119 Suppliers and Subcontractors Agree to Convert Debt to Equity

On the afternoon of April 25, 2024, Hoa Binh Construction Corporation (HBC) held its 2024 annual general meeting of shareholders virtually.

As of 2:15 PM on April 25, 398 shareholders attended the meeting in person or by proxy, representing more than 144 million shares, or 52.65% of the voting shares.

119 Suppliers and Subcontractors Agree to Convert Debt to Equity

Hoa Binh’s Chairman, Mr. Le Viet Hai, stated that many of the shareholders attending today’s meeting are suppliers and subcontractors who have agreed to convert their debt into equity. As of the date of the annual general meeting of shareholders, HBC had 119 suppliers, subcontractors, and construction material suppliers who agreed to convert their debt into equity, amounting to 821 billion VND. However, according to regulations, only a maximum of 100 separate investors are allowed to be issued, and according to the draft submission to the AGM, 99 suppliers and subcontractors were allowed to participate in the debt-to-equity conversion, with the total expected issuance value to date reaching 740 billion VND.

Potential of the International Market

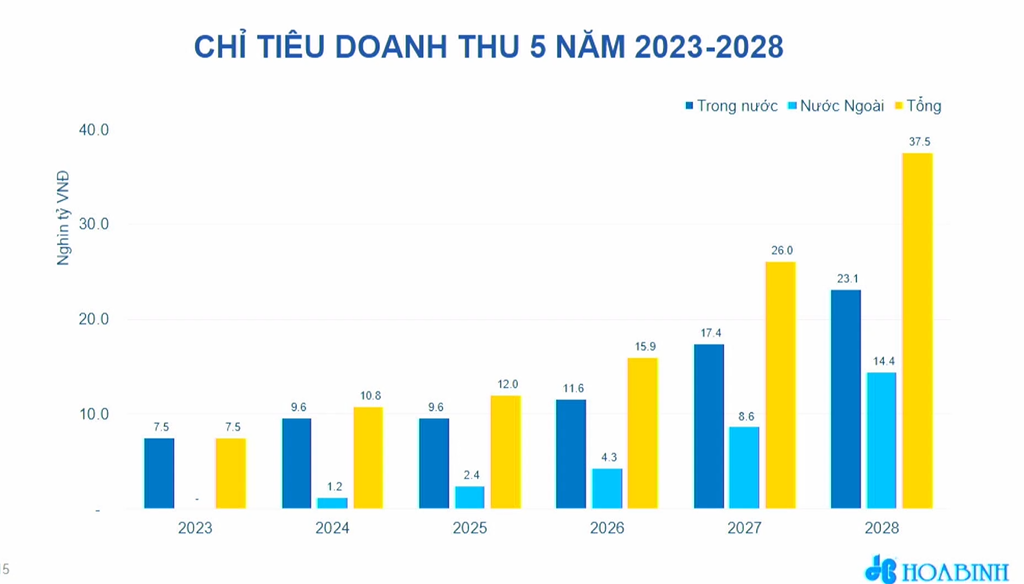

According to Mr. Le Viet Hai, in the face of the domestic market’s challenges, Hoa Binh has begun to recognize the potential of the international market. Hoa Binh, in particular, and Vietnamese businesses in general, have the capability to export comprehensive construction services to international markets.

Vietnam’s construction industry has witnessed a period of rapid growth after 50 years of stagnation from 1945 to 1995 due to the war and its consequences. Throughout the construction boom, the Vietnamese construction industry has learned, integrated the finest construction technologies, project management methodologies, and corporate governance practices from developed countries.

Vietnam not only possesses core competencies but also has an abundant and innovative workforce. Additionally, Vietnam’s construction supply chain is rapidly developing, with export revenues continually increasing.

Mr. Le Viet Hai also mentioned that the challenges that Hoa Binh Construction faced in 2023 seemed insurmountable. However, the company has now overcome the situation of “extreme hardship, with thousands of pounds hanging by a thread.”

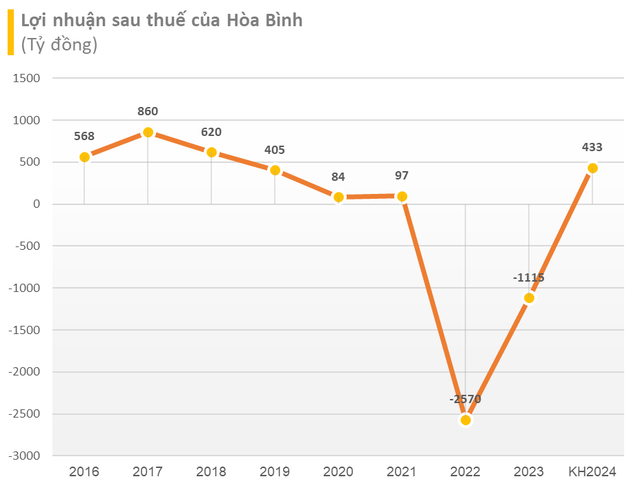

According to the audited financial statements for 2023, Hoa Binh achieved revenue of over 7,537.1 billion VND, reaching 60% of its target. After expenses, the company had a loss of 1,115 billion VND.

In 2024, HBC aims for total revenue of 10,800 billion VND, a 43% increase compared to 2023, and a profit after tax of 433 billion VND.

10-Year Vision

General Director Mr. Le Van Nam stated that the total value of HBC’s bid participation with investors is 34,500 billion VND, to be executed within 3-5 years. Of this, the plan is to sign contracts worth 7,000 billion VND in 2024 and record revenue of 2,600 billion VND; the backlog of 27,500 billion VND will be recognized in subsequent years.

The 10-year vision from 2024 to 2033 is for HBC to restore its position within the next 3-5 years, increase Hoa Binh’s equity capital to over 10,000 billion VND, and expand into the international market, aiming to become a top 50 construction company in the international market.

Mr. Le Van Nam, General Director of HBC, stated that the Company has outlined nine plans to raise equity capital to approximately 7.2 trillion VND by 2026, including: Issuance of shares to convert subcontractor/supplier debt (expected to increase equity by 740 billion VND); sale of debt (269 billion VND); sale of a portion of construction equipment (400 billion VND); handover of the Lake Side project, for which HBC serves as both the investor and general contractor (projected profit of 72 billion VND); acceleration of debt collection to reverse provisions (938 billion VND); implementation of the Asscent Nha Trang Long project (500 billion VND); transfer of several real estate projects, such as 1 Ton That Thuyet and 233 & 235 Vo Thi Sau (totaling 333 billion VND); mergers and acquisitions of two projects, 127 An Duong Vuong and Hai Luu Resort, through share issuance to partners (totaling 1,364 billion VND); and finally, share issuance to strategic partners (projected 2,400 billion VND).

Private Placement Plan to Increase Charter Capital in 2024

The Board of Directors of Hoa Binh Construction submitted a private placement plan to the shareholders to increase the charter capital and convert new debt this year. Accordingly, the corporation plans to issue 74 million shares (an increase of 20 million shares from the previous plan) with an offering price of 10,000 VND/share to convert debt with creditors such as suppliers, subcontractors, and manufacturers. The shares issued will be subject to a one-year transfer restriction.

In addition, Hoa Binh Construction will offer 200 million shares (a decrease of 20 million shares from the previous plan) at a price of 12,000 VND/share to raise charter capital. The estimated proceeds of 2,400 billion VND will be used to repay the company’s bank loans. The target audience for this offering is professional investors. The shares