FPT Retail (FPT Retail, stock code FRT) has announced its Q1/2024 business results with a positive consolidated pre-tax profit.

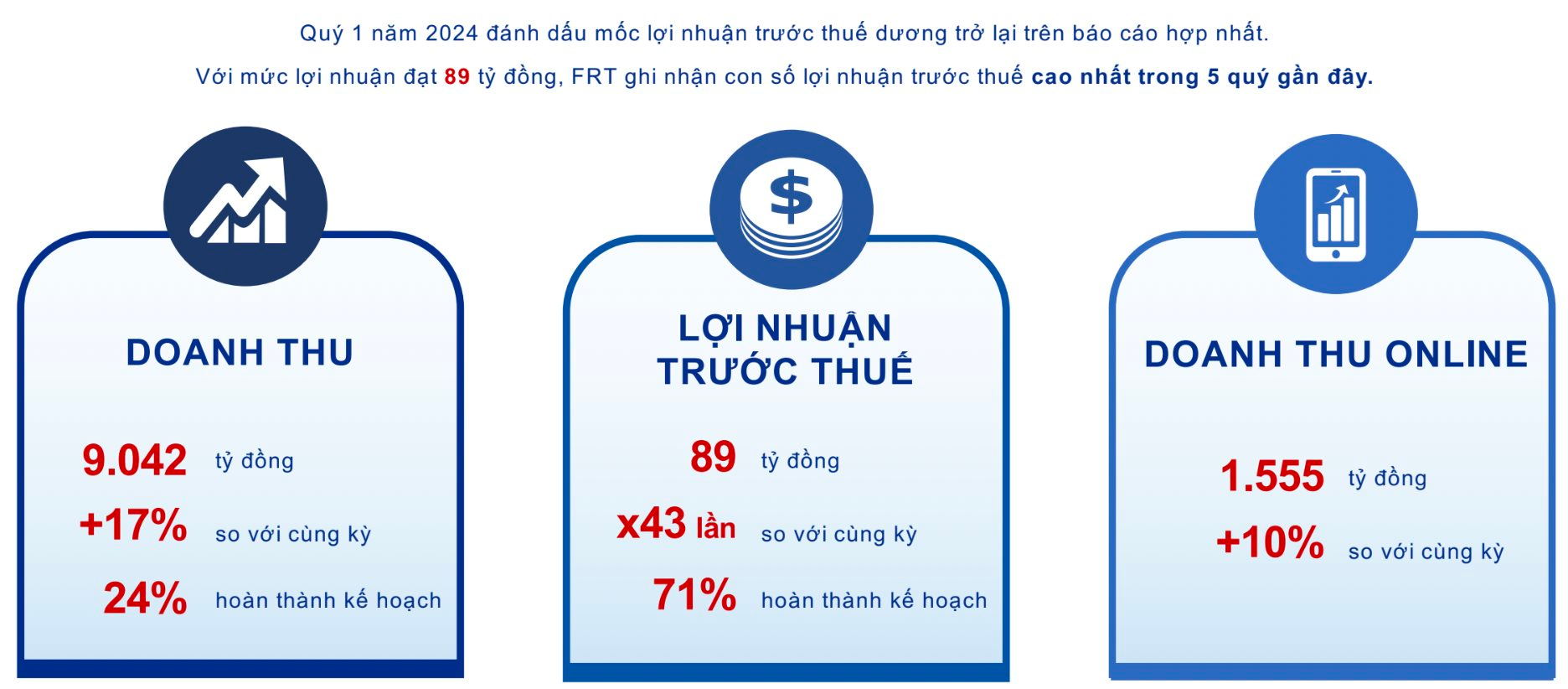

Specifically, FPT Retail recorded a consolidated revenue of VND 9,042 billion, up 17% year-on-year, fulfilling 24% of the plan. In which,

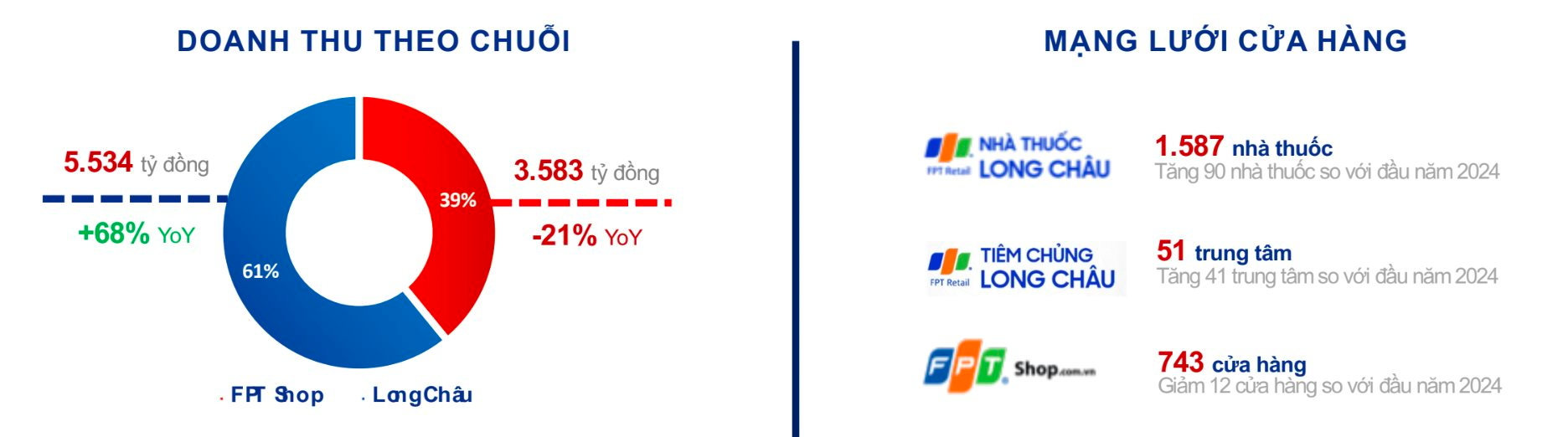

+ The pharmaceutical segment with FPT Long Chau contributed VND 5,534 billion, a 68% growth compared to Q1/2023 and accounted for 61% of the total revenue of the whole Corporation.

+ ICT segment with FPT Shop chain, the restructuring of product portfolio in the past time helped the system’s gross profit increase by 3% compared to the same period last year. At the same time, accessing to the source of loan with good interest rates also helped reduce financial costs by about 50% compared to the same period last year.

Besides, FRT’s online revenue increased by 10% compared to the same period, reaching VND 1,555 billion.

After deducting costs, FRT’s pre-tax profit in Q1/2024 reached VND 89 billion – 43 times higher than the same period last year. With the profit of VND 89 billion, FRT recorded the highest pre-tax profit in the last 5 quarters.

Regarding the store network, by the end of Q1/2024, FPT Retail owned a network of 2,381 stores nationwide. Notably, FPT Long Chau expanded strongly with 1,587 pharmacies, an increase of 90 pharmacies compared to the beginning of 2024. In parallel, the Company also developed a network of vaccine centers with 3 models: shop in shop, side by side and independent stores, opening 41 new centers in the first quarter of 2024.

At the Annual General Meeting of Shareholders held on April 17, the Company officially announced the strategy to expand the comprehensive healthcare ecosystem “Long Chau Healthcare Platform”. To invest in this strategy, FPT Long Chau plans to raise capital, through a private offering of shares to investors with a maximum offering value of 10%.