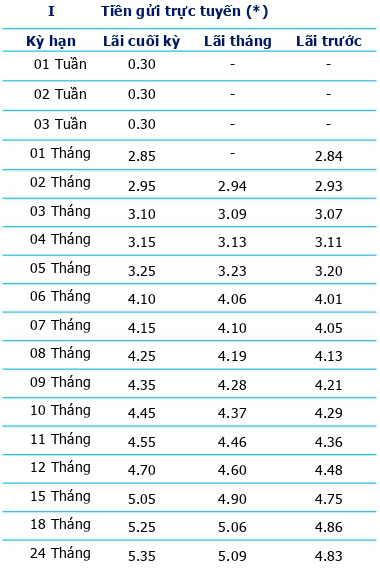

Vietnam Joint Stock Commercial Bank for Industry and Trade (BVBank) has officially increased its saving interest rates for terms of 3 months, 6 months, and 12 months with an increase of 0.05 percentage points. The table of latest saving interest rates at BVBank will be applied from today, April 24th.

Specifically, online saving interest rates for the 3-month term have increased to 3.1%/year.

Online saving interest rates for the 6-month term have increased by 0.05 percentage points to 4.1%/year.

Online saving interest rates for the 12-month term have also been adjusted to 4.7%/year.

Saving interest rates for other terms remain unchanged. Accordingly, saving interest rates for terms of 1-2 months are kept at 2.85-2.95%/year, terms of 4-5 months are 3.15-3.25%/year, terms of 7 months are 4.15%/year, terms of 8 months are 4.25%/year, and terms of 9 months are 4.35%/year.

The bank also keeps the saving interest rate for the 18-month term unchanged at 5.25%/year. Meanwhile, the saving interest rate for the 24-month term remains at 5.35%/year.

Latest online saving interest rates at BVBank.

Since the beginning of April, the wave of increasing saving interest rates has spread across many banks, including VPBank, Eximbank, KienlongBank, VIB, MSB, HDBank, GPBank, OceanBank, KienlongBank, VPBank, Eximbank, VietinBank. Notably, VPBank is also the bank that adjusted its interest rates up twice in April.

Before BVBank, OceanBank increased its saving interest rates for all terms with the highest increase of 0.9 percentage points. With this readjustment, the normal saving interest rates in the market have rebounded and exceeded 6%/year.