revenue of VND 212.7 billion, pre-tax profit of VND 5.2 billion, and ROE of 12.76%;

– APLACO, 30.41% owned by Vietnam Airlines, operates in the manufacturing of plastic products and general and high-grade plastic products, including industrial plastics, exported plastic products, household products, mold equipment, and plastic industry supplies. Due to significant challenges in 2023, Vietnam Airlines has not yet received financial statements from APLACO.