According to information from the Hanoi Stock Exchange (HNX), Hoang Anh Gia Lai Corporation (HAGL, stock code: HAG) recently announced the results of its early bond repurchase.

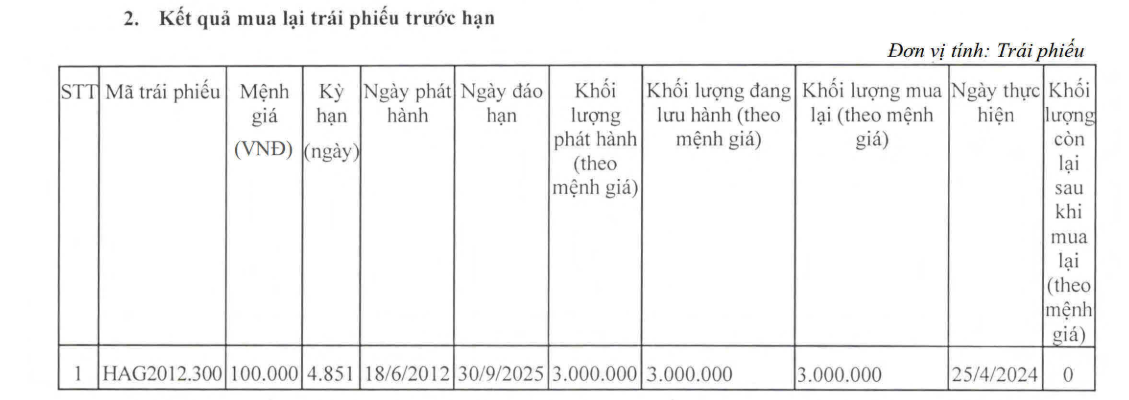

Specifically, on April 25, 2024, HAGL repurchased the entire VND300 billion HAG2012.300 bond issued on June 18, 2012, with a term of 4,851 days.

Source: HNX

Thus, Mr. Duc’s enterprise has fully repaid the bond issue more than a year ahead of schedule.

In addition to the above bond issue, HAGL still has an outstanding bond issue with the code HAGLBOND16.26 with a term of 10 years and an issuance value of VND6,596 billion. The outstanding value as of the end of 2023 was VND4,691 billion.

In another development, at the end of April 2024, HAGL Group announced measures and a roadmap to address the status of its shares being under warning.

The company stated that based on its consolidated financial statements for the first quarter of 2024, HAGL’s business results had improved and had partly addressed the reasons for its shares being put under warning. Specifically, the after-tax profit of the parent company in the first quarter of 2024 was VND214 billion; the total after-tax profit for the first three months of 2024 was VND226 billion.

Regarding the status of project investments, the company is still focusing all its resources on its two core business lines: livestock and cultivation, with the main products being bananas, durians, and pigs.

Regarding its financial situation, HAGL will continue to implement financial restructuring measures to further reduce its outstanding bank loans, reduce interest expenses, and maintain stable cash flow for the company’s business operations in the context of a still-difficult market.

In terms of business model, in 2024 in particular and the period 2024-2030 in general, the enterprise led by Chairman Doan Nguyen Duc will operate under a circular agricultural model. The aim is to create safe products, reduce waste of resources, and minimize environmental pollution in order to achieve sustainable development and meet the quality requirements of major import customers.

In addition, the company will continue to expand its clean land fund and prioritize investment in improving infrastructure, packaging plants, and packaging in the direction of applying advanced technology to improve productivity and product quality, while also contributing to the transformation of the labor structure in agriculture.

With the business results achieved in the first three months of 2024 and the operating model that has been set out, HAGL believes that its business activities in the coming period will achieve many positive results, gradually reducing and eliminating accumulated losses, and addressing the reasons that led to its shares being put under warning.