The stock market fluctuated dramatically in the session on April 23. The VN-Index marked an initial increase, but the strong correction pressure gradually drove the index down below the 1,180 point mark. As a result, the VN-Index decreased by 12.82 points (-1.08%) to 1,177.4 points. Foreign investors were less active, with a net sell value of VND 283 billion across the market.

In this context, domestic brokerage companies reversed their trend to sell net VND 1,052 billion on all three exchanges.

On the HoSE exchange, domestic brokerage companies sold net VND 1,074 billion, including a net sale of VND 1,148 billion through the order-matching channel but a net purchase of VND 73 billion via the negotiation channel.

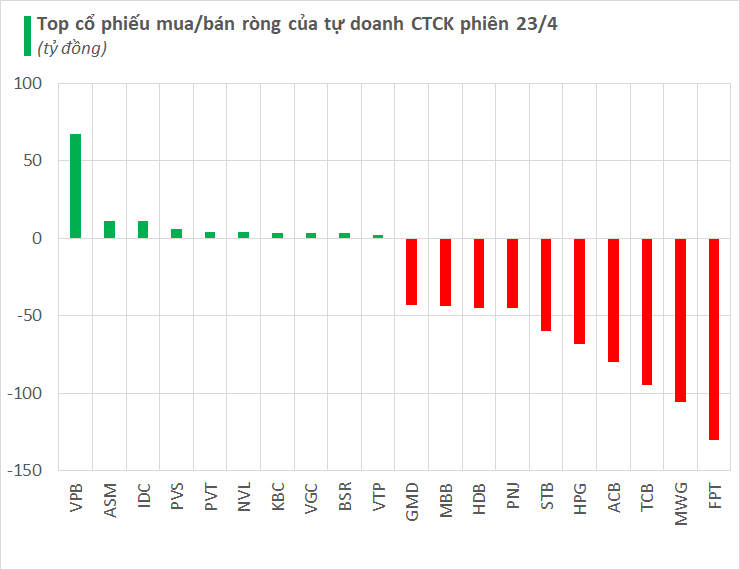

Specifically, brokerage companies with the strongest net selling were FPT and MWG, with values of VND 130 billion and VND 106 billion, respectively. These two stocks went against the grain and increased in value during today’s session, with FPT rising 1.8% and MWG gaining 2.5%. Following them were TCB and ACB, which were both sold net for VND 95 billion and VND 80 billion, respectively. Other stocks that were net sold during today’s session include STB, HPG, PNJ, HDB, etc.

Conversely, the group of brokerage companies with the strongest net buying was VPB bank with VND 67 billion, while ASM was also net bought for VND 11 billion. PVT and NVL were each net bought for approximately VND 4 billion. Additionally, stocks like KBC, VGC, VTP, NKG, etc. also experienced slight net buying during the April 23 session.

On the HNX, domestic brokerage companies bought a net value of over VND 18 billion, including a net purchase of nearly VND 11 billion on IDC. At the same time, PVS and MBS were net bought for VND 6 billion and VND 1 billion, respectively.

On the UPCoM, domestic brokerage companies bought a net value of nearly VND 4 billion, of which BSR was net bought for nearly VND 3 billion, and MCH and VEA were also net bought slightly.