Aiming for a market capitalization of 25 trillion VND by 2027

Ms. Nguyen Thanh Thao – CEO spoke about TVS’s vision of becoming a pioneering and trusted boutique merchant bank. The goal by 2027 is to have total assets under management of 75 trillion VND and a market capitalization of 25 trillion VND.

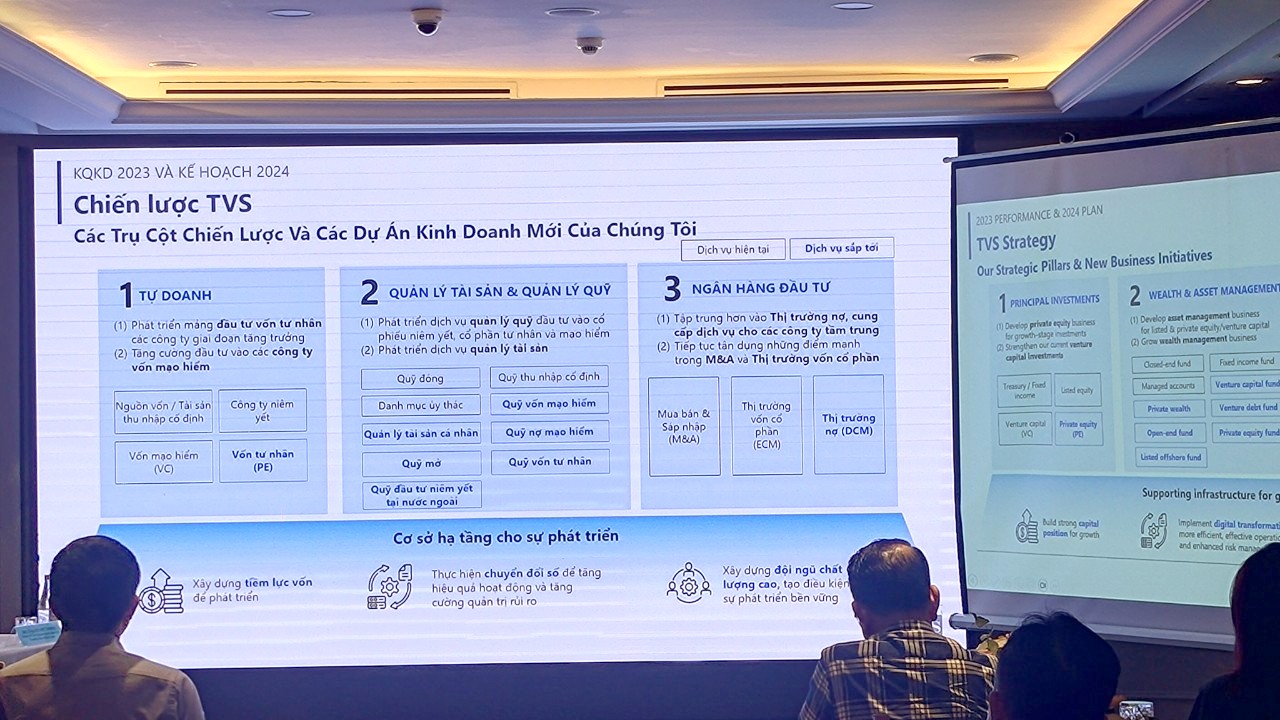

The three main pillars of the Company include:

Proprietary trading: Developing private equity investment, increasing investment in venture capital companies

Asset management, fund management: Developing investment management services for listed stocks, private equity and venture capital, developing asset management services

Investment banking: Focusing more on the debt market, providing services to mid-sized companies, continuing to leverage its strengths in M&A and equity capital markets.

On the sidelines of the meeting, Ms. Thao shared that TVS’s plan is built on the target of VN-Index reaching 1,300 points by the end of this year.

Currently, the Company has no plan to increase capital. In 2024, the Company plans to issue 800 billion VND of bonds, considering a private placement when the market improves but at that time the share price must reflect the full value of the Company.

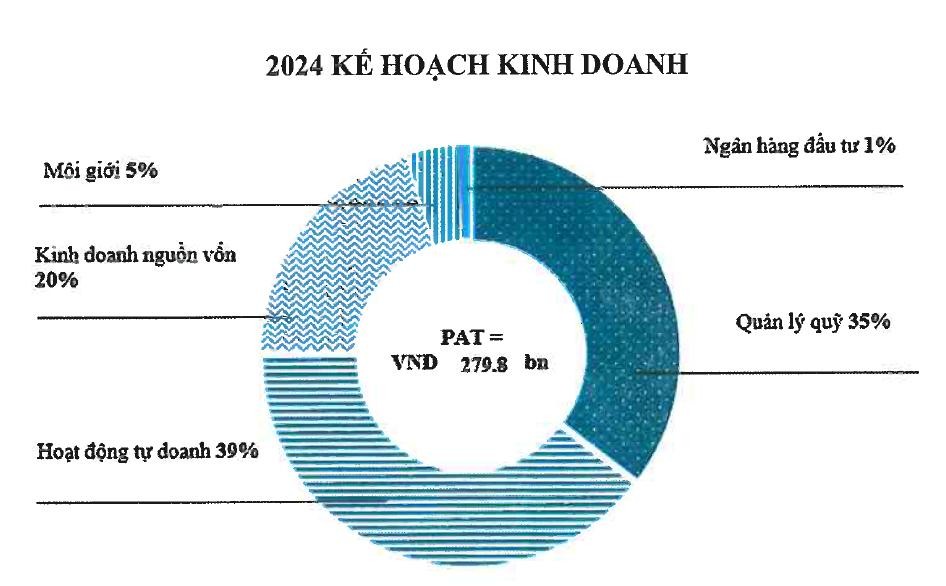

After-tax profit plan of 280 billion VND, an increase of 11%

In 2024, TVS set a target of after-tax profit of nearly 280 billion VND, an increase of 11% compared to the previous year. Of which, most of the income comes from equity investment (40%), fund management (35%) and fixed income (20%).

|

TVS’s after-tax profit structure

Source: TVS

|

With an expansionary monetary policy, TVS’s management expects the economy to improve in 2024. The barriers of monetary policy in 2023 will ease in 2024, including recovering global and domestic consumption demand, helping to boost credit demand for production and export; the passing of the amended Land Law will help to gradually remove legal obstacles for real estate projects, helping the real estate market to recover from the fourth quarter of 2024.

The growth drivers of the economy will come from the continued implementation of fiscal and monetary loosening policies, along with the recovery of import-export activities.

Looking ahead to 2024, TVS’s General Director predicts that there will be more capital flows into the market, coming from both domestic and foreign investors. Listed companies are expected to have double-digit earnings growth in 2024, a stark contrast to the modest decline in 2023. Some sectors will particularly benefit from positive macroeconomic conditions, such as public investment, import-export, and trade and retail.

TVS’s strategies and business pillars in 2024

|

TVS plans to distribute a dividend for 2024 in cash or shares not exceeding 10% of the charter capital.

In 2023, TVS agreed with shareholders to pay a dividend in shares at a rate of 10%. Accordingly, the charter capital will increase to VND 1,669 billion.

This AGM also elected the Board of Directors and the Supervisory Board for the 2024-2028 term.

The list of elected members of the Board of Directors includes Mr. Nguyen Trung Ha, Mr. Terence Ting, Ms. Bui Thi Kim Oanh, Ms. Nguyen Thanh Thao, Mr. Ngo Nhat Minh, Mr. Tran Vinh Quang and Mr. Huynh Minh Viet.

The list of elected members of the Supervisory Board includes Mr. Do Viet Hung, Ms. Tran Thi Hong Nhung, Mr. Bui The Toan.

At the end of the meeting, all proposals were approved.

Updated article