Hodeco Reports a Steep Decline in First-Quarter Profit Due to Real Estate Market Headwinds

Hodeco JSC (HoSE: HDC), a real estate developer based in Ba Ria-Vung Tau, Vietnam, has announced its consolidated financial results for the first quarter of 2024. The company’s revenue declined by 52% year-over-year to VND 85.3 billion (approximately USD 3.6 million). Gross profit also witnessed a significant drop of 81.4% to VND 15 billion (USD 634,000).

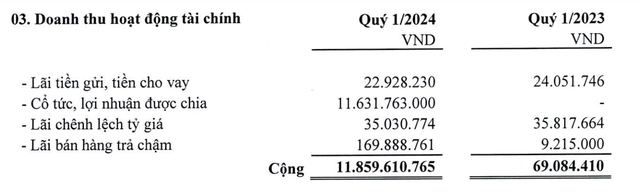

Despite a surge in financial income from VND 70 million to VND 11.86 billion (USD 501,000) and a 58% reduction in financial expenses to VND 9 billion (USD 381,000), Hodeco faced a 17% rise in selling and administrative expenses, reaching VND 11.79 billion (USD 500,000). The company also incurred a loss of VND 5.3 billion (USD 224,000) from its joint ventures and associates.

Consequently, Hodeco’s net income in the first quarter of 2024 plummeted by 96% to a mere VND 1.12 billion (USD 47,000). The company’s ability to avoid losses in the first three months of the year can largely be attributed to the surge in financial income.

According to the company’s financial statement, the increase in financial income was primarily driven by a dividend payment of VND 11.63 billion (USD 492,000), which was not recorded in the same period last year.

Hodeco has attributed the decline in its first-quarter profit to a combination of market challenges in the real estate sector, adjustments in its provision for impairment on investments, and a reduction in consolidated revenue compared to the same period last year.

For 2024, Hodeco has set ambitious targets, aiming for a 146.7% year-over-year increase in revenue to VND 1,657.6 billion (USD 70.2 million) and a 222.4% surge in after-tax profit to VND 424 billion (USD 17.9 million). As of the end of Q1 2024, the company has only achieved 0.3% of its revenue target.

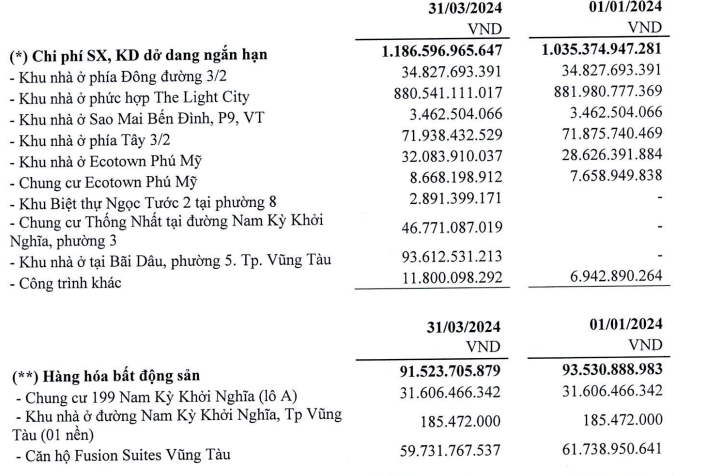

Total assets edged up by 1.2% from the beginning of the year to VND 4,753.3 billion (USD 200.9 million) as of March 31, 2024. Long-term construction in progress amounted to VND 1,290 billion (USD 54.8 million), representing 27% of total assets. The majority of this is for long-term construction in progress, primarily comprising a 18.54-hectare residential area in District 12 of Vung Tau City (VND 580 billion, or USD 24.7 million) and a residential area in Long Dien District (VND 5542 billion, or USD 23.6 million).

Inventory stood at VND 1,282.5 billion (USD 54.4 million), also accounting for 27% of total assets. The Light City project alone accounted for VND 880 billion (USD 37.4 million) of the work in progress inventory.

Current receivables reached VND 943.1 billion (USD 39.9 million), representing 20% of total assets, while long-term financial investments were valued at VND 814.6 billion (USD 34.6 million), accounting for 17% of total assets.

On the liabilities side, total short-term and long-term debt increased by 2.2% during the first three months of the year to VND 1,742 billion (USD 74.1 million), equivalent to 91% of the company’s equity. Short-term debt accounted for nearly VND 1,223 billion (USD 51.9 million), while long-term debt stood at VND 619 billion (USD 26.3 million), all of which was bank loans.