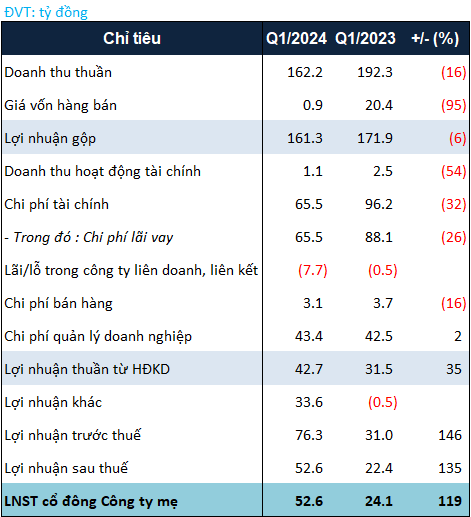

In Q1/2024, PDR generated over VND 159 billion from apartment transfers, but did not record any revenue from land transfers, leading to a 16% decrease in total revenue to more than VND 162 billion. However, due to the cost of goods sold being less than VND 1 billion, gross profit only decreased by 6% to over VND 161 billion.

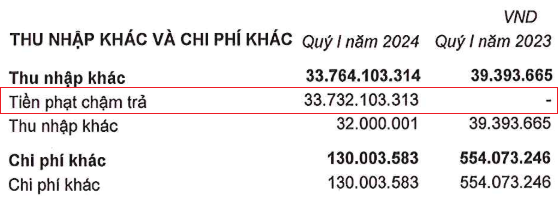

In financial activities, although revenue decreased by 54%, the value was insignificant. In contrast, financial expenses decreased by only 32% but helped PDR save tens of billions of dong, down to nearly VND 66 billion. During the period, the Company had other income of nearly VND 34 billion from collecting late payment penalties, while the same period last year was a loss.

Source: Financial Statements of PDR

|

Thanks to the reduction in financial expenses and extraordinary other income, PDR‘s net profit in Q1 was nearly VND 53 billion, 2.2 times higher than the same period last year. Despite the strong growth compared to Q1/2023, the result of the first quarter was only equivalent to nearly 6% of the plan that the Company expected to submit to the General Meeting of Shareholders on 26/04.

|

Q1/2024 Business Results of PDR

Source: VietstockFinance

|

On the balance sheet, PDR‘s total assets as of December 31, 2023 were over VND 21.4 trillion, an increase of 2% compared to the beginning of the year. The amount of cash decreased by 93% to nearly VND 35 billion, while short-term receivables increased by 17% to VND 4.8 trillion.

The value of fixed assets increased sharply from VND 27 billion to VND 756 billion in the context of the value of construction in progress decreasing by 54%, to nearly VND 534 billion. The significant changes in the above two items were due to PDR no longer recognizing the construction value of the building at 39 Pham Ngoc Thach, after the Company put this building into operation and moved its head office here.

PDR‘s liabilities increased by 3% to nearly VND 11.8 trillion. Borrowings increased by 14% to more than VND 3.5 trillion, in which the notable item was a USD 30 million (equivalent to over VND 732 billion) unsecured loan from ACA Vietnam Real Estate III LP with a 3-year term and an 8% interest rate.

PDR‘s management plans to submit to the annual General Meeting of Shareholders for approval a plan to issue shares to exchange for this debt. With an expected conversion price of VND 20,000/share (1 share converts VND 20,000 of debt), PDR could issue more than 34 million shares. Shares after issuance are subject to transfer restrictions for 1 year.