Rare earth elements are a group of 17 chemical elements that are used in products ranging from lasers and military equipment to magnets used in electric vehicles and consumer electronics. Due to their unique chemical, electromagnetic, electro-optical, nuclear and magnetic properties, rare earth elements are highly valued for their ability to significantly improve the performance, efficiency, longevity and reliability of technology products.

Rare earth prices surged to a decade high in 2022, before falling sharply in 2023 amid increased production from China and slower-than-expected demand growth as the world’s second-largest economy recovers more slowly from the Covid-19 pandemic. Prices of praseodymium oxide, one of the most widely used rare earth elements, fell 34% in 2023, while terbium oxide and neodymium oxide prices have retreated since March 2024 to late-2020 levels.

Trend in rare earth elements price.

More significantly, prices of neodymium-praseodymium (NdPr) oxide, used in permanent magnets, fell 38% in 2023 and are now approaching production costs, according to Yang Jiawen, an analyst with SMM.

A report last month from Guolian Securities said the global NdPr oxide market could flip to a deficit of 800 tonnes globally in 2024, from a surplus of 6,600 tonnes in 2023.

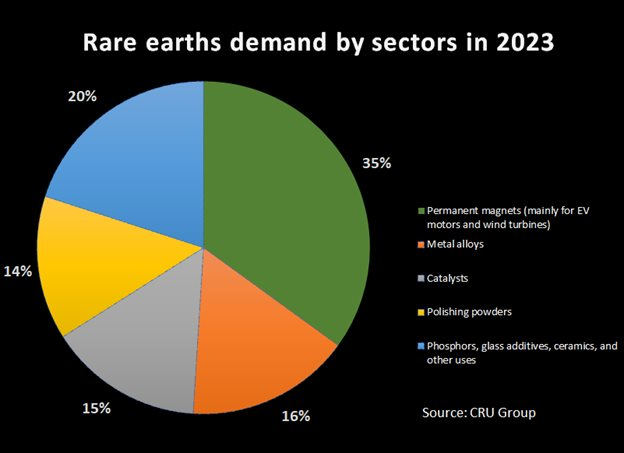

Rare earth demand by sector (2023).

“We expect some supply response to come into the back end of 2024, because demand is catching up with supply through continued rising electric vehicle sales and wind turbine manufacturing,” said Willis Thomas, an analyst with CRU Group.

China’s Quotas

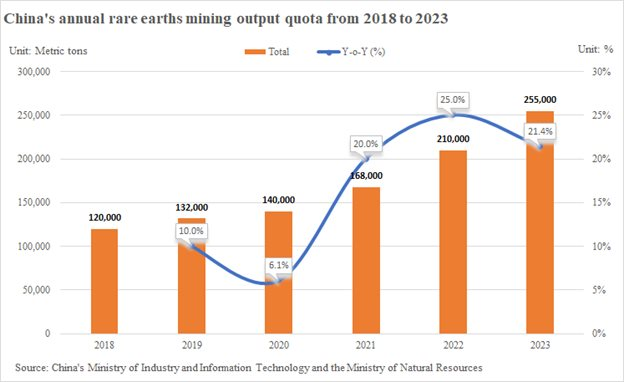

Last year, for the first time since 2006, China issued three batches of rare earth production quotas in one year, with the total for the year hitting a record high of 255,000 tons, up 21.4% year on year.

China’s annual rare earth mining quotas.

However, China’s 2024 quota is expected to increase at a slower pace of 10% to 15% from last year, analysts from information provider Baiinfo said in a research note.

“We do expect another increase to both mining and smelting quotas … but it won’t be to the extent that we saw last year,” said Ross Embleton, an analyst with Wood Mackenzie.

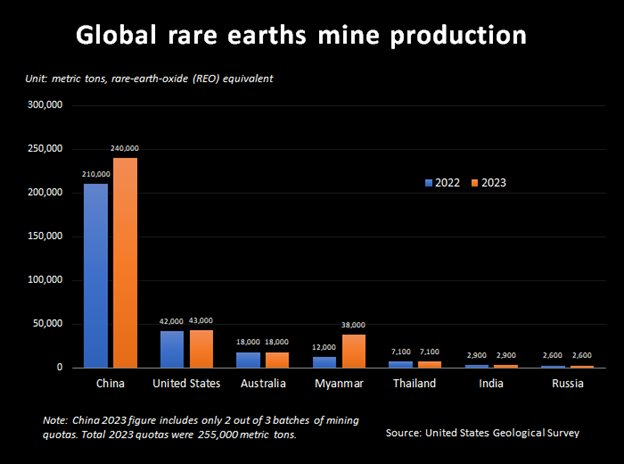

China, which accounts for about 70% of global rare earth mining and 90% of refined production, has controlled supply of the strategic resource through its quota system since 2006, according to the US Geological Survey.

Global production of rare earth oxides.

Source: Reuters