The gloom from yesterday’s nearly 13-point reduction has completely vanished as the market was quickly and continuously “injected” with adrenaline today. The VN-Index gained strength towards the end, closing the day at 1,205.61 points, regaining the psychological threshold of 1,200 points that was lost 4 sessions ago. Excluding capital withdrawal transactions in FUEVFVND fund certificates, foreign investors also made large net purchases today with many blue-chips.

Today’s 28.21-point increase in the VN-Index, equivalent to +2.4%, is the strongest increase since the session on November 8, 2023, or since the beginning of the recent uptrend. This development occurred after the market corrected by nearly 9% and many codes corrected by 15%-20%, indicating a positive shift in sentiment. It should also be noted that yesterday the market suddenly fell nearly 13 points after the session. the first week increased by 15 points, causing disappointment to many investors.

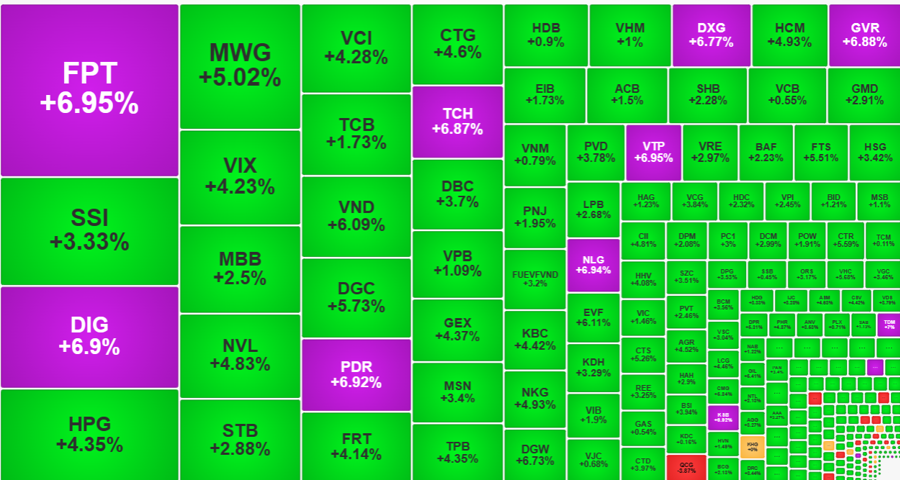

Today’s trading was in a state of extreme excitement despite the absence of any unexpected new supporting information. However, the demand for high prices is very good and buyers are willing to accept continuous price increases. The increase continued throughout the day and there was no correction phase in the VN-Index. The breadth was completely dominant, with HoSE closing with 435 gainers/69 losers, of which 18 codes hit the ceiling, 155 other codes increased by over 2%, and 65 codes increased from 1% to 2%.

The initial increase did not have a good consensus on liquidity, but the inflow of money later became stronger. In general, the total matched value of the two listed exchanges reached VND 18,326 billion, an increase of 9% compared to the previous session. If calculating the total transaction of the whole market including the agreement, the 3 exchanges reached VND 21,755 billion, an increase of 14%.

The HoSE floor recorded 47 stocks with liquidity from VND 100 billion or more, and all of them increased, of which 38 codes increased by over 2%. Leading the way was FPT, which increased by the ceiling price and also had the largest market liquidity with VND 1,204.7 billion. FPT officially reached a new historical peak in today’s session at VND 120,100/share. In general, the remaining gainers are all highly marketable, such as VTP, NLG, PDR, DIG, TCH, DXG, etc. The VN30 blue-chip basket only contributed GVR to increase the full margin.

However, the increase of the VN30-Index was stronger than that of the VN-Index when it closed above the reference by 2.65%. 22 stocks in this basket increased by more than 1% with leading capitalization pillars such as BID up 1.21%, CTG up 4.6%, VHM up 1%, HPG up 4.35%, TCB up 1.73%, VIC up 1.46%, FPT up 6.95% and VPB up 1.09%. It is a pity that the largest stock VCB only increased by 0.55% and the 5th largest stock GAS increased by 0.54%.

Foreign investors also chased prices enthusiastically today. FUEVFVND fund certificate unexpectedly appeared a negotiated net sale of VND 977 billion after the ATC session, making the overall position of foreign investors on the HoSE floor today -VND 244 billion. However, if calculated on stock transactions, this block still net bought about VND 733 billion.

The series of stocks that foreign investors bought strongly are HPG +164.4 billion, MWG +160.1 billion, VND +91.2 billion, SSI +72.5 billion, TPB +60.7 billion, TCH +49.1 billion, DGW +47.3 billion, VPB +39.6 billion, DIG +38.4 billion, PDR +31.7 billion, etc. It can be seen that many codes in this group also increased very strongly, even hitting the ceiling price. Foreign investors accepting to chase the price to the maximum range shows a very strong buying attitude.

Today’s strong increase makes the 3 fluctuating sessions just past have a fairly high probability of forming a bottom. First, the VN-Index pulled back yesterday but did not create a new bottom and today the breakout range was widened. Liquidity is also starting to recover. The market may still fluctuate up and down in the coming days, but as long as the lowest level of this week is maintained, the bottom can be confirmed.