The probability of the stock market bottoming out has notably risen due to the strong rally today. After yesterday afternoon’s “test supply” price drop that failed to push up liquidity, today’s significant range expansion in money flow sends a clear message.

In fact, a further decline earlier today would have been ideal for a more thorough assessment of the “loose” supply. However, rapidly increasing prices are also a way to ignite impatience in the money flow. Indeed, the buying force pushing up prices has taken hold, with HSX and HNX trading liquidity reaching a healthy 18.3 trillion VND today.

During the downturn and in the sideways consolidation phase, a sharp price rebound typically does not attract significant money flow, and liquidity is often low during price increases. However, today’s range expansion set it apart, and the money accepted the need to follow suit. Thus, the increase in liquidity is a positive sign, indicating a much greater willingness to take on risk compared to previous sessions.

Today’s developments were not based on any unexpected news factors; everything remains mostly unchanged from previous days. Even in the afternoon, there were concerns about exchange rates, rising OMO interest rates, and various other justifiable reasons for a reversal to the downside. However, such information and today’s movements simply reaffirm a well-established market principle: the market assesses good or bad news subjectively, not objectively.

Today’s strongest rally in five months will provide psychological support. Investors will readily find reasons to reinforce their belief in a market recovery and dismiss the negative sentiments that arose yesterday. Nevertheless, the information is secondary; the key remains in observing supply and demand, and further fluctuations are still to come. As stock holders grow more confident, the potential for price increases becomes more apparent. This corrective phase is simply a natural occurrence in a healthy market, making supply and demand the critical factors.

Today’s rapid gains forced many investors to chase prices higher. Acquiring at higher prices is acceptable if the market is in a recovery phase, but it is clear that prices will not be as favorable as during a downturn. Many were apprehensive or even outraged by “test supply” phases like yesterday’s, but this presents an excellent buying opportunity. The market will not soar upwards indefinitely in the upcoming sessions but will invariably experience pullbacks and even declines. A strategic purchasing strategy will optimize cost basis.

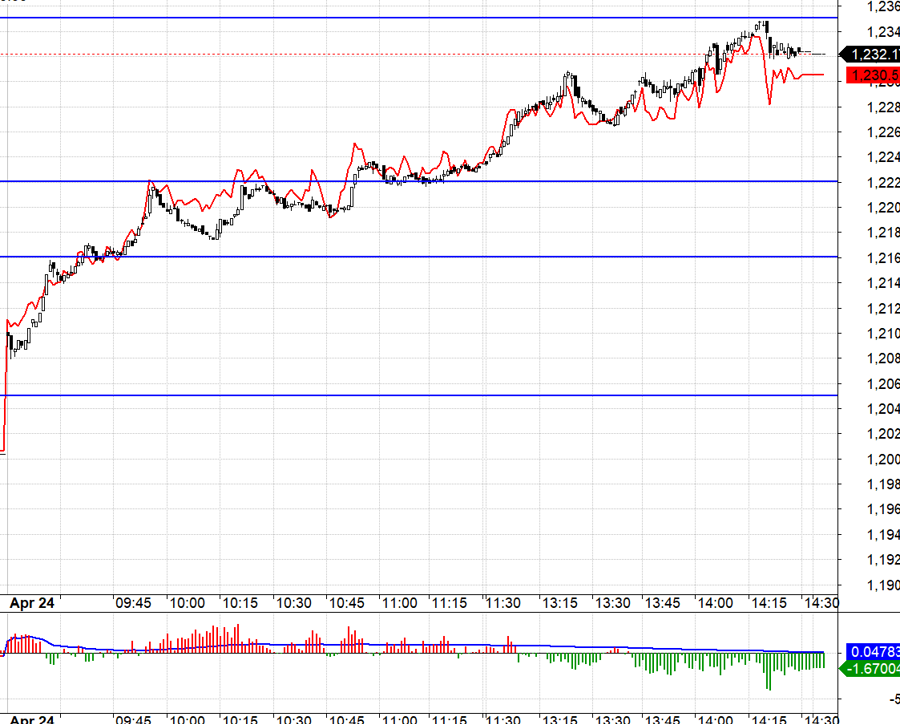

Today, the derivatives market rose continuously, with basis closely tracking VN30 until the final stretch when the pace of acceleration and amplitude grew too rapid, prompting more cautiousness among derivatives traders. Naturally, long positions profited handsomely from the uniform upswing and robust performance of the pillars. The pace of growth will slow tomorrow, and a reversal is possible. The strategy is flexible Long/Short play.

VN30 closed today at 1232.17. Tomorrow’s immediate resistance levels stand at 1235; 1239; 1246; 1252; 1258; 1262. Support levels: 1229; 1222; 1216; 1205.

“Stock Market Blog” is of a personal nature and does not represent the views of VnEconomy. The views and assessments are strictly those of the individual investor, and VnEconomy respects the opinions and writing styles of its authors. VnEconomy and the author are not liable for any problems arising from the published investment views and assessments.