Shocking News about the KRX System and the Extended Holiday Break Create a Perfect Storm

The recent “shocking” news about the KRX system and the upcoming extended holiday break have created an ideal opportunity to observe the selling pressure and the strength of bottom-fishing demand. With a significant data gap looming, sellers are selling, while those who remain optimistic are taking calculated risks to buy.

The fact that the VNI index closed in the green is not the most important factor. While VIC experienced a strong rally, VCB was heavily sold off during the ATC session. The key takeaway is the balance in market breadth and the large number of stocks recovering from their lows.

The market decline began early in the session, with the first half of the morning presenting the most significant test. The brokerage sector reacted negatively to the news that the KRX system would not be operational until May 2nd, and the overall market breadth was weak (declining stocks outnumbered advancing stocks by a ratio of approximately 3:1). The “disillusionment” led to selling activity, particularly among short-term traders who had taken profits. However, the “supply test” amidst the “bad news” resulted in only approximately 2 trillion VND in liquidity, and prices gradually recovered.

Even if prices had not recovered and the index had not closed in the green, maintaining low liquidity would still be a positive sign, indicating that selling pressure was not significant. The remainder of the session saw a tug-of-war between supply and demand, with liquidity remaining low. However, the market breadth showed signs of a broad-based recovery. In this situation, the wider the price recovery range, the better, regardless of whether the closing price exceeded the reference point.

The market is still in a phase of persistent “supply testing” to eliminate the most volatile stocks. Today’s trading range was wider than yesterday’s, and liquidity increased by approximately 15% on the HSX, but it remained low (14 trillion VND in matched orders). Liquidity struggled to increase because many buyers were hesitant to participate given the upcoming three-day holiday break. Furthermore, investors waiting to buy at lower prices contributed to the subdued liquidity, with sellers ultimately determining whether it would increase.

Our view remains that the signals from the “supply testing” are positive, indicating low selling pressure and gradually increasing optimism. At least for the time being, the majority of stocks and indices have established a reference bottom. Whether this is the true bottom of this correction is uncertain, but if it is not violated, it is reasonable to assume that it is the bottom. After a sharp correction, the market’s supply and demand have become balanced, and the pressure to cut losses and reduce margins has abated, increasing the likelihood of a bottom formation.

Regarding the KRX system, the announcement that it would begin operating on May 2nd was merely a “projection.” No one had guaranteed that it would be the official launch date, so the delay is not surprising. This is not the first time the system’s launch has been uncertain. It is always better to wait until everything is functioning smoothly rather than experiencing glitches. Additionally, the KRX’s launch will not have a significant impact on the market until new products are introduced. Liquidity will not necessarily increase simply because the system is up and running. A smooth-running system is merely a technical requirement for increased liquidity. The ultimate decision to buy and sell and the availability of investment capital lie with investors. The liquidity records set in 2023 on the current system are still sufficient.

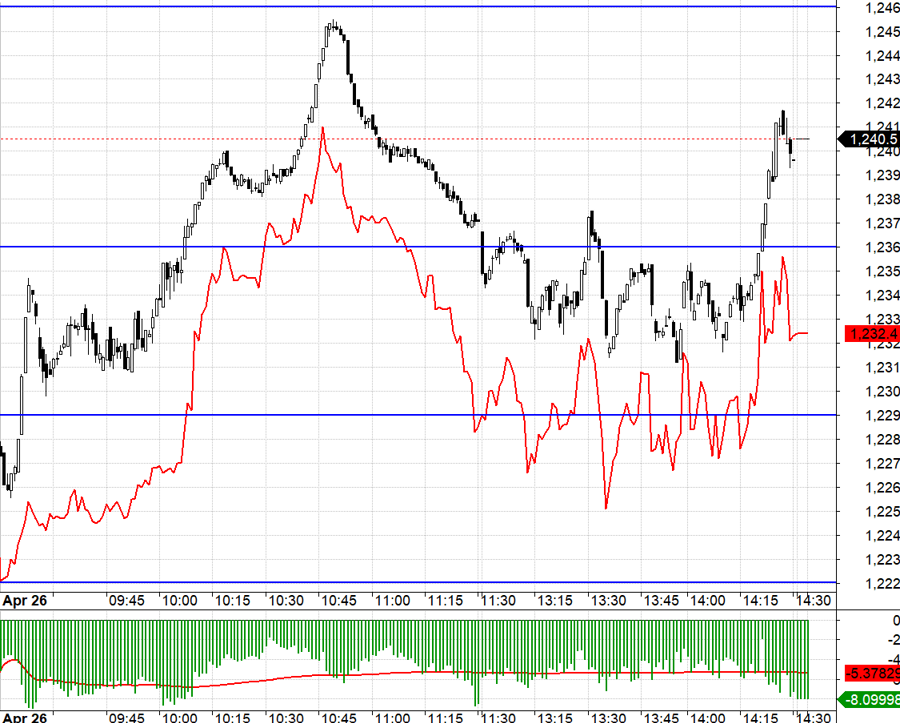

Today’s derivatives market was volatile, with liquidity 34% lower than yesterday. A Long strategy was reasonable, although Short was also acceptable, as the wide basis discount made Long a safer option. The most favorable Long opportunity was at the beginning of the session when the VN30 index hovered below 1236.xx, with F1 futures having a premium of over 6 points. If the VN30 index had broken above 1236.xx, it would have entered a “zone of open volatility,” with the next resistance level at 1246.xx. The recent acceptance of a wide basis discount by F1 positions can be attributed to the market’s anticipation of a pullback following the rally on February 24th. However, Short positions would be at a significant disadvantage in such a scenario if the VN30 index does not correct as deeply as expected.

The market is entering an extended holiday break, and this week’s positive performance will likely be a topic of conversation during the upcoming holiday. Domestic macroeconomic data will be released early next week – still during the break – and U.S. macroeconomic data will be released this weekend. The cooling down of the USD and its potential to reach a short-term peak are also positive factors. Generally, a long holiday break can help refresh investor sentiment, making the market more bullish upon its return. The suggested trading strategy is Long/Short with a focus on Long.

The VN30 index closed today at 1240.5. The immediate resistance levels for the May 2nd session are 1242; 1246; 1253; 1258; 1262; 1269; and 1278. The support levels are 1233; 1223; 1217; 1212; and 1203.

Disclaimer:

This “Stock Market Blog” is personal in nature and does not represent the views of VnEconomy. The opinions and assessments expressed are those of the individual investor, and VnEconomy respects both the perspective and the writing style of the author. VnEconomy and the author bear no responsibility for any issues arising from the investment assessments and views published.