2024 TMS Annual General Meeting of Shareholders held on April 25, 2024 – Photo: Huy Khai.

|

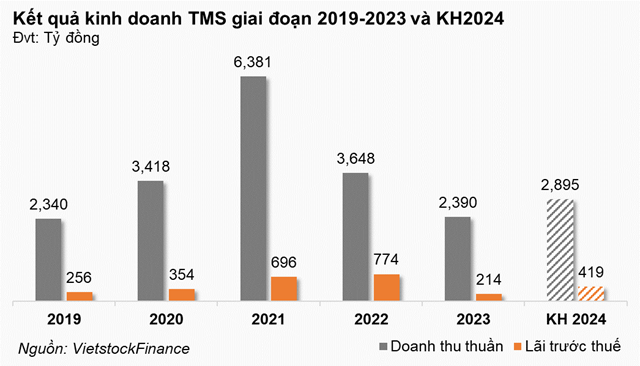

Net income plan doubled

In 2024, TMS set its business revenue plan at over 2,895 billion VND and net income before tax at nearly 419 billion VND, respectively increasing by 21% and 95% compared to the 2023 performance.

TMS stated that it will focus on developing business and restructuring services by reorganizing personnel at other companies where TMS is a controlling shareholder, parent companies in the North such as Mipec Port JSC., Foreign Trade and Transport Service JSC, Transport and Trade Service JSC. Negotiating and divesting from the investment in Nippon Express (Vietnam) Co., Ltd.

In addition, investing in phase 2 of the Thang Long Logistics Center, accelerating the progress of the Vinh Loc Logistics Center project, phase 2 of the cold storage warehouse in Ben Luc district, Long An province, and preparing operational services when putting it into use.

“With phase 2 of the cold storage at Ben Luc District, Long An Province, TMS expects to open and complete the investment by the end of June 2024″, said Mr. Bui Tuan Ngoc – Chairman of the TMS Board of Directors.

High expectations for the warehouse project in Long An

The cold storage project in Long An has 55,000 pallet locations (shelving for storing goods), larger than any of TMS‘s current warehouses and is assessed by the Chairman of TMS as: “The peak roof will hold the position of the tallest standing warehouse in the Mekong Delta for many more years”.

According to Deputy General Director Nguyen Hoang Hai, the project is conveniently located in the area connecting 11 provinces in the Mekong Delta with Ho Chi Minh City. Construction is divided into two parts, including traditional warehouse and system optimization, 40,000 pallets in the automated warehouse working with 5 robots.

With phase 1 already in operation, the frozen warehouse section has an occupancy rate of 90 – 99%. The company will put it into operation from May and June 2024, expected to bring in 23 billion VND in revenue in the first year.

Chairman Bui Tuan Ngoc shared: “In Long An, with a capacity of up to 55,000 pallets, if operating at 80 – 85% of capacity, it won’t be difficult to achieve 80 billion VND in net income before tax/year. Meanwhile, at VSIP II, if the model is completed, the output will be higher than before, thereby the net income before tax of 50 – 70 billion VND is completely within reach, especially when Logistics Vinh Loc is built on this 5ha land, it will not be too difficult to make a profit over 100 billion VND/year”.

Change in intended use of capital raised from share offering

For the private share offering that ended on December 31, 2021, TMS adjusted the intended use of the capital raised from implementing the Transimex dry port project in Yen My district, Hung Yen province, to investing in the purchase of container shipping vessels and receiving a 99.98% capital contribution transfer from a company operating in the logistics sector in VSIP II industrial park, Binh Duong province, with a value of 60 billion VND, expected to be disbursed in the second or third quarter of 2024.

Regarding this capital contribution, the Chairman of TMS said: “TMS has purchased a piece of land of about 3.5ha in VSIP II industrial park, currently applying for a permit to build a multi-purpose warehouse, a temperature-controlled warehouse. However, TMS uses an external company to purchase the land and plans to carry out procedures to transfer it to TMS“.

Lower bond issuance value

In addition, TMS will stop issuing 200 billion VND convertible bonds of Trasimex JSC to the public through the 2023 Annual General Meeting of Shareholders. The Company stated that due to the current unfavorable financial market conditions since the second half of 2023 and the changing capital demands.

On the other hand, TMS changed the plan to issue publicly convertible bonds of up to 700 billion VND, which was approved by the 2023 Annual General Meeting of Shareholders. Specifically, at this meeting, TMS reduced the issuance value to 400 billion VND to align with the capital utilization plan in 2024 and increase the persuasiveness of the documents explaining the intended use of the capital.

Many member companies have ineffective business operations

Regarding the question about the business results of the member companies with ineffective operations, according to the Chairman of TMS, a significant portion of dividends to TMS comes from the joint venture Nippon Express (Vietnam). However, in 2023, Nippon Express did not fulfill its plan, only achieving nearly 30%, which is far from the 2022 result.

Mr. Ngoc said that this is a common situation for the Vietnamese logistics industry in the past year when no company achieved profit as planned. The whole industry is facing difficulties in production. All supply chains for garment, leather, and wood products are disrupted, both exports and imports. The war situation also caused shipping lines to increase prices suddenly, causing many import and export companies to temporarily halt their operations.

Moreover, there are still many companies with losses that lasted longer than expected, such as Mipec Port JSC is losing money because it has not filled the weekly cargo volume to the port, and some shipping lines have not chosen to use its services. He hopes to improve from a loss of 130 billion VND to less than 30 billion VND per year in 2024. Mr. Ngoc assesses it as feasible as TMS has recently signed a contract with a shipping line with a frequency of 2 weeks/trip.

Regarding the large losses in previous years, the Chairman of TMS said that Mipec is one of the few port companies that pay for land use once for 50 years, investing systematically; therefore, the cost for completing the port is very high, including loan interest. TMS has worked with the bank to restructure the loan, reduce interest rates, and at the same time add more cash equity to reduce the interest incurred in 2022 and 2023.

As for Transport & Trade Service JSC (Transco), in 2023, it also made a loss because 2 aging bulk cargo ships were forced to be liquidated at the end of 2023 and recognized a profit from the liquidation. Currently, the staff of Transo is only 11 people, including drivers. “Hopefully, in 2024, we will buy new container ships to match the Transimex Sun to become a pair of ships, effectively exploiting them in all situations,” Ngoc shared.

The Chairman of TMS also mentioned other members such as Foreign Trade Transport and Service JSC (VNT), Vinatrans Da Nang Central Region Transport and Logistics JSC, Transimex Distribution Center Co., Ltd. (DC) reported difficulties, besides Thang Long Logistics Service JSC (Thang Long Logistics) made a profit but did not meet the plan.

In addition, TMS also incurs costs while waiting for projects that have not been implemented for 3-4 years, such as the Vinh Loc Logistics Center on 5 hectares of land, in cooperation with strategic shareholder Cholimex. The Chairman of TMS expects to accelerate this project together with Cholimex in 2024.

“The biggest mistake is that I was subjective, thinking that a piece of land in an industrial park for more than 30 years, putting a warehouse there would be extremely easy,