Following a well-received recovery earlier in the week, the stock market recorded a volatile trading session on April 23. VN-Index continued its upward trend at the beginning of the session with lower liquidity; however, the downside selling pressure caused the index to reverse and drop nearly 13 points. At the end of the session, VN-INDEX lost 12.82 points (-1.08%) to 1,177.4 points. Foreign trading was less active with a net sell-off of VND 283 billion in the entire market.

In light of the negative trend when buying power did not see any significant increase, many securities companies assessed that market risks were still high, and investors should keep a close watch on the trend and limit new investment, prioritizing portfolio restructuring during recovery phases.

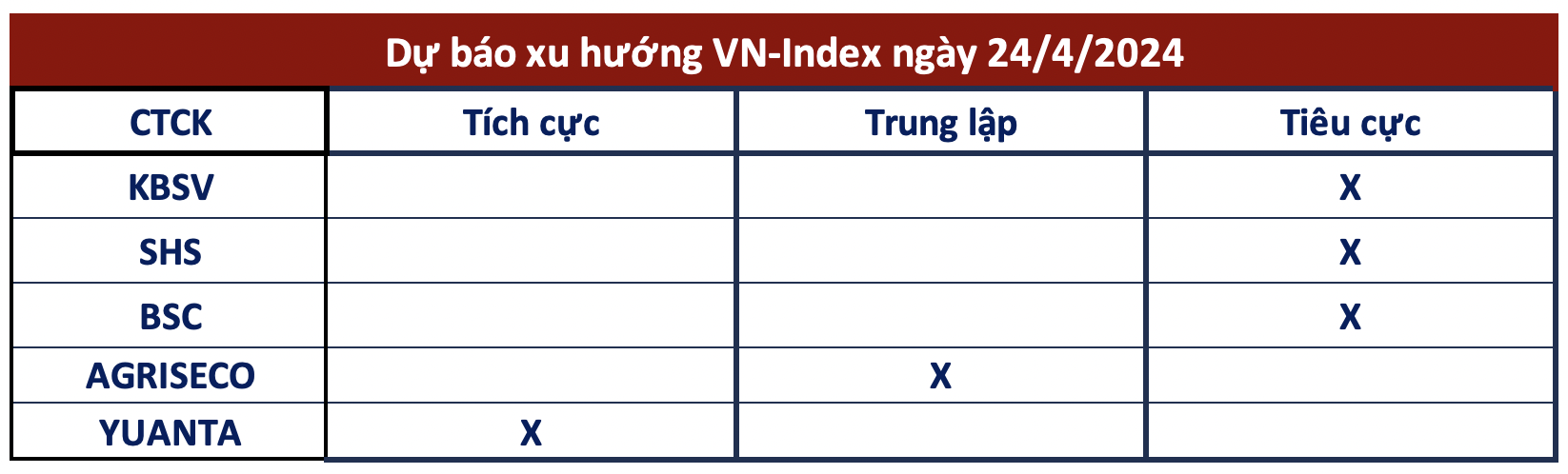

According to KB Securities Vietnam (KBSV), the weakness of the pillar stock group exerted pressure on the market in the afternoon session, causing the index to extend its decline towards the end of the session. Although buying demand increased in some pillar stocks, helping VN-Index avoid a deep decline, the tug-of-war between supply and demand is likely to continue, and the risk of a correction is still more prominent. Investors are advised to limit buying, prioritize risk management, and reduce positions, and restructure portfolios during early recovery sessions.

Similarly, SHS Securities assessed that the market continued to decline after a technical recovery and is still in a short-term downtrend. The benchmark index may fall further to approach the medium-term support level of 1,150 points. However, there are still opportunities for VN-Index to recover early to form a small double bottom pattern if the market’s decline stops in the next session.

Short-term investors need to closely monitor the market’s movement in the next session and may invest if VN-Index shows signs of an increase. If the index continues to decline, investors should patiently wait for VN-Index to retest the 1,150-point support.

Meanwhile, BIDV Securities (BSC) believes that the market is still bottoming out in the 1,170 – 1,195 range. In the coming sessions, VN-Index needs to narrow its trading range to form a solid accumulation bottom.

Agribank Securities (Agriseco) thinks that VN-Index has recorded a negative state and negated all recovery efforts in the previous session. However, there is a positive signal in that the increased demand at the end of the session helped VN-Index maintain the 1,177-point level, which is a long-term support level corresponding to the 200-day MA.

Agriseco Research predicts that alternating sessions of increases and decreases with a wide amplitude will continue to occur, helping VN-Index gradually form a new balance zone. Investors should decrease their ratios and limit investment in speculative stocks during the uptrend. At the same time, continue to increase the ratio of VN30 stocks, blue chips when the pressure is balanced at the oversold of stocks.