Oil Prices Decline Amidst Easing Middle East Tensions and Slowing US Business Activity

Oil prices decreased on Tuesday due to easing concerns about conflict in the Middle East and slowing business activity in the United States. However, falling U.S. crude oil inventories limited the price decline.

At the close of trading on April 24, Brent crude futures dropped 40 US cents, or 0.45%, to settle at $88.02 per barrel. Meanwhile, West Texas Intermediate (WTI) crude futures slid 55 US cents, or 0.66%, to end at $82.81 per barrel.

Analysts at Goldman Sachs stated that easing tensions between Iran and Israel could reduce oil prices by $5-10 per barrel in the coming months and projected a ceiling price of $90 per barrel for Brent crude.

The price decline was capped as the Energy Information Administration (EIA) reported that U.S. crude oil inventories for the week ending April 19, 2024, fell by 6.4 million barrels to 453.6 million barrels, against analysts’ expectations of an 825,000-barrel increase.

Business activity in the U.S. in April 2024 declined to a four-month low, with the composite Purchasing Managers Index (PMI), which tracks manufacturing and services sectors, falling to 50.9 from 52.1 in March 2024, according to S&P Global.

US Natural Gas Prices Fall 5%

U.S. natural gas prices tumbled 5%, weighed down by the prospect of reduced heating demand in the upcoming week.

Natural gas futures for May 2024 delivery on the New York Mercantile Exchange (NYMEX) decreased by 15.9 US cents, or 8.8%, to settle at $1.65 per million British thermal units (mmBTU).

Gold Prices Dip Slightly

Gold prices edged lower as Middle East tensions eased. Meanwhile, investors shifted focus to upcoming U.S. economic data later in the week for clues about the Federal Reserve’s interest rate path.

Spot gold on the LBMA remained around $2,322.09 per ounce after touching its lowest level since April 5, 2024, in the previous session. June 2024 gold futures on the NYMEX fell 0.2% to $2,338.4 per ounce.

Gold bullion has shed over $100 per ounce since hitting a record high of $2,431.29 per ounce on April 12, 2024. Meanwhile, the U.S. dollar index firmed 0.2%, making bullion priced in the greenback less attractive to overseas buyers.

Copper Prices Rise, Tin Dips

Copper prices advanced after two consecutive days of declines, but buying hesitancy from Chinese consumers amid copper hovering near a two-year high limited further gains.

Three-month aluminum on the London Metal Exchange (LME) gained 0.7% to $9,772 per tonne. Copper had eased from a peak of $9,988 per tonne earlier in the week, pressured by profit-taking selling.

LME tin lost 1% to $31,635 per tonne, extending losses after sliding to its lowest in almost two years in the previous session.

Iron Ore Prices Hit Over Six-Week High, Steel Rebar Rises

Iron ore futures on the Dalian Commodity Exchange surged to their highest in over six weeks, buoyed by expectations of improving steel demand in top consumer China and supply outlook after a major miner lowered its annual export guidance.

The most-active iron ore futures contract for September 2024 delivery on the Dalian exchange jumped 3.08% to 888 yuan ($122.55) per tonne, the strongest since March 8, 2024. Iron ore had declined by over 1.5% in the previous session.

On the Singapore Exchange, the benchmark May 2024 iron ore contract gained 5.12% to $118.55 per tonne, reaching its highest since March 7, 2024.

Analysts at Galaxy Futures said that iron ore fundamentals have improved, and a bullish outlook is expected for the ferrous complex.

In Shanghai futures, steel rebar rose 0.46%, hot-rolled coil increased 0.45%, and stainless steel climbed 0.53%, while coil dropped 0.31%.

Japanese Rubber Prices Decline for a Second Straight Session

Japanese rubber prices fell for the second consecutive day, tracking a downward trend in top producer Thailand, coupled with increased price competition and a surplus in the electric vehicle market that weighed on sentiment.

The Osaka Exchange (OSE) rubber contract for October 2024 delivery retreated 3.8 yen, or 1.23%, to settle at 309.3 yen ($2.00) per kilogram.

Meanwhile, the most-active rubber contract on the Shanghai Futures Exchange for September 2024 delivery dropped 155 yuan to 14,215 yuan ($1,961.85) per tonne.

The Singapore Exchange rubber contract for May 2024 delivery declined 0.44% to 160.1 US cents per kilogram.

Coffee Prices Gain

London robusta coffee futures for July 2024 delivery rose $149, or 3.6%, to $4,266 per tonne, revisiting the record high ($4,292 per tonne) reached in the previous week.

Supply concerns in top robusta producer Vietnam persist, and robusta output in Brazil is estimated to be lower than anticipated.

Simultaneously, ICE arabica coffee futures for July 2024 delivery gained 1.8% to $2,259 per pound, supported by the strong rally in robusta prices.

However, arabica coffee stocks as of April 23, 2024, increased to 647,530 bags (60 kg), compared to 251,224 bags at the end of 2023.

Sugar Prices Continue to Rise

Raw sugar futures for May 2024 delivery on the ICE exchange rose 0.09 US cent, or 0.5%, to 20.09 US cents per pound.

White sugar futures for August 2024 delivery on the London exchange gained 0.6% to $576.6 per tonne.

Wheat Prices Advance, Corn and Soybeans Dip

U.S. wheat futures continued to climb, driven by dry weather raising concerns in key wheat-growing areas and disruptions to supply chains due to Russia’s conflict in the Black Sea region.

On the Chicago Board of Trade, wheat futures for July 2024 delivery rose 10-1/4 US cents to $6.13 per bushel, the strongest since January 25, 2024. Corn futures for July 2024 delivery dipped 4 US cents to $4.48-1/2 per bushel, and soybeans for nearby delivery fell 1/2 US cent to $11.81-1/2 per bushel.

Palm Oil Prices Decline

Malaysian palm oil futures fell, pressured by weaker soybean oil and crude oil prices, while a firmer ringgit also weighed on sentiment.

The benchmark palm oil contract for July 2024 delivery on the Bursa Malaysia Derivatives Exchange decreased 28 ringgit, or 0.71%, to 3,943 ringgit ($825.76) per tonne.

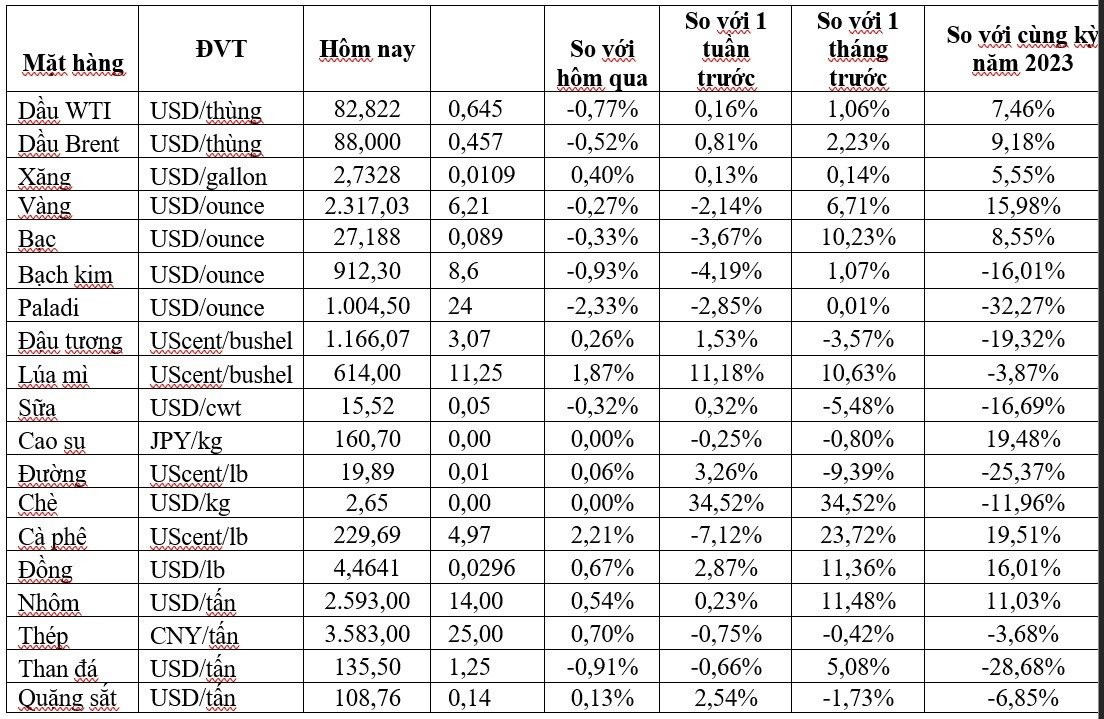

Key Commodity Prices as of April 25, 2024