MSB’s 2024 Annual General Meeting of Shareholders took place on the morning of April 23 in Hanoi. Photo: The Manh

|

According to the voting minutes, as of 9:00 AM on April 23, MSB’s 2024 Annual General Meeting of Shareholders was attended by 185 shareholders, representing over 1.55 billion shares, equivalent to 77.63% of the total voting shares. The meeting was duly convened.

Pre-tax profit target of VND 6,800 billion

In 2024, MSB aims for total assets to reach VND 280,000 billion, a 5% increase compared to 2023. Mobilized capital in market 1 and bonds will reach VND 178,900 billion, up 27%. Outstanding loans (including loans to economic organizations and individuals, and investment in corporate bonds) will reach VND 178,200 billion, an increase of 18%. The non-performing loan ratio is controlled below 3%. Pre-tax profit is expected to be VND 6,800 billion, up 17%.

|

MSB’s Pre-Tax Profit for the period 2010 – 2023 |

MSB’s management board said that in 2024, the bank will focus on diversifying revenue, strengthening cross-selling solutions, and making non-interest income one of the pillars to reduce pressure on core operations. By the end of the first quarter of 2024, MSB recorded foreign exchange transactions with a total expected trading volume of USD 51 billion, with profit from this segment estimated at over VND 550 billion, equivalent to 54% of net profit from foreign exchange trading activities in 2023.

MSB’s credit growth in Q1/2024 is estimated to reach over 5%. MSB also launched a VND 3,000 billion green credit package with preferential interest rates, supporting corporate customers with investment projects in fields such as energy, water resources, waste, construction, processing and manufacturing, green transformation… Besides, MSB’s CASA ratio is estimated to exceed 29% at the end of Q1/2024.

Declared dividend of 30% in shares, raising capital to VND 26,000 billion

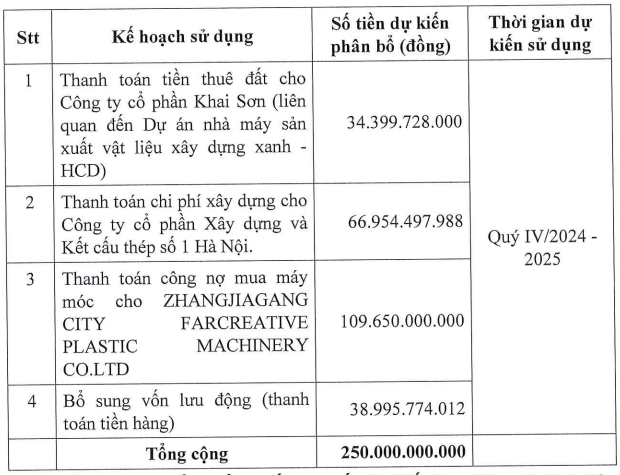

Regarding the 2023 profit distribution plan, after setting aside various funds, MSB’s retained profit after tax was over VND 3,946 billion. The bank plans to issue an additional 600 million shares to pay dividends to shareholders, equivalent to a ratio of 30%. These shares will not be subject to transfer restrictions. The implementation time is expected to be in 2024.

The additional capital will be used to expand the bank’s scale, increase its competitive position, and enhance its financial capacity to expand the implementation of strategic goals. If successful, MSB will increase its charter capital from VND 20,000 billion to VND 26,000 billion.

An MSB representative added: “In addition to increasing the risk buffer, the capital increase will also create additional resources to further promote the digitalization process as well as projects serving the sustainable development strategy in the bank’s greening journey.”.

With the expected profit generated in 2024 and the retained profit after completing the charter capital increase to VND 26,000 billion from the 2023 share dividend, the Bank’s Board of Directors will submit to the General Meeting of Shareholders for approval a plan to declare dividends from the profit source that can be used to pay dividends at a rate of less than 15% in cash and/or shares, the timing of the interim dividend payment will depend on market developments and MSB’s business operations.

Electing a replacement for one member of the Board of Directors

At the General Meeting of Shareholders, MSB shareholders voted to add a new member to the Board of Directors for term VII (2022 – 2026) after receiving approval from the State Bank of Vietnam, in order to complete the senior personnel structure.

MSB will elect two additional members to the Board of Directors after Ms. Nguyen Thi Thien Huong submitted her resignation. The two candidates expected to be elected to the Board of Directors are Ms. Dao Minh Anh – Vice Chairwoman of MSB’s Credit and Investment Council and Mr. Vo Tan Long – Chairman of MSB’s Technology Committee.

The election results showed that only Mr. Vo Tan Long was elected to the Board of Directors for the 2022 – 2026 term.

Mr. Vo Tan Long was born in 1968, has a degree in Electrical Engineering from the Leningrad Institute of Electrical Engineering, and a Doctorate in Physics and Mathematics from Saint Petersburg State Electrical Engineering University. He has been working in the financial and banking sector since 2013 and has worked for companies such as IBM, VPBank, PWC, MSB, ROX…

Discussion:

Expected conversion of core banking by the end of April 2024

Will the core banking conversion affect customers’ daily activities, and when will the conversion be completed?

Mr. Nguyen Hoang Linh, Member of the Board of Directors and General Director of MSB: We plan to convert core banking by the end of April 2024, starting from the holiday break. The conversion is also part of MSB’s completion process. We have gone through this process twice before, once in 2002 and again when we merged with Mekong Bank.

The entire conversion process has been carried out continuously over the past two years by MSB’s experts and staff. In terms of risk, there will not be many major issues, there will only be a slight disruption during the transition from the old system to the new system, but it will be very quick.

Therefore, the bank will choose times when customers have the least number of transactions, during public holidays. Otherwise, customer transactions will proceed as usual.

Share about the recent deposit incident? How did the information from the media affect MSB?

CEO Nguyen Hoang Linh: With regard to depositors, MSB affirms that legitimate customers will always have their rights protected by the bank. The recent incident was due to the fact that MSB proactively discovered it and reported it to the公安 for clarification. MSB always respects the rulings of the competent authorities to ensure the rights of customers, if they are legitimate customers.

Losing money in the banking system is not a simple matter. If all the necessary checks and controls are carried out, we can avoid risks in depositing money.

Regarding the recent incident, MSB’s customers are all very intelligent and have the ability to assess information. Therefore, the deposit balance was not affected and remained stable, with over VND 58,000 billion in January, over VND 60,000 billion in February, and the latest updated balance has increased to VND 62,000 billion.

The incident also provided an opportunity for MSB to explain that, in our risk management activities, we annually set aside more than VND 2,000 billion to provide for risk in corrective actions, therefore, the incidents mentioned above do not have too much of an impact on the bank’s operations.

Mr. Nguyen Hoang An, Vice Chairman of the Board of Directors: The bank is becoming more and more modernized, and technology criminals are taking advantage of this to gain control of users, steal money from customers and the bank. Not only MSB, but also other banks are heavily affected by technology crime. The公安 has also recommended extreme caution in technology operations.

We proactively reported the recent incident to the公安 from