Vietnam Airports Corporation (stock code: ACV) has just announced its business results for the first quarter of 2024 with revenue of VND 5,643 billion, an increase of 19.3% compared to the same period last year. Of which, revenue from providing aviation services accounted for the majority of the company’s total revenue, reaching VND 5,303 billion, up 19.3%.

Excluding cost of goods sold, ACV’s gross profit reached VND 3,599 billion, up 22.5% compared to last year. Gross profit margin is nearly 64%. The company brought in VND 478.8 billion in financial revenue, up 15.12%. This item of the company’s business is mainly from interest on bank deposits.

With large financial revenue, ACV only had to pay nearly VND 19 billion in the last quarter, a decrease of 97.6% compared to the previous year. This year, the company no longer records losses due to exchange rate differences, while in the same period last year, this figure was VND 771 billion. The remaining expenses of this business all increased, but not significantly.

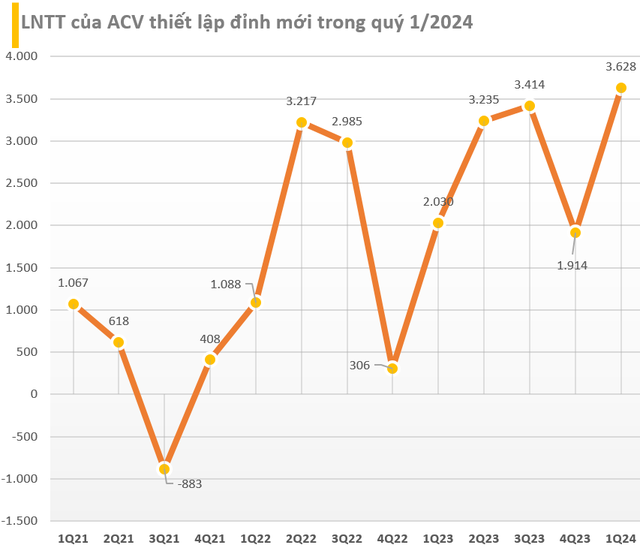

As a result, ACV brought in VND 3,628 billion in pre-tax profit, up 78.6% compared to the same period last year. After-tax profit to shareholders of the parent company reached VND 2,917 billion, up 78.6%. EPS increased from VND 598 to VND 1.91. This is also a record profit that this aviation “giant” has recorded in its history.

As of December 31, 2023, ACV’s total assets reached VND 67,059 billion, down VND 300 billion compared to the beginning of the year. Of this, cash and cash equivalents account for nearly half of the company’s assets, reaching VND 26,591 billion (more than USD 1 billion).

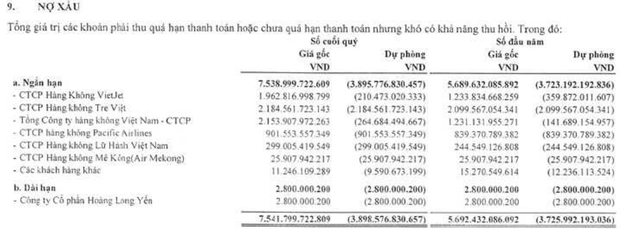

Short-term receivables are at VND 13,810 billion, an increase of more than VND 1,000 billion compared to the beginning of the year. This is the amount that ACV has to collect with Vietnamese airlines. The “giants” of the aviation industry from Vietnam Airlines, Vietjet and Bamboo Airways range from VND 2,000 billion to VND 3,000 billion. Of which, ACV recorded bad debts of VND 2,154 billion with Vietnam Airlines, Vietjet (VND 1,962 billion) and Bamboo Airways (VND 2,184 billion).

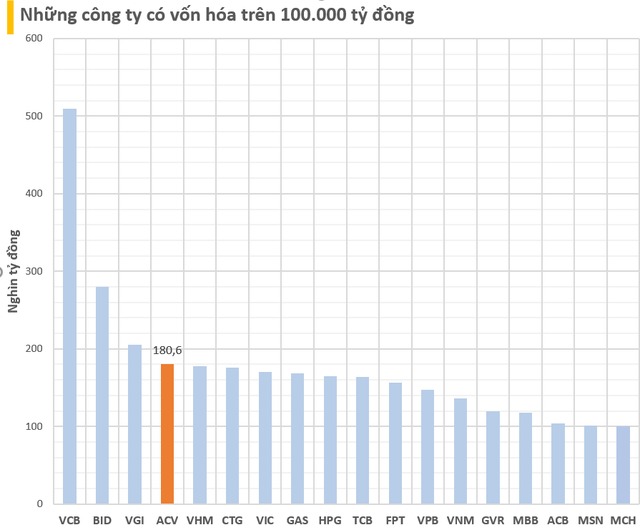

Not only did it record record profits in the first quarter of 2024, ACV’s stock price has also “skyrocketed” since the beginning of the year. At the end of the trading session on April 26, ACV shares reached VND 83,000 per share, an increase of 25.7% compared to the beginning of the year.

With this price, ACV’s current market capitalization has reached VND 180,600 billion, an increase of nearly VND 37,000 billion (USD 1.5 billion) since the beginning of the year. ACV’s value is currently ranked 4th on the Vietnamese stock market, surpassing blue chips such as Vinhomes, Vietinbank. Hòa Phát, Vingroup…

ACV was established in 2012 on the basis of merging Airport Corporation in the three regions of North – Central – South. In 2015, the corporation was equitized and officially operated as a joint stock company from April 1, 2016 with a charter capital of VND 21,771 billion, in which state shareholders held 95.4% of charter capital.

Nearly 2.18 billion ACV shares were officially traded on UPCoM on November 21, 2016, with a reference price of VND 25,000 per share, corresponding to an initial valuation of approximately VND 54,400 billion (~USD 2.3 billion). After more than 7 years of ups and downs in the stock market, the market capitalization of the “boss” of the airport has tripled.

ACV is currently the sole provider of aviation services for domestic and foreign airlines such as security services, ground services, passenger services, take-offs and landings… The corporation is assigned to manage, coordinate operations and invest in exploitation of the entire system of 22 airports throughout Vietnam, including 9 international airports and 13 domestic airports.

The corporation currently has two subsidiaries, Noi Bai Aviation Fuel Service (NAFSC) and Southern Airport Aircraft Maintenance Service (SAAM). In addition, ACV also has 10 associated companies, mainly operating in the field of aviation services, of which there are many names on the stock market such as Tan Son Nhat Airport Services (SASCO – code SAS), Phục vụ Mặt đất Sài Gòn (SAGS – code SGN), Saigon Cargo Service (code SCS),…

Currently, ACV is the investor of many aviation projects, with a total investment in projects under implementation of more than VND 133,000 billion. Notably, the most notable is the Long Thanh International Airport project, Tan Son Nhat International Airport Terminal T3.