Today’s modest correction had many positive aspects, most notably the low liquidity. With quite good short-term profits but continuous fluctuations during the session, liquidity did not increase, indicating that investors are holding onto stocks rather than surfing the waves.

A quick survey of the VNAllshare basket on the HSX exchange showed that nearly 63% of the stocks in the basket had T+2 profits (which can be closed this afternoon) of over 1%, and about 30% had profits of over 3% (calculated based on the closing price). If we calculate up to T+4 (buying at the bottom on April 19), more than 41% had profits of over 3%.

From the perspective of T+ trading, this is a very good profit margin, so today’s downturns can be seen as a challenge for this group of speculators. Throughout the session, the market repeatedly plunged and surged 4-5 times, especially in the afternoon when there was a strong push and squeeze on the pillar stocks. In the context of the bottom not yet clear, the most liquid stocks are those with profits, and when liquidity is low, it means that the demand to sell is not high. Today, HSX and HNX only traded 13.2 trillion VND.

The assessment of market strength or weakness is often clearer in down sessions/declines because that’s when sentiment is easily shaken. When the market is rising steadily, of course everyone wants to hold onto stocks to “profit more”, but when the market is fluctuating unclearly, the pressure to preserve profits can easily drive trading. From the perspective of the market having temporarily found a reference point for the bottom and it is not yet clear whether the bottom has actually been reached, the decision to hold onto stocks is a strong sign of sentiment.

Actually, if today there had been a larger decline, it would have been easier to observe supply and demand. The deepest decline in the VNI was only 5.4 points compared to the reference, which is quite mild considering yesterday’s 28-point increase. The correction range, if about 50%, equivalent to 14-15 points, would create a heavier psychological pressure. Of course, many stocks have corrected more sharply than the index, but basically, they all have support from below and have pushed prices up with low liquidity. That is also a signal that the selling pressure is not strong.

In general, after yesterday’s strong increase, correction sessions or sessions with no large selling volume will reinforce the signals of the bottom. Buyers are still waiting for such price drops to enter the market. This is still a “test” phase of supply and demand to see which side has the stronger sentiment. Only when the money-holders decide that it is difficult to buy at a lower price and decide to raise the price will liquidity increase.

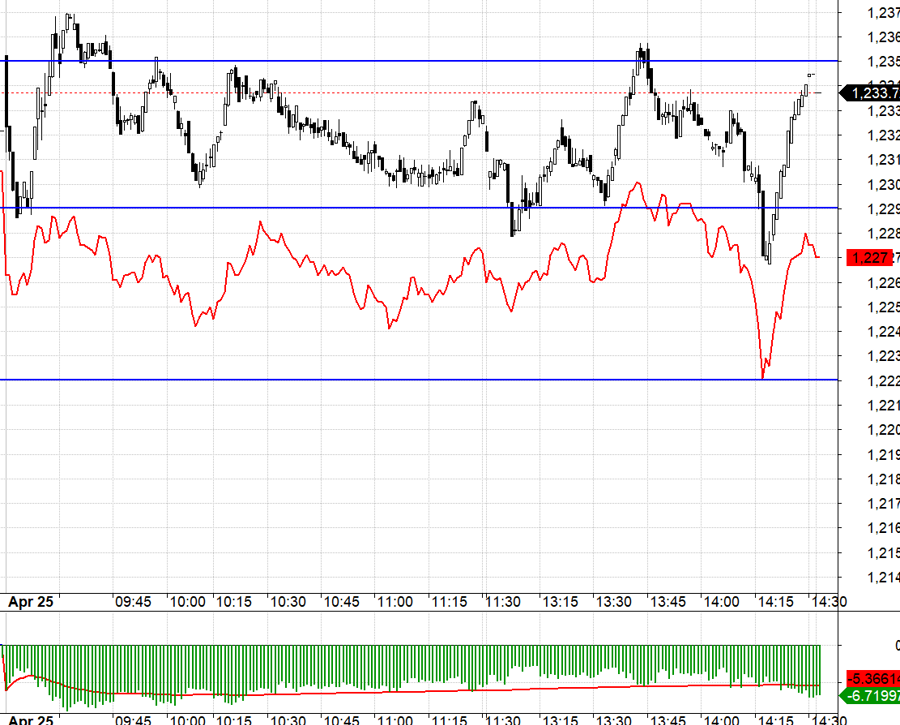

Today, the derivatives market was difficult to trade on the short side because the basis discount was too wide. VN30 only fluctuated in the range of 1235.xx – 1229.xx. Long is also limited in profit in this situation. Today’s developments are good for the underlying market but offer little room for derivatives.

Currently, the sentiment of those holding stocks is quite stable, with little swing trading. In general, an uptrend depends largely on the liquidity and scale of the volume of goods available for sale. The underlying market has likely bottomed out in the short term and is entering a recovery phase. The strategy is to watch for Long.

VN30 closed today at 1233.72. The nearest resistances tomorrow are 1236; 1246; 1258; 1262; Supports are 1229; 1222; 1215; 1206; 1198.

“Stock market blog” is personal in nature and does not represent the opinion of VnEconomy. The views and assessments are those of individual investors, and VnEconomy respects the views and writing style of the author. VnEconomy and the author are not responsible for any problems arising in connection with the investment assessments and views posted.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)