Q1 2024 Net Profit of PHR Hits Multiple Record Lows

| Q1 2024 net profit of PHR sets multiple dismal records |

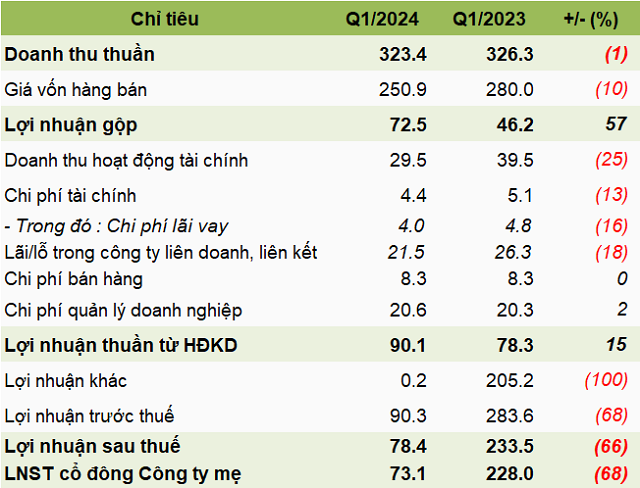

According to its Q1 2024 financial statements, PHR reported a net revenue of over VND 323 billion (USD 13.9 million), showing an insignificant decrease compared to the same period last year. Notably, rubber and timber businesses accounted for nearly VND 298 billion (USD 12.8 million), slightly decreased by 3% and contributed 92% to total revenue; while industrial parks, industrial wastewater treatment, and other segments made up an insignificant proportion.

Gross profit reached VND 72 billion (USD 3.1 million), surging by 57%, benefiting from a gross profit margin improvement of 8.2 percentage points to 22.4%.

|

PHR received a sum of compensation, support, and resettlement for its VSIP III industrial park project, as per the decisions dated December 31, 2021, of Tan Uyen Town People’s Committee and dated February 24, 2022, of Bac Tan Uyen District People’s Committee regarding the approval of the compensation, support, and resettlement plan. PHR began recording this compensation since Q1 2022, accumulating to nearly VND 982 billion (USD 42.2 million) by the end of 2023. |

However, in Q1, PHR ceased to earn income from the compensation for the implementation of the Vietnam – Singapore Industrial Park III (VSIP III) project in Tan Lap commune, Bac Tan Uyen district, Binh Duong province; while in the same period last year, it had recognized up to VND 200 billion (USD 8.6 million) from this source. Moreover, interest from bank deposits declined sharply, causing financial revenue to drop by 25% to nearly VND 30 billion (USD 1.3 million); interest corresponding to PHR‘s ownership in Nam Tan Uyen Industrial Park JSC (UPCoM: NTC) decreased, leading to an 18% reduction in profit from joint ventures and associates to over VND 21 billion (USD 900,000).

Due to the aforementioned pressures, PHR‘s net profit amounted to only VND 73 billion (USD 3.1 million), marking a 68% decrease.

|

Q1 2024 Business Performance of PHR

Unit: VND billion

Source: VietstockFinance

|

As of the end of Q1 2024, PHR‘s total assets were nearly VND 5,900 billion (USD 253 million), a 3% decrease compared to the beginning of the year. In particular, short-term financial investments accounted for over VND 2,001 billion (USD 86 million), representing the highest proportion of 33%, mostly time deposits with a tenor of less than 12 months at commercial banks with interest rates ranging from 2.9-9.7%/year.

Regarding capital sources, unearned revenue accounted for over VND 1,327 billion (USD 57 million), or 22%. This revenue was received in advance from customers leasing industrial park infrastructure (already handed over) for the entire lease term at Tan Binh Industrial Park, Bac Tan Uyen district, Binh Duong province. This amount will be gradually recognized as revenue in future financial results.

PHR maintained a low level of debt, accounting for only about 5% of total capital, corresponding to a value of nearly VND 324 billion (USD 14 million), and mostly short-term loans.