CLW 2024 Annual General Meeting

CLW’s 2024 Annual General Meeting was held on the morning of April 24, 2024.

|

Plan to reduce water loss rate, highest net profit in history

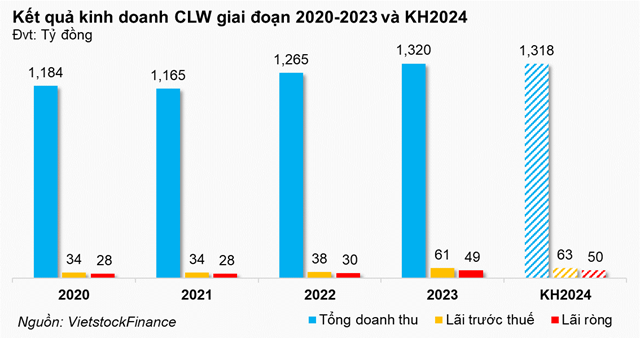

For 2024, the CLW general meeting agreed on a target of total revenue of over VND 1,318 billion, almost the same as in 2023. Pre-tax profit of VND 63 billion, up 3%, and net profit of over VND 50 billion, up 3%, the highest in history according to statistics since 2009.

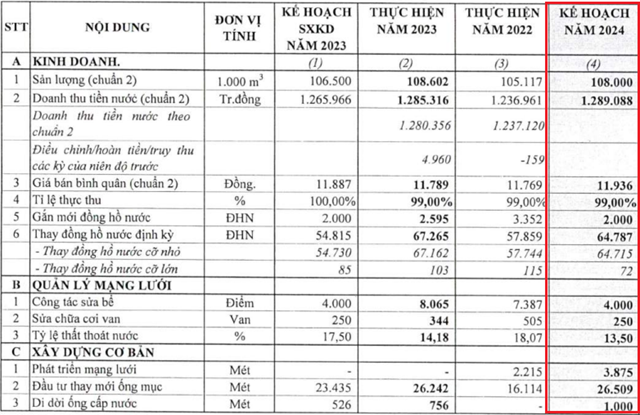

CLW expects that the actual consumption will slightly decrease, reaching 108 million m3 of water with an average selling price increasing slightly by 147 dong, reaching 11,936 dong/m3, corresponding to a water revenue of over 1,289 billion dong, which is not significant compared to the implementation in 2023. The actual collection rate is expected to remain at 99%.

CLW plans to install 2,000 new water meters, a decrease of 23%; periodically replace 64,787 water meters, a decrease of nearly 4%, including 64,715 small meters and 72 large meters. In terms of network management, CLW plans to repair 4,000 broken sections, repair 250 valves and the water loss rate reduced to 13.5%.

In terms of the capital construction plan, after 2023 there was not any new network developed, and in 2024, CLW plans to develop 3,875m of the network, invest in replacing 26,509m of pipelines, and relocate 1,000m of water supply pipes. Total initial capital investment of over 322 billion VND, from business capital and borrowed capital.

|

Business plan for 2024 of CLW

Source: CLW

|

Regarding the 2024 wholesale water purchase contract with its parent company, the Saigon Water Corporation – Limited Liability Company One Member (Sawaco), the General Meeting of Shareholders approved the unit price of VND 6,712.4 per m3, equivalent to the adjusted unit price of 2023. For 2025, the General Meeting of Shareholders authorized the Board of Directors to review and decide on the unit price in the time before the 2025 annual general meeting was held.

In the first quarter, CLW announced its business results with total revenue decreasing by 3% compared to the same period last year, to nearly 329 billion VND, but net profit increased by 16%, to over 21 billion VND. With this result, CLW has achieved 25% of its total revenue target and 42% of its net profit target for 2024.

Dividend payment at a high level among state-owned water companies

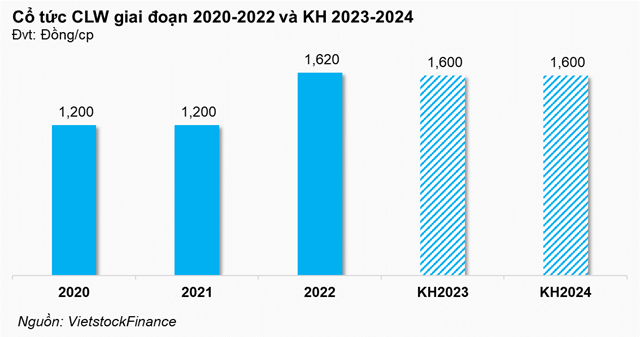

The General Meeting also approved the 2023 dividend payment plan in cash at a rate of 16% (VND 1,600 per share), corresponding to the need to spend VND 20.8 billion in 2 installments. The record date for the first installment (12%) is expected to be June 6, 2024, and the second installment (4%) is November 1, 2024. Notably, the rate of 16% is higher than the plan approved by the 2023 Annual General Meeting of Shareholders at only 12%. For 2024, the dividend rate of 16% is expected to be maintained.

Regarding the proposal of Ho Chi Minh City State Finance Investment Company (HFIC) that CLW should reconsider the ratio between dividend payment and fund reserves, Mr. Huynh Tuan Anh – Director of CLW said that ensuring shareholders’ rights is the top priority of the Board of Directors and shared the difficulties that CLW has faced in recent years:

“In recent years, the Company’s operations have encountered many difficulties, having to supply water to Binh Chanh district, carrying out many tasks, and the network after many years, without timely renovation, has led to a quite high water loss rate, for many years CLW reported losses until the third quarter, CLW’s current distribution output has not yet recovered compared to the period before the COVID-19 pandemic.”

He added: “The price increase path of Ho Chi Minh City People’s Committee ended in 2022, in 2023 CLW also did not increase the water price, but still made efforts to implement many solutions to overcome the difficulties, reduce the water loss rate.”

“The allocation rate of funds of about 40% is also close to previous years, at the same time, although the accumulated loss from previous years has increased to over 13 billion VND, CLW still increased the 2023 dividend to 16% at par value, instead of just 12% as approved by the 2023 Annual General Meeting of Shareholders,” emphasized the Director of CLW.

Member of the Board of Directors Nguyen Thanh Phong shared more: “In the context of many difficulties, the dividend rate of 16% is a very high level among the state-owned water companies and I personally feel satisfied as a major shareholder.”

Clearance of wholesale water purchase debt of over VND 31 billion

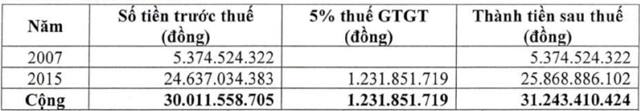

The General Meeting approved the payment of wholesale water purchase debt in 2007, 2015 to its parent company Sawaco, the amount after VAT over VND 31 billion.

Previously, according to the recommendation of the State Audit Office, in 2023, CLW coordinated with Sawaco to inspect and review the cost of purchasing clean water from February 1, 2017 to December 31, 2020. After checking and comparing, CLW determined that the clean water purchase cost before VAT payable to Sawaco in 2007 and 2015 was over VND 30 billion.

UHY Audit and Consulting Company Limited – a unit that has signed a service consulting contract with CLW – has conducted an audit and provided legal advice to CLW through a report on the actual findings. Accordingly, UHY’s report determined the output and cost of purchasing clean water after VAT payable to Sawaco at the time of official conversion into a JSC (2007) and the time of selling water through the total meter (2015) with a total amount after VAT of over VND 31 billion.

|

Plan to pay off wholesale water purchase debt in 2007, 2015 between CLW and Sawaco

Source: CLW

|

Huy Khai