Services

Mr. Do Minh Phu, Chairman of Board of Directors of Tien Phong Commercial Joint Stock Bank

|

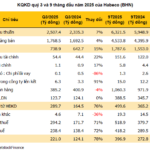

Delivering his opening remarks at the General Meeting, Mr. Do Minh Phu, Chairman of the Board of Directors, stated that in 2023, with the continuous support of its shareholders, TPBank overcame the “headwinds” of the business year, moved forward steadily, and significantly increased many key growth indicators. Total assets increased to over VND 350,000 billion, exceeding the annual plan by 9% compared to 2022. Loans to customers exceeded the VND 200,000 billion mark, representing a 27% increase. Total operating income for the year surpassed VND 16,000 billion, with the main contribution coming from net interest income of nearly VND 12,500 billion, an increase of 9%. The bank recorded over VND 5,600 billion in pre-tax profit, corresponding to an ROE of nearly 14%. Exemplifying its commitment to supporting customers through difficult times, TPBank proactively reduced interest rates for retail and corporate customers, providing total assistance worth nearly VND 2,000 billion.

In addition, TPBank also achieved record growth milestones in terms of scale. Non-term deposits (CASA) increased by 34%, surpassing VND 47,000 billion, contributing to a 7% growth in deposits from individuals and organizations. This growth both allows the bank to save on capital costs and demonstrates its ability to ensure continuous and seamless transactions, giving customers peace of mind in using these deposits for their daily financial activities.

Thanks to its innovative and comprehensive digital banking strategy, TPBank’s customer base increased to a record 3.5 million in 2023, bringing the total number of customers served to over 12 million. In just three years, TPBank has attracted over 8.6 million new customers, doubling its total customer base from the previous 12 years.

In 2023, under the direction, guidance, and supervision of the new Board of Directors, TPBank continued to demonstrate its solid financial foundation, retaining its position as the leader in Vietnam for the second consecutive year in The Asian Banker’s “Strongest Banks in Asia-Pacific” list. Shining brightly in the Vietnamese banking market with a brand valuation exceeding US$425 million, TPBank made its debut in the rankings of the world’s leading brand valuation organization, Brand Finance, and became one of the Top 5 private banks with the highest brand value in Vietnam.

34% profit growth target

At the 2024 TPBank Shareholders’ General Meeting, the business plan for 2024 was approved, with the aim of diversifying revenue sources and enhancing asset quality, with the goal of achieving a consolidated pre-tax profit of VND 7,500 billion, a 34% increase compared to the previous year. To achieve this goal, total assets are expected to increase by 9.36% to VND 390,000 billion. Total outstanding loans are projected to grow by 15.75% to VND 251,821 billion, while capital mobilization is expected to rise by 3.31% to VND 327,000 billion. With its strong performance and ability to meet customer needs through its digital platform, TPBank is also targeting a significant increase in its customer base, reaching 15 million in 2024.

Ahead of the General Meeting, experts from KB Securities Vietnam commented that with TPBank’s efforts to strengthen its bad debt resolution in 2023, it will significantly reduce the pressure on provisions in 2024, providing a solid foundation for achieving sustainable business growth targets. In 2024, TPBank aims to keep its non-performing loans below 2.5%.

Mr. Do Minh Phu – Chairman of the Board of Directors of TPBank shared: “As one of the 14 credit institutions identified as systemically important by the State Bank of Vietnam, with a spirit of pushing boundaries, unity, and dedication, TPBank flexibly responded to the complex market developments in 2023 to continue achieving remarkable milestones. This strong performance has laid the foundation for the bank to set even higher goals, drive credit growth, and prioritize green lending in 2024. We will leverage our strengths in technology and digital innovation to lead the transformation of the banking industry, adopting international risk management standards to control bad debts and ensure efficient operations“.

TPBank Shareholders’ General Meeting 2024

|

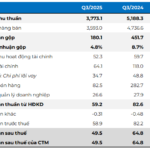

To achieve the 2024 goals, in the first quarter of 2024, TPBank’s financial results exceeded VND 1,800 billion, an increase of 5.5% compared to the same period last year. Total operating income increased by 28% compared to the same period in 2023, reaching nearly VND 4,700 billion. Notably, through its market agility and expertise, TPBank’s investment banking business generated significant profits, with income from this segment increasing by over 120% compared to the same period last year.

25% dividend payout in cash and shares

One of the highlights of the General Meeting was the approval of the 2023 dividend payment plan (to be implemented in 2024) at a rate of 25% in cash and shares. The source of dividends will be from undistributed profits after setting aside reserves in accordance with the audited financial statements.

As one of the banks to pay a high dividend in 2024, this is not the first time TPBank has brought good news to its shareholders. Previously, in April 2023, TPBank distributed nearly VND 4,000 billion to shareholders as a cash dividend of 25% (shareholders received VND 2,500 for each share owned). The source of the dividend was undistributed profits up to 2021, following the deduction of reserves in accordance with the audited financial statements.

In 2023, TPBank also issued nearly 620 million shares as a dividend to existing shareholders at a rate of 39.19%, funded by retained earnings of VND 1,536 billion, share premium of VND 2,561 billion, and VND 2,102 billion from retained earnings in 2022.