Sharp Declines in VN-Index Amidst Geopolitical Tensions and Monetary Policy

Plummeting pressures on the index over the past trading week were primarily driven by escalating tensions in the Middle East, notably after the State Bank of Vietnam (SBV) officially announced intervention to stabilize exchange rates. Throughout the week, the VN-Index witnessed four declining sessions, shedding 101.75 points or 7.97%, settling at 1174.85 points. Since its peak on March 28, the index has lost 116 points, representing an 8.9% decline.

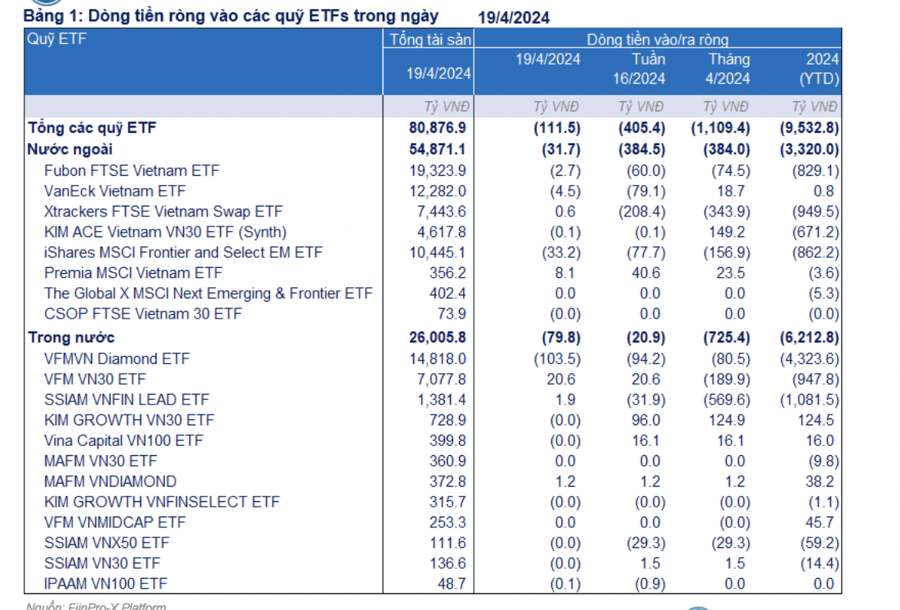

Between April 15th and 19th, 2024, net outflows from ETF funds persisted, amounting to over VND 405 billion, marking the tenth consecutive week of negative capital movements. This surge in net outflows, indicating a 628% rise compared to the previous week, occurred as the VN-Index faced significant selling pressure, resulting in a 101.75-point decline or 7.97%. Net outflows were observed in 10 of the 20 funds, including both foreign and domestic funds, primarily concentrated in the Xtrackers FTSE Vietnam Swap ETF.

Since the commencement of April 2024, net outflows from ETF funds have exceeded VND 1.1 trillion. Consequently, year-to-date net outflows from ETF funds have reached over VND 9.5 trillion.

Notably, net outflows resumed from foreign ETF funds, totaling VND 384 billion, with the Xtrackers FTSE Vietnam Swap ETF accounting for the majority, amounting to over VND 208 billion. Additionally, the VanEck Vietnam ETF and iShares MSCI Frontier and Select ETF reported net inflows of VND 79 billion and VND 77 billion, respectively. The Fubon FTSE Vietnam ETF faced net outflows of VND 60 billion.

Domestic ETF funds continued to experience net outflows, albeit at a reduced rate compared to the previous week, totaling approximately VND 21 billion. The VFMVN Diamond ETF primarily contributed to this decline, with net outflows exceeding VND 94 billion. Additionally, the SSIAM VNFIN LEAD ETF reported net outflows of nearly VND 32 billion. In contrast, the two major funds, KIM GROWTH VN30 ETF and VFM VN30 ETF, garnered net inflows of VND 96 billion and VND 20 billion, respectively.

During the April 22nd, 2024 trading session, the Fubon FTSE Vietnam ETF witnessed a slight net inflow of approximately VND 3 billion, without any significant buy/sell activities for the stocks within its portfolio. However, the VFM VNDiamond ETF resumed substantial net outflows, amounting to over VND 209 billion.

According to statistics from Yuanta, within the Asian market, India and South Korea continue to attract foreign investment, with net inflows of USD 1.4 billion and USD 1 billion, respectively, during the past week. Conversely, the Taiwanese stock market experienced further net outflows of USD 423.3 million.

Net inflows into ETF funds across Asia remained relatively balanced, with a modest net inflow of USD 0.1 million. Thailand and Singapore led the inflows, garnering USD 2.4 million and USD 1.9 million, respectively. In contrast, Vietnam led the net outflows, totaling USD 3.2 million, primarily attributed to the FUESSVFL fund (-USD 20.6 million), despite Fubon’s resurgence with net inflows of over USD 21.5 million last week.

Conversely, US ETF funds investing globally sustained their momentum of net inflows. Specifically, equity funds saw an additional USD 3 billion, representing a 45% increase, while bond funds attracted USD 3.2 billion in net inflows, doubling the previous week’s levels.

Throughout the past week, foreign net selling declined by 52% compared to the preceding week, recording net outflows of VND 971 billion, equivalent to USD 38.9 million. Notably, VHM stock alone faced net sales exceeding VND 1.1 trillion during the week. Since the beginning of the year, foreign investors have sold a net amount of VND 13,500 billion on the Vietnamese stock market.

Amidst exchange rate pressures, foreign capital is anticipated to return gradually around mid-year as exchange rates stabilize and the KRX system is scheduled to commence operations on May 2nd.