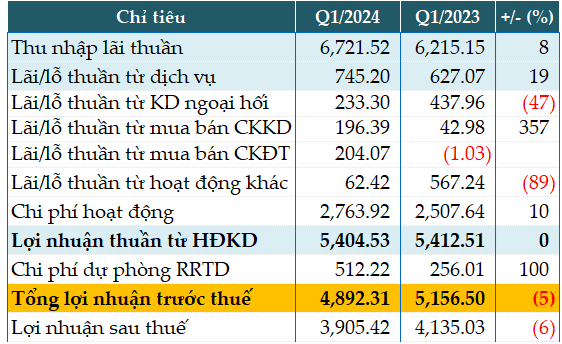

In the first quarter, ACB’s net interest income rose by 8% year-on-year to nearly VND6.722 trillion. Service fee income jumped by 19% to VND745 billion.

ACB’s securities trading income continued to boom this quarter. The bank reaped over VND196 billion ($8.4 million) from trading, quadrupling the previous year’s figure. Investment securities also generated over VND204 billion ($8.78 million) in profit, compared to a loss in the same period last year.

Besides, ACB set aside VND512 billion ($22.1 million) for potential credit risks in the quarter, double the year-ago figure. Therefore, the bank’s pre-tax profit reached over VND4.892 trillion ($210.5 million) in Q1, down 5% year-on-year. ACB attributed the slight decline to extraordinary income in the first quarter of 2023 and increased bad debt provisions.

After the first quarter, ACB has completed 22% of its pre-tax profit target of VND22,000 billion ($948.3 million) for 2024.

|

ACB’s Q1/2024 business results. Unit: VND billion

Source: VietstockFinance

|

By the end of the first quarter, ACB’s total assets were roughly the same as at the beginning of the year, at VND727,297 billion ($31.3 billion). Customer loans rose by 4% to VND506,112 billion ($21.8 billion), while customer deposits increased by 2% to VND492,804 billion ($21.2 billion). The CASA ratio stood at 23.7%. ACB’s ROE was 23.4%.

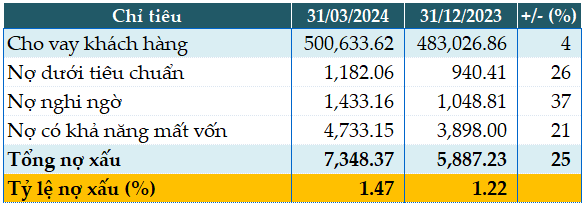

Excluding VND5,478 billion ($236.2 million) in loans for margin trading of ACBS, ACB’s total bad debts as of March 31, 2024 were VND7,348 billion ($316.4 million), up 25% from the beginning of the year. The ratio of bad debts to total loans slightly increased from 1.22% at the beginning of the year to 1.47%.

|

ACB’s loan quality as of March 31, 2024. Unit: VND billion

Source: VietstockFinance

|