Translated Content

According to the voting records, as of 9 a.m. on April 25, Vingroup’s 2024 Annual General Meeting of Shareholders (AGM) was attended by 135 shareholders representing over 2.94 billion shares, equivalent to 76.9% of the total number of voting shares. The AGM was eligible to proceed.

Chairman Pham Nhat Vuong attends Vingroup’s 2024 Annual General Meeting held in Hanoi on the morning of April 25. Photo: BTC

|

Vingroup’s 2024 Annual General Meeting of Shareholders. Photo: The Manh

|

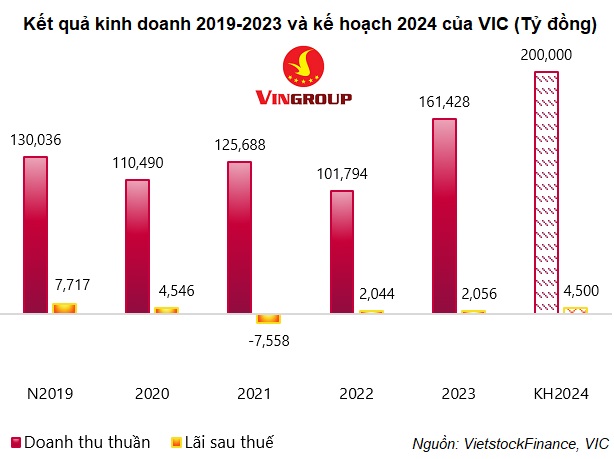

2024 post-tax profit target more than double that of the same period

In 2024, VIC aims for a record net revenue of 200,000 billion VND, a 24% increase compared to 2023. Post-tax profit is 4,500 billion VND, more than double that of the previous year. The company said that this year it will continue to promote business activities to strengthen the three main pillars: technology-industry, trade-services, and social charity.

According to each business sector, in the vehicle manufacturing sector, VinFast aims to increase delivery output and focus on optimizing costs through design, procurement, and production initiatives. Continue to expand distribution channels, leveraging local networks to achieve approximately 400 points of sale globally by the end of 2024. At the same time, deliver new vehicle models in the US market, export vehicles to Europe, and start distribution in Indonesia.

In the real estate sector, Vinhomes (VHM) will strengthen the distribution channel and promote the O2O model to prepare for a new growth cycle in the market, specifically by building a self-operated distribution system in parallel with the existing dealer system nationwide, while also continuing to improve the online sales system. In addition to projects that have been opened for sale, Vinhomes is focusing on developing potential new projects that have completed legal procedures, aiming to build social housing projects.

In the tourism-vacation-entertainment sector, Vinpearl (VPL) aims to maintain its position as the number 1 brand for entertainment and resorts in Vietnam in 2024. Vinpearl expects the market to continue its strong recovery, particularly from international visitors.

In order to support the company’s entertainment business activities in future complex real estate projects, the 2024 AGM approved the addition of new business activities including botanical gardens, zoos, and natural reserves.

Accumulated retained earnings exceed 14 trillion VND

Regarding the profit distribution plan for 2023, shareholders unanimously agreed to allocate 5 billion VND to the reserve fund and did not discuss the payment of dividends to shareholders. If approved, this would be the third consecutive year that the company does not pay dividends and instead retains all accumulated profits for its business plan. As of December 31, 2023, VIC‘s accumulated undistributed post-tax profit was over 14,100 billion VND, based on the audited consolidated financial statements for 2023.

To serve Vingroup’s entertainment business activities in future complex real estate projects, VIC shareholders will consider and approve the addition of business activities, including: Operation of botanical gardens, zoos, and natural reserves; other sports activities; animal husbandry services; sports education and recreation; rental of other personal and household items.

In addition, to ensure that the listing of bonds issued by VIC to the public is carried out in accordance with legal regulations, shareholders approved the company’s registration and custody of the bonds with the Vietnam Securities Depository and Clearing Corporation and listing on the Hanoi Stock Exchange (HNX) after completing the bond issuance.

Discussion

Vinpearl to be listed at the end of this year

Are there any plans to list Vinpearl in the 2024-2025 period?

Chairman Pham Nhat Vuong: We are preparing the listing documents for Vinpearl at the end of the year, and we hope the market conditions will be favorable.

Does Vingroup plan to divest from other business sectors?

Chairman Pham Nhat Vuong: We do not have any plans at this time.

Does Xanh SM plan to go public?

Chairman Pham Nhat Vuong: Xanh SM is currently expanding its operations and will develop strongly in the international market. We are preparing, and if there is an opportunity, we will list on the international market.

The Chairman will continue to fund “out-of-pocket” at least 1 billion USD for VinFast

Is the market skeptical about Vingroup’s cash flow?

Chairman Pham Nhat Vuong: The market’s skepticism about Vingorup’s cash flow capacity is unfounded and based on rumors. Vingroup has never been late in paying a single interest payment to a bank, let alone repaying the principal. All plans are being implemented seriously. The worst is over, the market is recovering, and we can look at Vingroup’s product sales numbers, for example, Vinhomes sold a huge amount of inventory in March and April 2024 compared to the same period in 2023, and VinFast became the first brand with the highest sales in Vietnam compared to other electric vehicle brands in the market.

Progress is certain, and it is necessary to be steadfast, so these doubts are unfounded. Of course, there are difficulties, but nothing worthwhile is easy. I have said for a long time that VinFast is a project that we do out of social responsibility, to contribute to the country, to become a world-class brand, a brand that not only sells cars but also wants to become a top car brand in the world.

The issue of cash flow is a concern. We have to put all our resources together. I can confirm that Vinfast is the future, the pride, and the mission of Vingroup, so we will never give up on Vinfast. After I fund 1 billion USD, I will continue to arrange to fund at least another 1 billion USD. I hope that all Vietnamese people will join hands to contribute to VinFast, so that the brand can bring pride and a foundation for the development of other industries.

How far has the Group prepared its cash flow for the construction of factories in the US, India, and Indonesia?

Chairman Pham Nhat Vuong: Building factories abroad will not only help VinFast increase its competitiveness by minimizing logistics costs, but the Group will also be able to receive greater support from policies and taxes, “getting more” from local incentive mechanisms.

In the US, in the five years VinFast spent 2 billion USD on development, it could receive more than 2 billion USD in support, including policies in the host country. These are the levers that will enable VinFast to gain an advantage in the international market and improve sales.

The capital for the development of factories in these countries comes from funds raised in the host countries because there are strong support policies for green development in these countries.

Is Vingroup involved in the semiconductor chip sector?

Chairman Pham Nhat Vuong: I am an automotive expert, not a chip expert, so I cannot comment.

When will VinFast break even and cover its accumulated losses?

Chairman Pham Nhat Vuong: According to the plan, by 2026, we will begin to break even on EBITDA, and gradually, step by step, we will become profitable. In fact, some markets have already started to make a profit but on a “3 no” basis: no depreciation – no profit – no financial expenses, and all of these costs are excluded from the cost price to make the competitive advantage stronger. Gradually, step by step, we can tell the story of including depreciation and financial expenses in the price of the car in order to make a profit. From 2026, VinFast will have positive cash flow.

Electric vehicles are an irreversible trend

The survival of the Group depends on VinFast