Market liquidity low on April 25th

Liquidity on April 25th was low. Specifically, VN-Index averaged only VND 12 trillion, almost VND 17 trillion lower than the previous session.

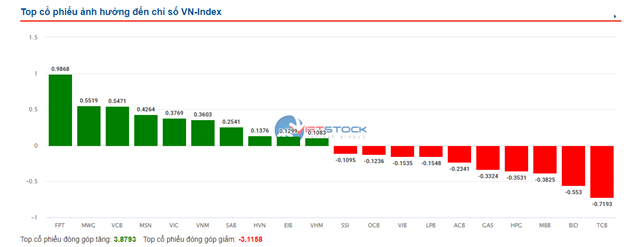

FPT (+2.58%), MWG (+2.87%) and VCB (+0.44%) made the most significant contributions to the VN-Index, respectively. Also banks, TCB (-1.81%), BID (-0.8%) and MBB (-1.33%) were disappointing. While FPT helped the index gain 0.98 points, TCB lost 0.7 points.

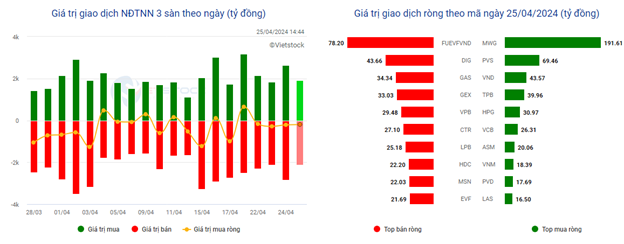

MWG (+2.87%) was the most net bought by foreign investors, with a value of VND 191 billion. Following were PVS (0%), VND (+0.48%) and TPB (-0.28%). Foreign investors sold strongly FUEVFVND ETF (+0.07%), DIG (-1.22%) and GAS (-0.8%) at VND 78 billion, VND 43 billion and VND 34 billion, respectively.

13:45: Identify SAB, MWG and FPT

The afternoon session continued to be positive for retail stocks such as MWG or consumer goods-related stocks such as SAB and MSN. VN-Index is hovering around 1,205 points, with no significant changes.

At 13:45, SAB (+2.99%) had a good increase, perhaps partly due to positive signals from the 2024 Annual General Meeting of Shareholders held earlier that day. The beer stock is hovering around VND 55,000/share. This level has been declining steadily since the 2017 peak and is currently trading near its lowest level since the beginning of 2020.

Despite some disadvantages from Decree 100, SAB’s management is still confident in setting a target of 13% revenue growth and 8% after-tax profit compared with last year.

Retail stock MWG (+2.29%) maintained the highest trading value and trading volume in the market, at over VND 872 billion and 16.4 million units, respectively, and broke its previous peak of VND 53,200/share set about 2 weeks ago.

| Recent price movement of MWG stock |

While the market has recently turned downward, FPT (+2.58%) has shown a different face. The technology stock is almost certain to have a second consecutive session surpassing its all-time high, although the volume may not be as high as in the previous session. The price has doubled since the beginning of 2023.

From the beginning of the year to the present, in the VN100 group, TCB (-1.81%) is the stock that has increased the most, by 47%. The next positions belong to FRT (+1.66%), GVR (+0.17%) and CTR (-0.8%), at 41%, 39% and 38%, respectively. The biggest decrease was AGG (+0.73%), HHV (-0.39%) and BCM (+0.57%), at 22%, 17% and 16%, respectively.

11:30: The market gradually loses momentum

At the end of the morning session, investors’ trading sentiment showed renewed pessimism as VN-Index fell back to around 1,203 points.

The information technology sector, led by FPT (+3%), continued to lead in terms of gains, posting 2.69% though no longer as positive as at the beginning of the session. Conversely, the market was pessimistic about the rubber products sector as it fell the most by 2.89%. The stocks SRC (-4.83%), DRC (-2.66%), CSM (-2.68%) were all sold heavily.

MWG (+1.72%) rose to lead in trading volume after the morning session with over 10 million units. Following were TCH (+0.96%), VIX (-1.74%) and DIG (-1.75%) with 8 million units, 7 million units and 6.5 million units, respectively.

In terms of trading value, MWG also led with VND 559 billion. FPT, MSN (+1.64%), DIG and SSI (-1.12%) were the next, posting VND 440 billion, VND 259 billion, VND 185 billion and VND 167 billion, respectively.

After the morning session, FPT continued to lead the gainers in the VN30 thanks to positive news about its partnership with NVIDIA. SAB also had a good increase of 2.8%. Following were MWG, MSN and VCB (+1.43%).

CTG (-1.82%) fell the most in the VN30, after a 4.6% increase in the previous session. It was followed by VRE (-1.77%), VJC (-1.45%) and TPB (-1.39%).

10:40: Foreign investors are net selling

In the mid-morning session, VN-Index fluctuated and had no clear direction. Foreign investors were net sellers of VND 283 billion. VCB and FPT were still the most prominent names.

As of 10:30, the largest index on the Vietnamese market continued to fluctuate around 1,205 points. Trading value at this time was about VND 3.8 trillion, about VND 1,000 billion lower than the previous session.

VCB (+1.55%) surpassed FPT (+4%) to have the greatest impact on the increase of VN-Index, followed by MSN (+1.79%). Conversely, CTG (-1.52%), HPG (-1.39