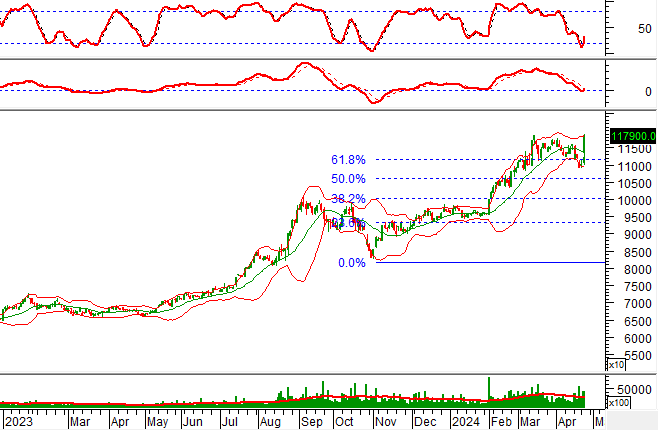

Technical signals of VN-Index

During the morning trading session on 24/04/2024, the VN-Index rose strongly and trading volume increased slightly in the morning session indicating that investors’ sentiment is gradually becoming optimistic again.

Alongside that, the index rebounded after testing the Fibonacci Projection 38.2% threshold (equivalent to 1,265-1285 points) in the context of the Stochastic Oscillator indicator generating a buy signal again in the oversold area indicating that the situation has improved.

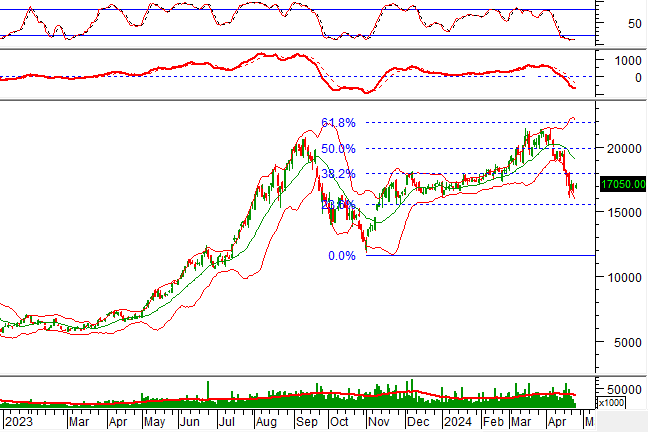

Technical signals of HNX-Index

During the trading session on 24/04/2024, the HNX-Index increased and trading volume increased significantly in the morning session indicating that investors’ sentiment is quite optimistic.

Alongside that, the Stochastic Oscillator indicator has generated a buy signal again in the oversold area. In the next sessions, if the indicator continues to maintain the buy signal and breaks out of this area, the short-term recovery is likely to come back.

FPT – Joint Stock Company FPT

In the morning session on 24/04/2024, FPT increased strongly and at the same time, the Rising Window candlestick pattern appeared and liquidity increased significantly exceeding the average 20 sessions indicating that investors are quite active in transactions.

Alongside that, the stock price increased after retesting the Fibonacci Projection 61.8% threshold (equivalent to 111,800-113,800) in the context that the MACD indicator is narrowing the gap with the Signal line. If the indicator generates a buy signal again, the long-term uptrend will be further strengthened.

VIX – Joint Stock Company Securities VIX

In the morning trading session on 24/04/2024, VIX increased strongly and there was a significant increase in volume in the morning session indicating that investor sentiment is gradually becoming optimistic again.

Alongside that, the stock price is still testing the Fibonacci Projection 23.6% threshold (equivalent to 16,500-17,500) in the context that the Stochastic Oscillator indicator is giving a signal to buy in the oversold area. If the indicator continues to maintain the buy signal and breaks out of this area, the short-term recovery scenario will soon appear.

Technical Analysis Department, Vietstock Consulting Room