Yuanta has just released an updated 2024 banking industry outlook report with the CAMEL model, highlighting that ACB and VCB maintain their positions as the top two highest-quality banks.

The total after-tax profit of the parent company’s shareholders in 2023 for 28 listed banks reached 204 trillion VND, an increase of 4%. Among the 7 banks in the recommended portfolio, 6 banks had positive profit growth in 2023, including STB +53%, HDB +30%, BID +18%, MBB +18%, ACB +17%, and VCB +11%. Except for VPB, whose profit decreased by 45%, mainly due to FE Credit.

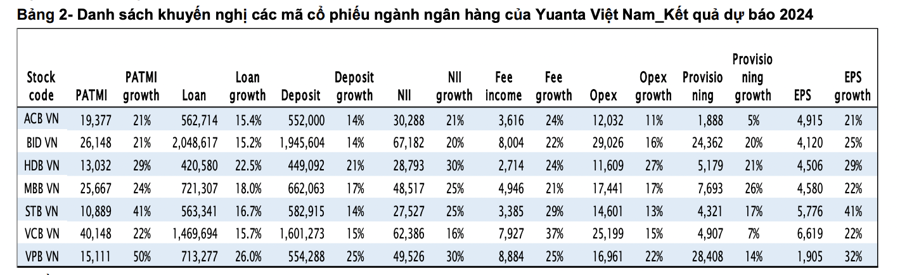

The driving force behind the 2023 profit is profit from investment securities, contributing up to 13.8 trillion VND. However, in 2024, net interest income will become the main driver based on expectations of high credit growth and reduced capital costs. Yuanta expects credit growth to reach 15% in 2024.

Asset quality deteriorated in 2023, but there is optimism about an improvement in 2024 due to expectations of economic recovery and a low-interest-rate environment. The bad debt ratio may peak amid a low-interest-rate environment and the possibility of extending Circular 02.

Although the banks have applied multiple provisioning policies at the same time, the total provision of the whole industry in 2023 increased by 3% compared to the same period last year. The pressure on provisioning will be reduced in 2024 due to expectations of improved asset quality; however, banks with low LLR ratios and high bad debt ratios may need to increase their provisioning costs.

Yuanta has updated the valuation model for the 7 banks in the recommended portfolio, applying a lower discount rate and shifting the valuation basis to 2025. VCB and ACB maintain their rankings as number 1 and number 2 in the bank ranking according to the CAMEL model in Q4/2023. VCB’s and ACB’s bad debt ratios are among the lowest in the industry, at 0.98% and 1.21%, respectively. Furthermore, VCB also stands out with the highest LLR ratio in the industry, reaching 230% as of the end of Q4/2023.

Yuanta maintains a buy recommendation for ACB, MBB, VCB, VPB, and HDB. VPB’s stock yield is far lower than that of other banks; however, at the current valuation, VPB’s stock has the potential to yield around 24%, including dividends. VPB’s stock will see price increases based on forecasts of FE Credit’s recovery.

The 2024E PB valuation of the banking industry is at 1.1x with a 2024E ROE of 18%. Referring to historical data, banking stocks are still trading below the average 10-year PB. With expectations of improved earnings in 2024, Yuanta maintains its recommendation on banking stocks with an average 2024 ROE forecast of 20% for the 7 banks above.

Net interest income is expected to be the main driver of 2024 earnings amid expectations of improved credit growth and lower funding costs. This is especially true for banks involved in the restructuring of weak banks, which will achieve higher-than-average credit growth in 2024, including HDB, MBB, VCB, and VPB.

The key trend in Q4/2023 has been the recovery of the CASA ratio and a reduction in the cost of capital mobilization. The CASA ratio in Q4/2023 rose to 22% for the aggregate of 28 banks, an increase of 2.5 percentage points compared to the previous quarter and 80 basis points compared to the previous year. The CASA ratio is expected to continue to increase in 2024 amid the context of unattractive interest rates on term deposits.

“Asset quality also improved slightly, with the bad debt ratio decreasing to 1.94%, down 30 basis points compared to the previous quarter but up 35 basis points compared to the same period last year. The bad debt ratio may peak and then decline in 2024 due to expectations of low interest rates reducing the burden of debt repayment for borrowers and a better economic outlook.

Although provisioning pressure may ease in 2024, banks, especially those with low bad debt coverage ratios and high bad debt ratios, may need to increase their provisioning costs,” Yuanta’s analysts emphasized.