Lac Hong Tourism Raises Additional VND 140 Billion in Corporate Bonds

Lac Hong Tourism has secured an additional VND 140 billion in bonds.

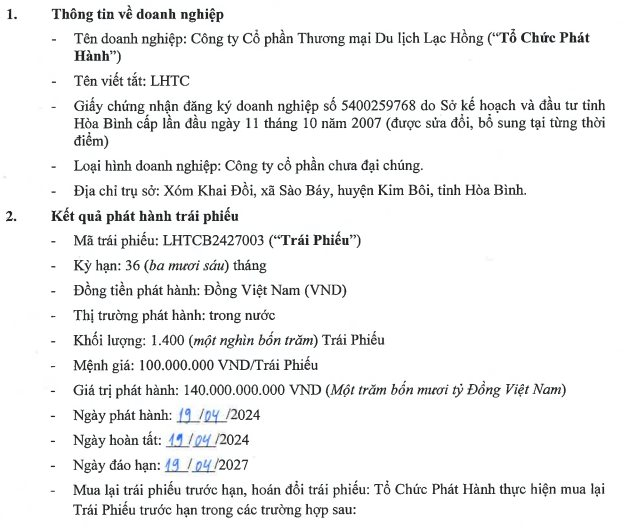

Lac Hong Tourism Joint Stock Company (Lac Hong Tourism) has announced the results of its private bond offering to the Hanoi Stock Exchange (HNX).

According to the announcement, Lac Hong Tourism has completed the issuance of the LHTCB2427003 bond series, with a value of VND 140 billion, on April 19, 2024.

Specifically, the LHTCB2427003 bond series was issued by the Hoa Binh tourism company in the domestic market, with a term of 36 months and an issuance volume of 1,400 bonds, with a face value of VND 100 million per bond, corresponding to an issuance value of VND 140 billion.

The LHTCB2427003 bond series was issued by Lac Hong Tourism and completed on April 19, 2024. Thus, the maturity date for this bond series will be April 19, 2027.

This is a non-convertible bond series that does not include warrants and is secured by assets. The form of security is “Payment guarantee from financial and credit institutions; Secured by assets.”

This is the third successful bond issuance of the Hoa Binh tourism company since the beginning of this year.

Regarding interest rates, the LHTCB2427003 bond series has a combined interest rate of fixed and floating rates, as follows:

- For the first 04 Interest Calculation Periods: fixed interest rate of 9% per year.

- For the remaining Interest Calculation Periods: floating interest rates equal to 4.3% per year plus Reference Interest Rates.

Previously, in February and March, Lac Hong Tourism had completed the issuance of two bond series, LHTCB2427001 and LHTCB2427002, with a total value of VND 600 billion, with the same term, interest rate, and asset security as the LHTCB2427003 bond series mentioned above.

Thus, since the beginning of this year, Lac Hong Tourism has raised VND 740 billion from bonds, nearly 1.6 times the company’s charter capital.

According to the information available, Lac Hong Tourism Joint Stock Company, headquartered in Khai Doi Hamlet, Sao Bay Commune, Kim Boi District, Hoa Binh. The company operates in the commercial and service sectors and currently has a charter capital of VND 465 billion.