BAF Sets Ambitious Goal with 10-Fold Profit Increase in 2024

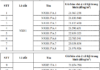

On April 26, 2024, BAF Vietnam Agriculture Joint Stock Company (stock code: BAF) held its Annual General Meeting of Shareholders (AGM), approving a revenue plan of VND 5,500 billion (6% increase) and a post-tax profit of nearly VND 306 billion, a tenfold increase from the previous year. This is the second highest level since its establishment in 2017. BAF’s profit in 2021 reached a record of VND 322 billion.

Pork Sales Target Approaching 610,000 Heads

This year, BAF projects its livestock segment to sell approximately 610,000 pigs (96% meat pigs, 4% breeding pigs), more than double the previous year’s figure. The livestock segment’s gross profit margin is expected to be 23%.

As of March 2024, the Company’s total herd reached nearly 430,000 heads, an increase of approximately 87% compared to the same period last year, corresponding to an annual production of approximately 1 million commercial pigs.

The animal feed production segment is expected to achieve a revenue of VND 144 billion, with a post-tax profit of over VND 3 billion, accounting for 1% of consolidated profit.

The agricultural products segment is projected to generate a revenue of VND 2,000 billion and a post-tax profit of VND 32 billion, accounting for nearly 11% of the Company’s total profit.

At the end of the first quarter of 2024, BAF recorded a revenue increase of nearly 60% to VND 1,300 billion; net profit reached nearly VND 119 billion, significantly higher than the previous year’s VND 4 billion. The main contributor to Q1 profit was the proceeds from land divestment.

At the AGM, Chairman of the Board of Directors, Mr. Truong Sy Ba, stated that BAF owns a land plot in Mai Chi Tho with an area of nearly 1,600 m2, intended for the construction of an office building for both company use and leasing. However, after developing a design plan and taking into account bank interest rates, they realized that the cost would be excessive and inefficient. In comparison, leasing would be more cost-efficient. Additionally, the Company requires additional resources for investment, prompting the decision to sell the land plot. According to Mr. Ba, this transaction generated significant revenue for the Company, amounting to approximately VND 80 billion in profit.

Expansion Plans: 7 New Piggeries in 2024

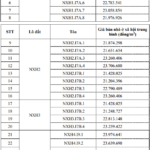

In 2024, BAF will continue to actively expand its operations. The Company plans to launch 7 farm projects, including 4 in Tay Ninh (Tan Chau, Tam Hung, Hai Dang, Tay An Khanh), 1 in Phu Yen (Phu Yen 2), 1 in Binh Phuoc (Thien Phu Son), and 1 in Gia Lai (Hung Phat Farm 1).

Of these, the Hai Dang complex (5,000 sows and 60,000 fattening pigs), Tan Chau farm (30,000 fattening pigs), and Tam Hung farm (5,000 sows) commenced operations in March 2024.

BAF also plans to initiate 7 additional projects in 2024, including 6 piggery farms and 1 feed mill in Binh Dinh. The total herd size is projected to double by the end of 2024, reaching 75,000 sows and 800,000 fattening pigs (compared to 37,000 and 330,000 at the end of 2023, respectively).

Regarding this expansion, Mr. Sy Ba highlighted BAF’s strategy of establishing large-scale farms. Previously, the Company believed that larger operations carried greater risks. However, achieving significant scale is necessary to execute large-scale projects. In addition to the farm itself, ample buffer zones are required to maintain biosecurity.

According to BAF representatives, the pig farming industry is currently concentrated in the Southern and Central Highlands regions (approximately 70%), with the remaining in the North. This is primarily due to farming conditions and land availability. The Southern and Central Highlands provide sufficient land for large-scale farms. In contrast, farms in the North tend to be smaller. Furthermore, while the South experiences high temperatures, they remain stable throughout the year.

Mr. Truong Sy Ba: Small-scale farming operations have declined by 50-70% and are projected to disappear within 7-10 years.

At the AGM, when a shareholder expressed concern about BAF facing numerous domestic and international competitors, Mr. Sy Ba emphasized the need to identify specific competitors and determine which were direct rivals.

“CP, Masan, etc., are indeed competitors, but they are not direct rivals for BAF, meaning they cannot prevent the Company from growing if it achieves sufficient scale. So who is the real competitor? As much as we may not want to admit it, it’s the small-scale pig farmers,” Mr. Sy Ba stated.

According to him, before the pandemic, small-scale farming accounted for over 70% of the total herd, while large-scale farming companies like CP and Masan accounted for less than 30%. The outbreak of African swine fever led many farmers to abandon their operations, and new regulations required compliance with certain standards or face closure. Consequently, the number of small-scale farmers has fallen to below 50%.

BAF representatives predict that this decline will continue in the coming years, and the Company and other large-scale farming businesses are capturing market share from these diminishing small-scale operations. They anticipate that within 7-10 years, large-scale farming companies will dominate the market, and competition will intensify.

“Many people claim that CP controls the price in the Vietnamese market, but I believe that’s not true. Market laws dictate that a company must have a 30-35% market share to influence pricing, while a 10-15% share is insufficient. For example, if CP increases its prices and fails to sell its products for several days, it will have to reduce prices immediately,” Mr. Sy Ba explained.

IFC Representative Appointed to Board of Directors

The AGM also approved the resignation and replacement of two members of the Board of Directors. Mr. Bui Quang Huy and Mr. Nguyen Duy Tan resigned as Directors, effective September 30, 2023, and April 26, 2024, respectively.

BAF appointed two new Directors to the Board:

+ **Mr. Nguyen Thanh Tan (born 1975), holding a Master’s degree. Mr. Tan is also the Chairman of the Board of Directors of BrainMark Vietnam Joint Stock Company**, a member of BrainGroup, a consulting firm specializing in developing management, human resources, marketing, and branding systems for businesses.

+ **Mr. Prasad Gopalan (born 1964, Indian nationality). Mr. Gopalan is a representative of the International Finance Corporation (IFC)**, which provides green financing to BAF. He currently serves as the Global Director of Agriculture and Forestry.

Chairman Truong Sy Ba stated that Mr. Gopalan has worked at IFC for over 30 years. He has successfully managed numerous agricultural projects worldwide, including a Chinese company that has become a global leader in the industry. Mr. Sy Ba expressed his hope that Mr. Gopalan’s presence on the Board will bring valuable experience and demonstrate IFC’s continued support and commitment to BAF, not only for the 2023 deal but also for future funding rounds.