SGR is “thirsty” for capital to develop projects

Sharing at the annual General Meeting of Shareholders held on April 26, Chairman of the Board of Directors of Saigon Real Estate Joint Stock Corporation (HOSE: SGR) Pham Thu mentioned that the Company will restart the plan to issue 20 million shares at a price of 30,000 – 35,000 VND/share this year. Mr. Thu said that this plan was included in the Resolution in 2021, but due to the pandemic in 2022 and the real estate market downturn in 2023, the Company has not been able to implement it.

According to Mr. Thu, the source of investment capital is an issue that he, the Board of Directors, and the Executive Board find extremely important at present. In addition to the difficulties in the external environment, SGR has internal difficulties, which are extremely difficult, and it seems impossible to overcome, Mr. Thu said.

There is little bank capital, a lot of compensation for projects, and debts from partners have not been recovered. Banks do not lend to real estate businesses unless they start construction, and they do not lend to compensate or prepare for investment, Mr. Thu explained the difficulties.

Meanwhile, SGR has to distribute 60 billion VND of dividends to shareholders. So where will the investment capital come from to implement and prepare for the Company’s projects? According to Mr. Thu, the biggest difficulty is the investor’s capital or equity (charter capital). Each project now requires the investor’s capital to account for 20% of the total project investment, otherwise it will not be approved, this is a prerequisite. However, in reality, this source of capital at SGR is insufficient.

SGR‘s charter capital currently stands at 600 billion VND from 2020 to the present, of which the capital invested in member companies is 250 billion VND, in joint ventures is over 200 billion VND, and compensation for land is almost gone, said the Chairman of SRG.

The bidding units now have very clear requirements on capital issues. The Board of Directors believes that this year it needs to have about 1,400 – 1,500 billion VND of equity, and by 2025, it will be 2,500 billion VND. The Board of Directors plans to work with a number of securities companies to issue 20 million shares at a price of about 30,000 – 35,000 VND/share on the market this year. Accordingly, the Company can add 600 billion VND this year and 900 billion VND in 2025, and if it does not distribute dividends this year, the capital after the issuance can reach 1,500 billion VND.

2024 Annual General Meeting of Shareholders of SGR.

|

Where will more than 1.6 billion VND be invested in the near future?

Faced with questions from shareholders about the market price of shares and the Company’s ROE ratio being commensurate with the scale of the company’s assets, Mr. Thu said that the two issues were different.

According to the Chairman, in the period from 2010 to 2023, from the time when the Company’s charter capital was only over 200 billion VND, until now, the total profit earned in the past 14 years on average charter capital in 14 years, SGR achieved about 27%/year. “This is a very high profit margin because during that time we went through the 2008 financial crisis, the real estate downturn in 2012 and 2018, the COVID-19 pandemic in 2021-2022 and in 2023 extremely difficult.”.

In 14 years, there were 6 years of the pandemic and economic downturn, but ROE was on average 27% because in the years that were not in recession, ROE reached 70-80%/year or even 135%. In addition, shareholders received bonus shares, dividends, and more importantly, we have built up a land fund of 1 million m2, and that land fund is our real profit in the future”, said Mr. Thu.

In 2024, SGR expects revenue of 628 billion VND, which is more than 3 times higher than in 2023; pre-tax profit of 190 billion VND, 48% and investment value of 1,645 billion VND, 3.4 times higher.

Sharing about the investment of more than 1.6 billion VND in 2024, Mr. Thu explained that this number is a disbursement for both projects in 2025 and onwards. This year alone, the Company will invest about 500 billion VND, and the remaining 1.1 billion VND is to prepare for pillow projects, projects that are being prepared for investment, and projects that are being compensated in the period of 2025-2028. The leader said that SGR currently has about 20 projects in hand.

Regarding the projects in 2024, the Company said it will continue to focus resources on projects being invested in, such as: Van Lam – Binh Thuan residential area, Viet Xanh – Hoa Binh ecological urban area, Cua Can – Phu Quoc commercial housing area, Phu Dinh Riveside apartment complex, Phu Hoi residential area, Cai Rang district center, the intersection of Le Sat and Tan Huong streets, Tan Phu district, etc. At the same time, SGR also continues to look for investors for potential projects through direct investment, M&A, joint ventures, joint ventures, investment cooperation, etc.

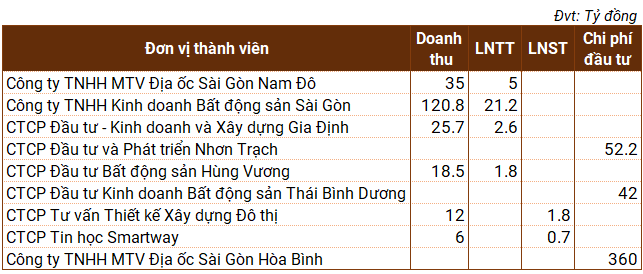

The Company sets out a number of business targets for its member units.

Source: VietstockFinance

|

With after-tax profit in 2023 reaching more than 102 billion VND, SGR will allocate 2 billion VND to the bonus and welfare fund, and the rest will be added to equity to increase investment capital for production and business activities.

Receivables from DXG

Regarding the receivables with Dat Xanh Group Corporation (HOSE: DXG) in the two projects An Phu 1 and An Phu 2, SGR has not yet received the full transfer payment, the Chairman explained that the two projects with DXG are conditional sale and purchase contracts, not transfer contracts because the projects have not completed infrastructure and roads. This task is the responsibility of DXG, but the road is invested by the state, so it depends on the progress of the state. So far, DXG has encountered financial difficulties and has only paid SGR 220 billion VND out of the total 650 billion VND transfer price committed to by the two parties. If the traffic infrastructure is completed and SGR does not need to invest additionally, the Company can record a profit of 300 billion VND.

“Last year we set a target to collect all of this money but could not do it, so this year if we can collect it, the profit will be very large, but we must actively work to collect the money,” said Mr. Thu.