Prioritizing Favorable Lending Policies, Interest Rate Support for Customers

The State Bank of Vietnam (SBV) has set a general credit growth target of 15% for the beginning of the year for the entire system as well as specific targets for each bank, creating opportunities for banks to set business growth targets from the beginning of the year.

At OCB in particular, leading the way in partnering and supporting customers through preferential products/policies, meeting the actual needs of each customer group. The Bank is prioritizing directing the credit capital flow into products with good interest rates accompanied by acceptable risks, promoting loans for business production, and purchasing houses for individuals with real needs with interest rates from only 5.2%… Particularly for businesses, customers are classified into support groups by industry, such as the import-export sector can borrow at interest rates from 5% or even lower. Not only reducing interest rates for new loans, but even old loans are also reduced by the bank, thereby supporting and creating conditions for customers to expand their business and develop. At the same time, businesses with green projects, helping to reduce environmental emissions, projects aimed at benefiting the community, will be given priority for additional preferential policies.

OCB prioritizes favorable lending policies, interest rate support for customers

|

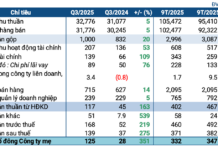

Thanks to many flexible solutions that help customers easily access capital sources, OCB has achieved a much higher credit growth rate than the industry average (0.26%). As of the end of the first quarter of 2024, OCB‘s Tier 1 market debt balance recorded good growth, reaching 3.5% to VND 153,199 billion. This is the first “sweet fruit” that the bank has reaped from its strategy of focusing on expanding its customer base, partnerships, and digitization. OCB‘s total assets reached VND 236,980 billion as of March 31, 2024.

In the context of system-wide deposit interest rates hitting bottom and continuing to decline, OCB has maintained its Tier 1 market mobilization capital at VND 163,401 billion.

OCB‘s total net revenue reached VND 2,287 billion, an increase of 9.4% compared to the same period in 2023, in which the main contribution to growth came from net interest income and foreign exchange trading activities. Net interest income in the quarter reached VND 1,901 billion, an increase of 8.6% compared to the same period and accounting for 83.12% of total net revenue thanks to preferential interest rate policies, supporting customers and businesses in accessing capital supply.

Non-interest income also grew well with an increase of 13.8% to VND 386 billion. In particular, net interest income from foreign exchange trading reached VND 118 billion, 2.4 times higher than the same period last year, thanks to taking advantage of the strong fluctuations in exchange rates in the early months of the year.

By the end of the first quarter of 2024, OCB recorded a pre-tax profit of VND 1,214 billion, an increase of 23% compared to the same period last year in the context of the continued complex economic fluctuations.

Risk management related ratios such as capital adequacy ratio (CAR), short-term capital to medium- and long-term lending ratio, loan to deposit ratio (LDR), are always maintained by OCB at a safe level. The bad debt ratio is controlled below 3%, meeting all regulations of the SBV. Liquidity ratios are stable with sufficient liquidity buffers.

Green banking transformation and digital acceleration

Besides business targets, the sustainable development strategy through digital acceleration has also been prioritized by the bank for implementation from the beginning of the year.

OCB and IFC representatives sign an agreement to provide advisory services for green banking transformation and digital banking services.

|

Recently, OCB and the International Finance Corporation (IFC) have officially signed an advisory agreement for the transformation of green banking and digital banking services for retail and small and medium enterprises (SME). This not only promotes the development of climate finance but also opens up opportunities for capital access for SME businesses, especially businesses owned by women. This opportunity contributes to OCB gradually becoming a pioneer bank in the field of green transformation, promoting the growth of business opportunities, creating more jobs, and improving the standard of living and promoting social progress. In line with this trend, OCB is also continuing to review the existing loan customer portfolio, proactively considering reducing transaction fees for customers operating in some specific business lines related to the energy sector, wind power, etc.

It is known that in the third quarter of 2024, the bank is expected to release an independent sustainability report advised by PwC.

Not only focusing on sustainable investment portfolios, OCB continues to enhance digital acceleration, which is a strength as well as a priority strategy of the bank in 2024 to increase revenue from services while reducing operating costs. On May 10, OCB will launch the new generation of OCB OMNI digital banking services, based on a partnership with Backbase – the world’s leading fintech company.

The new generation of OCB OMNI digital banking services, optimizing experience and security

|

With powerful and modern transaction processing capabilities, ensuring fast speed, automatic suggestion of products, services, and financial solutions that are personalized for each customer, combined with FIDO security technology combined with advanced biometric authentication will be launched in the coming July. This version completely eliminates OTP codes that cause inconvenience in experience as well as security, ensuring the safety, protecting the financial information of users in an optimal way, expecting to help OCB increase and expand its customer base. thereby bringing high efficiency in terms of business.

In 2024, OCB aims to increase its charter capital by VND 4,168 billion to VND 24,717 billion, pay a 20% dividend in shares, and target a pre-tax profit of VND 6,885 billion, an increase of 66% compared to the result. in 2023.