HTI organized its annual Shareholders’ Meeting on April 25, 2024, in an online format. Photo: Thanh Tú

|

Targets 300 Billion VND Industrial Cluster Project in Tiền Giang Province

Chairman of the Board of Directors, Mr. Nguyễn Hồng Hải, stated that the company’s toll collection operations have stabilized, and the toll collection period is currently under negotiation. As such, the Board has determined that developing new projects, including industrial and cluster zones, will be a core objective for the upcoming period.

With the consensus and support from IDICO Corporation (HNX: IDC), the parent company holding 57.5% of shares as of the end of 2023, HTI has gained access to highly viable industrial cluster projects. One notable project is the Mỹ Phước Industrial Cluster investment project in Tân Phước District, Tiền Giang Province (worth approximately 300 billion VND). However, this project requires feasibility assessment and participation in an auction, which is expected to take place in the third quarter of this year.

“In case the project demonstrates high feasibility, the Company will resolutely expand into this field, as it represents an excellent opportunity for the Company to leverage its resources, cash flow, and stable long-term development,” said Mr. Hải.

Mr. Nguyễn Hồng Hải, Chairman of the Board of Directors of HTI. Photo: Thanh Tú

|

BOT Toll Collection Period Expected to End in the Fourth Quarter of 2032

Member of the Board of Directors and General Director, Mr. Lê Quốc Đạt, stated that according to calculations by the State Audit, HTI is projected to conclude its BOT project toll collection period in the fourth quarter of 2032, and no changes have been made to this timeline as of now. This year, HTI will engage in negotiations with the competent authority to determine the final date.

“Between now and the fourth quarter of 2032, approximately 8 years and 8 months remain, a significant duration during which the company will explore projects to extend the toll collection period. Ho Chi Minh City currently has 5 BOT projects operating under the special mechanism of Resolution 98, and the company is also researching and bidding for some of these BOT projects, provided that they ensure profitability during the investment period,” informed Mr. Đạt.

Moreover, the Company will participate in the bidding process for the remaining construction work on the Tân Kỳ Tân Quý bridge in the second quarter (with an estimated contract value of approximately 60 billion VND). Elaborating on capital recovery for the Tân Kỳ Tân Quý bridge construction project, Mr. Đạt noted that the project’s investment format has been converted from a BOT contract to public investment. This is an unprecedented case, requiring consultations with numerous ministries and agencies.

The project commenced on March 2, 2018, and construction was temporarily suspended in December 2018. The actual investment value, including interest expenses and investor profits, is projected to exceed 230 billion VND as of the end of 2023, with an initial payment of over 138 billion VND already received.

The Company continues to collaborate and work with relevant departments, agencies, and the Ho Chi Minh City People’s Committee to report to the Ministry of Finance for guidance before proceeding with the second payment (80% of estimated profits and interest expenses until the date when HTI receives the contract termination payment), which is scheduled for the second quarter of 2024, and the third payment, projected for the first quarter of 2026.

“Currently, the conversion procedures have been completed, and the Ho Chi Minh City People’s Committee signed an agreement to terminate the contract appendix ahead of schedule on November 7, 2023, with the Company,” said Mr. Đạt.

Mr. Lê Quốc Đạt, Member of the Board of Directors and General Director of HTI. Photo: Thanh Tú

|

Additionally, the investment project to complete the electronic non-stop toll collection (ETC) system at the An Sương – An Lạc toll station (installation of ETC for the remaining 4 lanes) is expected to be finalized in the second quarter. Simultaneously, HTI will carry out the necessary procedures to adjust the toll rates at the An Sương – An Lạc station when the VAT is likely to increase back to 10% from July 1, 2024. This move will boost revenue and secure capital for the Company’s investment activities.

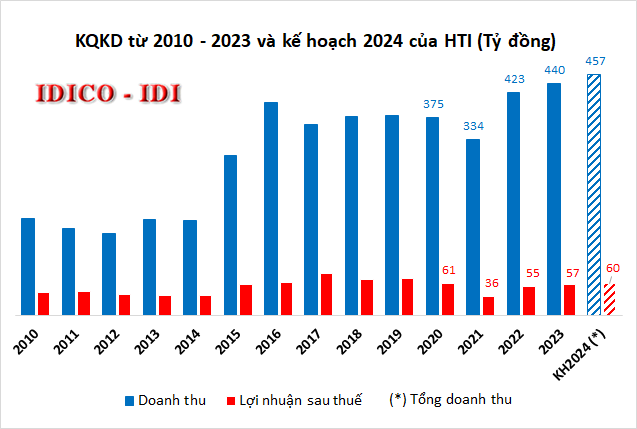

Plan for a Slight Increase

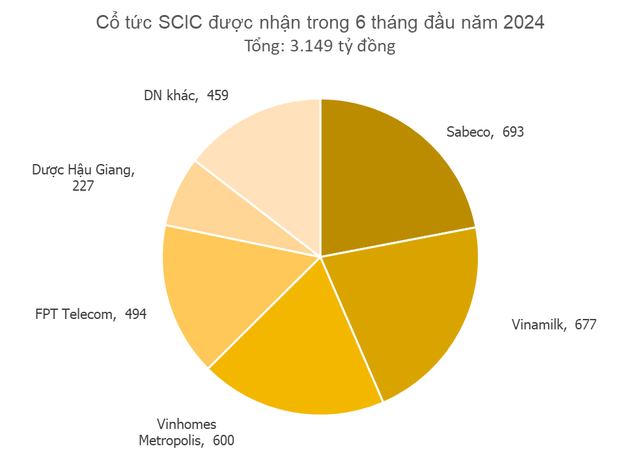

The HTI General Meeting of Shareholders approved the business plan for 2024, targeting revenue of approximately 457 billion VND and after-tax profit of 60 billion VND, representing increases of 3% and 5%, respectively, compared to 2023. Furthermore, the company also plans to increase its investment value to 300 billion VND, almost 24 times higher than the previous year.

In the first quarter of 2024, HTI’s net revenue reached over 110 billion VND, a 4% increase year-on-year. After-tax profit amounted to nearly 15 billion VND, up by 7%. Compared to the plan, the company achieved 24% of its revenue target and 25% of its after-tax profit target after the first quarter.

|

Maintaining Dividends for 2024 at 16%

At the General Meeting of Shareholders, many shareholders expressed their desire for the company to raise the dividend payout for this year and the coming years, as the project’s cash flow is gradually improving.

On this matter, Mr. Đạt stated that the company’s decision to maintain a dividend payout of 16% is appropriate. According to the BOT contract that the company has signed with the state agency, the return on equity (ROE) is 14%, reflecting the company’s financial strategies, and HTI is also making provisions for cash flow to invest in projects in the coming years.

Additionally, this year, the company will continue negotiations with relevant authorities to determine the payback period for the company, after which it will submit a plan to the Board of Directors to modify the current dividend scheme.

Finally, the General Meeting of Shareholders approved a dividend payout ratio for 2024 of 14-16%. For 2023, a cash dividend of 16% was agreed upon, with the payment scheduled for the second quarter of 2024.

Moreover, the company also approved the dismissal of Mr. Nguyễn Anh Dũng as a member of the Board of Directors and three Supervisory Board members: Mr. Nguyễn Văn Thọ, Ms. Nguyễn Thị Minh Phương, and Mr. Nguyễn Đăng Thanh.

In their place, the candidates nominated by IDC for appointment for the 2022–2027 term are Mr. Đỗ Chí Linh as a member of the Board of Directors and three Supervisory Board members: Ms. Nguyễn Thị Thanh Huyền, Mr. Nguyễn Bình Minh, and Lê Thùy Trang.

Percentage of Faulty Etags Shows