DuPont Chemical Corporation Reports Challenging First Quarter Performance

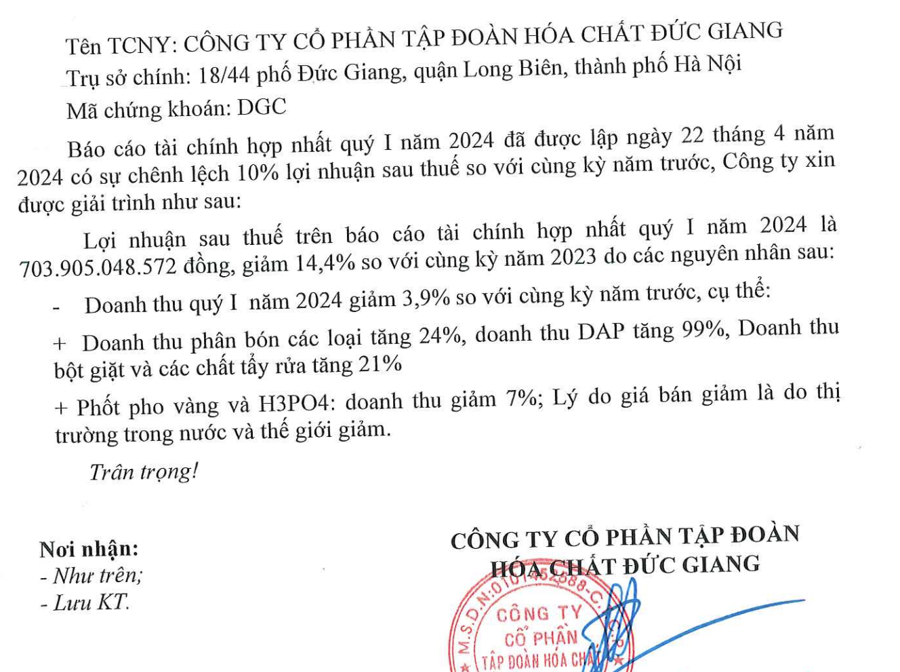

German Chemicals Group Corporation (DGC) has just announced its business results for the first quarter of 2024, which represent the most challenging business environment in the past three years.

Accordingly, in the first quarter, DGC achieved nearly 2.4 trillion VND in revenue, down 4% year-on-year. The cost of goods sold increased by 2%, to over 1.6 trillion VND, leading to a 14% decrease in the enterprise’s gross profit to 766 billion VND. Financial revenue increased slightly to 165 billion VND. After deducting expenses, the chemical giant ended the first quarter with a net profit of 673 billion VND, down 15% year-on-year. This is also the lowest profit level of Duc Giang Chemicals since the third quarter of 2021.

Explaining the decline in revenue and profit, according to General Director Dao Huu Duy Anh, although fertilizer, DAP, detergent, and cleanser revenues increased, yellow phosphorus and H3PO4 revenues decreased by 7%. The selling prices of these items decreased due to a decline in both domestic and international markets.

Previously, DGC’s 2024 General Meeting of Shareholders approved a plan for revenue of over 10 trillion VND and after-tax profit of 3.1 trillion VND. With these results, the chemical giant achieved 23.4% of its revenue target and nearly 23% of its after-tax profit target after the first quarter.

At the end of the first quarter, the company recorded over 14 trillion VND in total assets, down 7% compared to the beginning of the year. The majority of this is in the form of short-term assets, at nearly 11.5 trillion VND, down 8%. Notably, the company holds a large amount of cash, nearly 9.6 trillion VND, mostly in short-term deposits. This amount brought DGC over 165 billion VND in financial revenue in the first quarter.

In the stock market, DGC’s share price exceeded its previous peak to reach 126,000 VND/share in March.

Commenting on the share price at the 2024 Annual General Meeting of Shareholders, Mr. Dao Huu Huyen, Chairman of the Group’s Board of Directors, stated that Duc Giang Chemicals is still performing well, still making steady profits, and also trading in popular products with competitiveness. If that logic is followed, DGC stocks will only rise. “However, if the economy is difficult, investors flee, and no funds are pumped in, the stock will fall,” said Mr. Huyen.