State Bank of Vietnam injects liquidity through repo and bond issuance

Source: SBV

|

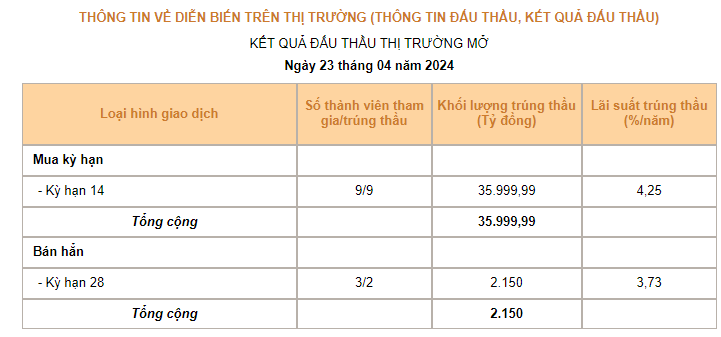

On April 23, the State Bank of Vietnam (SBV) provided a total of VND 36,000 billion ($1.55 billion) to nine members via secured lending with a 14-day term and an interest rate of 4.25% per annum. This is the largest-scale transaction on this channel to date.

Meanwhile, the central bank also issued an additional VND 2,150 billion ($92.6 million) worth of treasury bills with a 28-day term and an interest rate of 3.73% per annum. Three members participated in the auction, and two were awarded the bills.

|

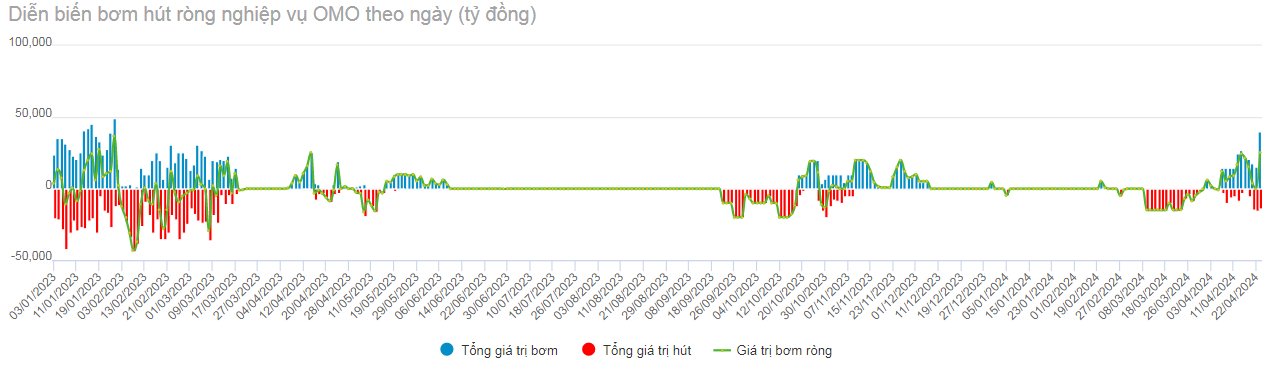

Daily liquidity injection/withdrawal through OMO. Unit: VND billion

Source: VietstockFinance

|

Also on April 23, a VND 12,000 billion ($517.2 million) loan secured on April 16 matured, withdrawing liquidity from the market, while a VND 3,700 billion ($160.4 million) treasury bill due on March 26 matured, returning funds to the market. Therefore, the SBV injected a net total of VND 25,550 billion ($1.1 billion) on April 23, the highest since February 2023.

This week, a VND 26,500 billion ($1.14 billion) treasury bill and a VND 24,000 billion ($1.03 billion) loan on the OMO channel will mature. After the developments on April 23, the SBV maintains a net injection of VND 27,375 billion ($1.18 billion), while in late March 2024, it withdrew a net VND 176,000 billion ($7.58 billion).

Source: SBV

|

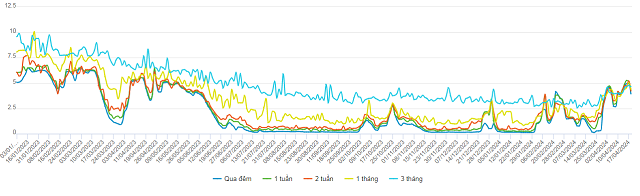

According to the latest data from the State Bank of Vietnam, the average interbank interest rate for the overnight term (the dominant term, accounting for about 88% of total transaction volume) declined to 3.87% on April 22, from 4.95% per annum on April 17, the highest level in the past eight months (since August 2023).

|

Interbank interest rates across tenors

Source: VietstockFinance

|

Interbank overnight interest rates can be seen soaring as system liquidity tightened in the first two weeks of April, and the term repo facility was utilized in large volumes (VND 12 trillion/$517.2 million per session). The pressure gradually eased towards the end of week 19/04, and in total, the SBV provided VND 32.86 trillion ($1.41 billion) through the 7-day repo facility at a 4% interest rate.

By the end of the afternoon on April 15, the Vietcombank USD selling price continued to set a new peak of VND 25,488 per USD. This marked the seventh consecutive session that the USD selling price has broken its record and reached the highest level in Vietcombank’s history from 2000 to date. This level also exceeded the USD spot exchange rate of VND 25,450 per USD announced by the State Bank of Vietnam (SBV) on the same day.

The strong demand for USD in the international market has led to persistent heat in the USD/VND exchange rate at domestic banks.

|

USD-Index movement over the past 5 years

Source: tradingview

|

The USD has gained strength, with the USD-Index remaining high above 106 – the highest level in over 5 months – as the scenario of the US Federal Reserve (Fed) not cutting interest rates in 2024 becomes increasingly likely after Fed Chair Jerome Powell indicated that it may be “somewhat longer” before it will be appropriate to cut rates.

In addition to the stronger international USD, experts at brokerage firm SSI said that rising import demand (a trade deficit of $1 billion in the first half of April) combined with many foreign-invested enterprises repatriating profits has contributed to the significant appreciation of the exchange rate. With the interbank exchange rate having touched the USD selling rate set by the SBV (VND 25,450), on April 19, the Foreign Exchange Management Department announced a plan to sell foreign currency to commercial banks with negative foreign exchange positions to bring the foreign exchange position to 0, with the intervention rate set at VND 25,450. However, there were no successful transactions last week, and the focus will be on the transactions this week.