Luxury Retail in Ho Chi Minh City Booming Amidst Stiff Competition

Ho Chi Minh City’s luxury retail sector has witnessed a surge in demand, attracting leading names in high-end fashion, jewelry, and watches. The influx of these brands has sparked fierce competition for prime retail spaces in the city’s central districts.

According to a recent report by Savills, luxury brands are vying for scarce ground-floor retail space in Ho Chi Minh City’s downtown area.

Forecast to Generate $992.20 Million in Revenue in 2024

Statista estimates that in 2023, the luxury goods sector in Vietnam generated a total revenue of $957.22 million. Key drivers of this revenue include high-end cosmetics and fragrances, fashion, leather goods, and luxury timepieces and jewelry. The industry is projected to reach $992.2 million in 2024.

The report highlights Vietnam’s stable annual growth rate in the luxury goods segment, estimated at 3.10% (CAGR 2024-2028). The growing middle class and rising disposable incomes have fueled a surge in demand for luxury items.

Further supporting this growth, Knight Frank’s recently released 2024 Wealth Report indicates that Vietnam ranks fifth in the Asia-Pacific region for its ultra-wealthy population growth between 2023 and 2028. This growth surpasses that of South Korea, Hong Kong, and Singapore. Vietnam’s ultra-wealthy individuals, defined as those with a net worth of $30 million or more, numbered approximately 752 in 2023, a 2.4% increase from the previous year. While this growth rate is lower than neighboring countries like Malaysia (4.3%), Indonesia (4.2%), and Singapore (4%), it is three times higher than Thailand’s 0.8%.

By 2028, Vietnam’s ultra-wealthy population is expected to reach 978, a 30% increase from 2023, placing it among the top five in the Asia-Pacific region, ahead of South Korea, Hong Kong, and Singapore. This has led to an influx of luxury jewelry brands, with some pieces valued in the billions of VND.

Competition for Prime Retail Space

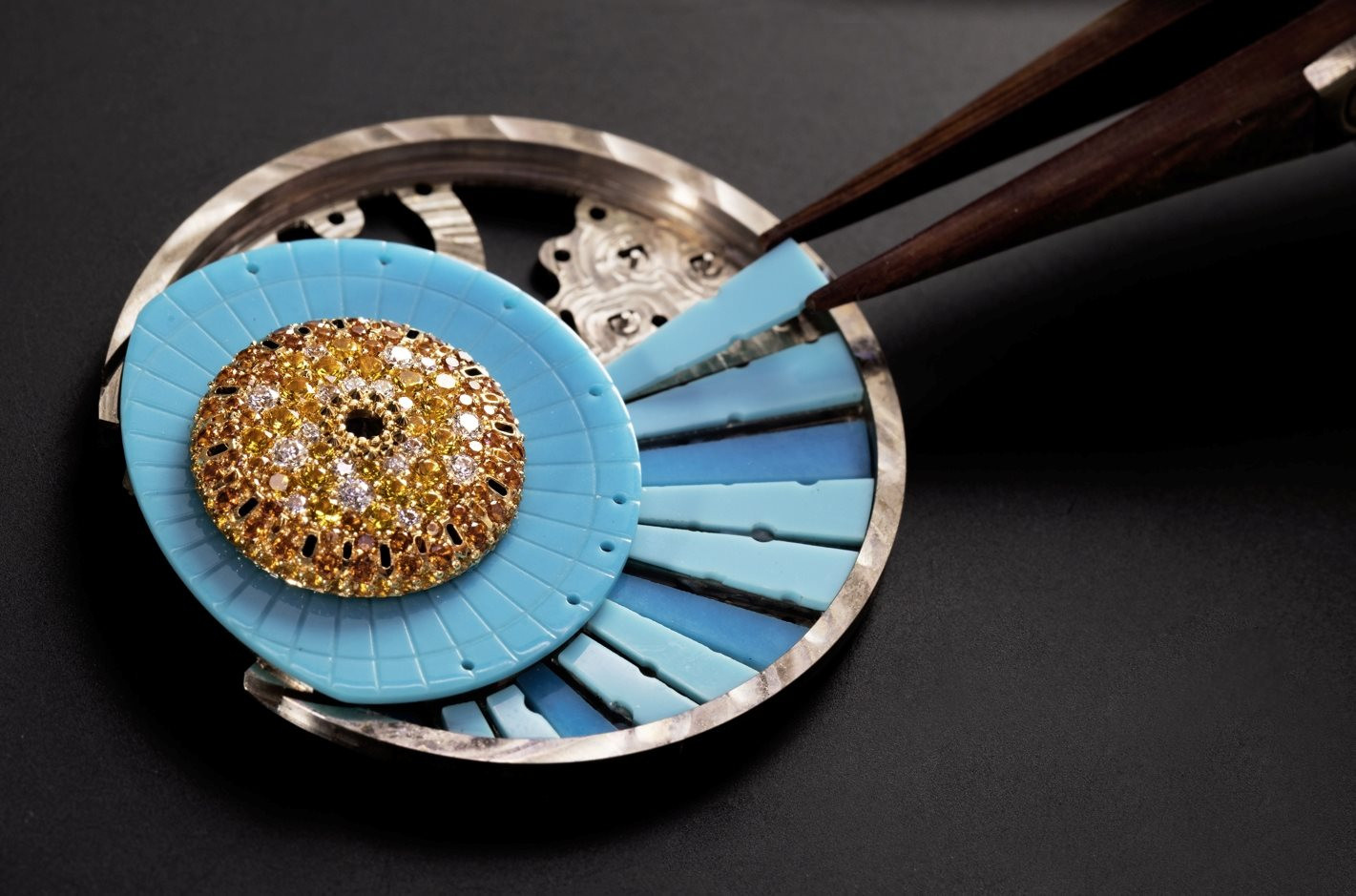

Savills’ Q1/2024 real estate market report reveals that several international luxury brands have quickly entered the market in recent months, including Fendi, Cartier, and Loewe. These are renowned names in the field of high-end timepieces and jewelry.

Statita also reports that the luxury goods market has experienced a significant shift towards online sales, which are projected to account for 8.6% of total revenue in 2024. However, physical stores still dominate the market, contributing over 90% of sales.

Savills’ data shows that F&B, sports, and cosmetics retailers led leasing activity across the region in the second half of 2023. Outdoor retailers also expanded, while entertainment and activity brands occupied more space in shopping malls.

In the luxury sector, brands are investing in concept stores and more experiential retail concepts. Flagship luxury stores, such as watchmaker Richard Mille’s new boutique in Singapore, provide an immersive, luxurious experience complete with bars, cafes, and artwork.

In Vietnam, Tran Pham Phuong Quyen, Senior Manager of Leasing Services for Savills Ho Chi Minh City, notes that high-end brands are now mainly concentrated in downtown areas with existing clusters of luxury brands. This trend demonstrates the strong appeal of these locations to potential customers of luxury brands.

“However, the supply of retail space in existing luxury clusters is scarce, leading to intense competition among brands,” Quyen says.

According to Quyen, the trend towards seeking clustered ground-floor retail space in central District 1 reflects the “safety in numbers” mentality prevalent in the retail industry.

“Brands tend to choose locations in areas with multiple brands within their segment to benefit from the crowd effect and attract customers,” Quyen explains.