Unexpected news about the KRX system being delayed to May 2nd led to notable market disappointment. Selling pressure increased in the morning, partly due to the extended trading halt. However, bottom-fishing demand was strong enough to maintain equilibrium, while VIC’s dominance pushed the VN-Index close to its session high, contributing 2.3 points to the total increase of 4.55 points.

Usually, when trading is paused for an extended period, investors adopt a cautious approach to potential fluctuations. This holiday, in particular, coincided with the release of key domestic and US macroeconomic data, which could significantly impact stock market expectations. Local investors traded less or sold more, reflecting a normal risk-aversion stance.

This morning, trading volume on the two exchanges increased by 25%, and there was a sharp decline early in the session. News that the KRX system would not be operational from May 2nd caused a sharp decline in brokerage stocks, which dragged down other stocks as well. At the close of the morning session, the VN-Index breadth showed only 176 gainers and 243 decliners.

In the afternoon session, liquidity dropped even further, with trading on the two exchanges decreasing by 1.2% compared to the morning session. However, the market did not form a new lower low. Instead, selling pressure eased, leading to an improvement in breadth, indicating a recovery in stock prices. The closing breadth recorded 209 gainers and 227 decliners. The VN-Index gained 0.38% compared to its reference point.

The afternoon’s performance was a combination of an explosive rise in blue-chip stocks and widespread bottom-fishing demand. VIC was a prominent leader. The stock closed the morning session strongly, rising by 2.74%, but it performed even better in the afternoon after news of its Q1 2024 business results. During the ATC session, VIC’s closing price was at its ceiling for an extended period before settling at a 5.83% gain. This represented an additional 3.01% increase for VIC in the afternoon compared to the morning, despite relatively low liquidity of only 72.7 billion dong. This indicated a significant reduction in selling pressure, as the price was able to rise sharply without encountering significant selling volume.

Other blue-chips that contributed to the VN-Index’s rise in the afternoon included HDB, which gained 4.89% and rose by 1.07% in the afternoon session; PLX, which gained 1.71% and rose by 1.42% in the afternoon; and GVR, which gained 2.04% but saw most of its gains in the morning, rising by only 0.33% in the afternoon. MBB, CTG, HPG, TCB, VPB, VHM, and others also contributed by reducing their losses. The biggest disappointment was VCB, which faced strong selling pressure during the ATC session, rising by only 0.22% despite reaching a 1.43% gain earlier in the session. If VCB had joined forces with VIC, the market would have closed even stronger.

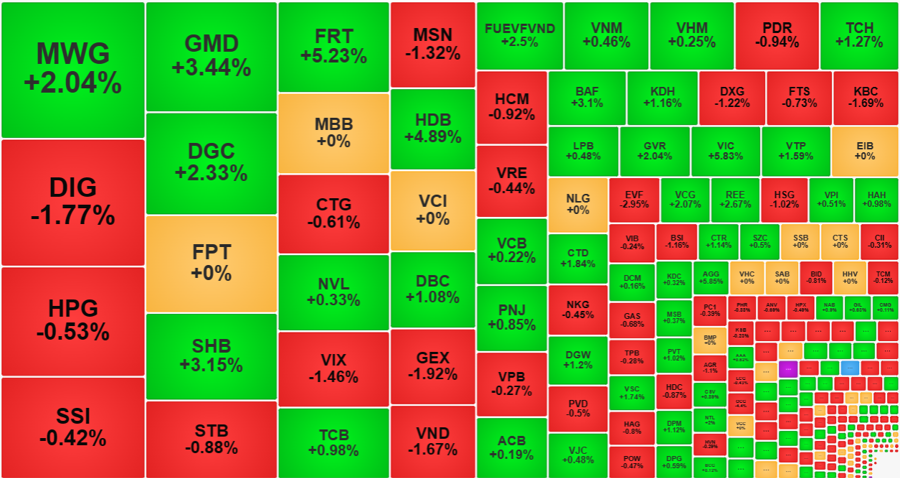

Despite these setbacks, the market continued to improve towards the end of the session. Not only did the breadth regain balance, but the price level of the advancing group also increased. HoSE closed with 79 stocks rising over 1% (compared to 58 stocks in the morning session). This group accounted for nearly 31% of the exchange’s total trading value. Many of these stocks were among the most liquid in the market, including MWG, which gained 2.04% with a liquidity of 645.6 billion dong; GMD, which gained 3.44% with 476.2 billion; DGC, which gained 2.33% with 422.3 billion; SHB, which gained 3.15% with 376.4 billion; FRT, which gained 5.23% with 333.6 billion; and HDB, which gained 4.89% with 299.8 billion. Notably, most of these stocks successfully reversed their declines from the morning session.

The declining group was also significant (227 stocks), with 74 stocks falling by more than 1%. However, their liquidity was concentrated at only 16.3% of the market. Additionally, only about 20 stocks had liquidity exceeding 10 billion dong, primarily DIG, VIX, MSN, GEX, VND, DXG, and KBC, which traded over 100 billion dong in this session.