Services

|

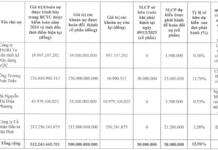

At the end of 2023, VietABank’s total assets reached 112,196 billion VND, an increase of 6.7% compared to 2022. In which, outstanding loans to customers reached over 69,190 billion VND, an increase of 10.2% compared to 2022. Customer deposits were close to 87,181 billion VND, an increase of 23.9% compared to 2022. Consolidated profit before tax reached 917 billion VND.

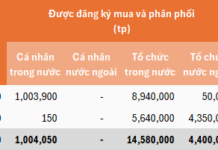

In order to strengthen its financial resources and increase medium- and long-term capital to expand its network and develop its business, VietABank’s General Meeting of Shareholders has approved a plan to increase its charter capital by 2,106 billion VND, equivalent to 39%, through the issuance of shares to pay dividends from retained earnings and additional capital reserves as of December 31, 2023. After completing the dividend distribution, VietABank’s charter capital is expected to increase to over 7,505 billion VND. The timing of the share issuance will be decided after receiving approval from the State Bank of Vietnam (SBV) and the State Securities Commission.

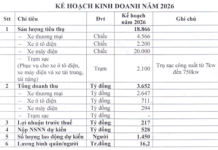

VietABank’s General Meeting of Shareholders has approved the 2024 business plan with the following projected targets: profit before tax of 1,058 billion VND, an increase of 15.4% compared to the results achieved in 2023; total assets increased by 4.3% to nearly 117,000 billion VND. In which, outstanding credit increased by 12.36% to 77,741 billion VND; Customer deposits and issuance of negotiable papers are expected to increase by 5.6% to 92,027 billion VND; bad debt ratio controlled below 3%. At the end of 2023, VietABank’s bad debt ratio was 1.59%, which is relatively low among commercial banks.

Also at this congress, the General Meeting of Shareholders approved the plan to list all of the bank’s outstanding shares (after approval by the management agency) on the Stock Exchange when market conditions are favorable, in accordance with legal procedures. The choice of listing on the Ho Chi Minh City Stock Exchange (HOSE) or the Hanoi Stock Exchange (HNX) will be decided by the Board of Directors. In addition, the Board of Directors is also authorized for other matters related to listing on the exchange.

At the same time, the General Meeting of Shareholders approved the resignation of Mr. Hoang Vu Tung and elected Mr. Tran Ngoc Hai to replace Mr. Tung as a member of the Supervisory Board. The number of members of VietABank’s Supervisory Board after the General Meeting of Shareholders is 3.