Vinhomes CEO Nguyen Thu Hang.

On April 24, Vinhomes JSC (stock code: VHM) held its 2024 Annual General Meeting of Shareholders (AGM). At the meeting, a shareholder raised concerns about how VinFast, which is experiencing financial issues within the Vingroup ecosystem, will impact Vinhomes. They also questioned why dividends would not be distributed this year.

In response to the shareholder’s inquiries, Nguyen Thu Hang, CEO of Vinhomes, stated that the company had loaned very little money, approximately 1,200 billion VND, to related companies in the 2023 financial statements.

“We do not provide funding to other companies within the group’s ecosystem, especially VinFast. This electric vehicle manufacturer can now raise capital independently and has its own fundraising channels. We only engage in short-term capital transactions with other companies within the ecosystem, with a maximum term of 12 months. All transactions will be transparently recorded in the financial statements as Vinhomes is a publicly traded company”, affirmed the CEO of Vinhomes.

Regarding dividend payments, Nguyen Thu Hang explained that Vinhomes had paid dividends to shareholders between 2020 and 2021. However, since 2022, the market has started to decline, so the company has suggested retaining all profits for the past two years to mitigate risks in case it is unable to issue bonds or prepare for new sales strategies or major projects. Additionally, Vinhomes requires flexible capital to prepare for the new real estate industry cycle and maintain its market position.

Elaborating on the five-year strategy, the CEO of Vinhomes stated that the company aims to remain the leading real estate developer in Vietnam and expand regionally. Vinhomes has a land bank that ensures stable growth. “We will continue to develop more mega-projects in the coming years”, affirmed Nguyen Thu Hang.

Regarding Vinhomes’ capital sources, Nguyen Thu Hang mentioned that at the 2023 AGM, Vinhomes presented shareholders with a plan to issue international bonds if market conditions are favorable. However, the current situation is not entirely favorable, and Vinhomes can still exploit domestic capital sources. This year, the company is closely monitoring the international market for potential issuance. If bonds are issued, they will not be accompanied by warrants.

Vinhomes Annual General Meeting 2024.

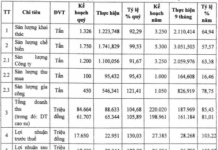

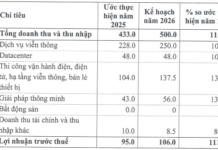

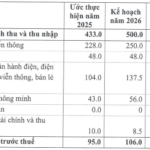

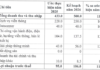

Vinhomes plans to achieve revenue of VND 120,000 billion and after-tax profit of VND 35,000 billion in 2024, representing an increase of 16% and over 4%, respectively, compared to 2023.

Commenting on the real estate market in 2024, CEO Nguyen Thu Hang said that the market will recover but at a slower pace than expected. Market demand remains significant due to rapid urbanization, population growth, and an increasingly younger population, resulting in a high demand for housing. Supply will also recover in major cities such as Hanoi, Ho Chi Minh City, and Hai Phong, but prime locations remain limited. Vinhomes continues to ensure legal compliance, handover progress, and construction progress of its products.