Bitcoin (BTC), the pioneer cryptocurrency, recently underwent its halving cycle, slashing the block reward for miners by half. Many analysts consider halvings to be bullish as they reduce the supply of an asset, thereby increasing demand.

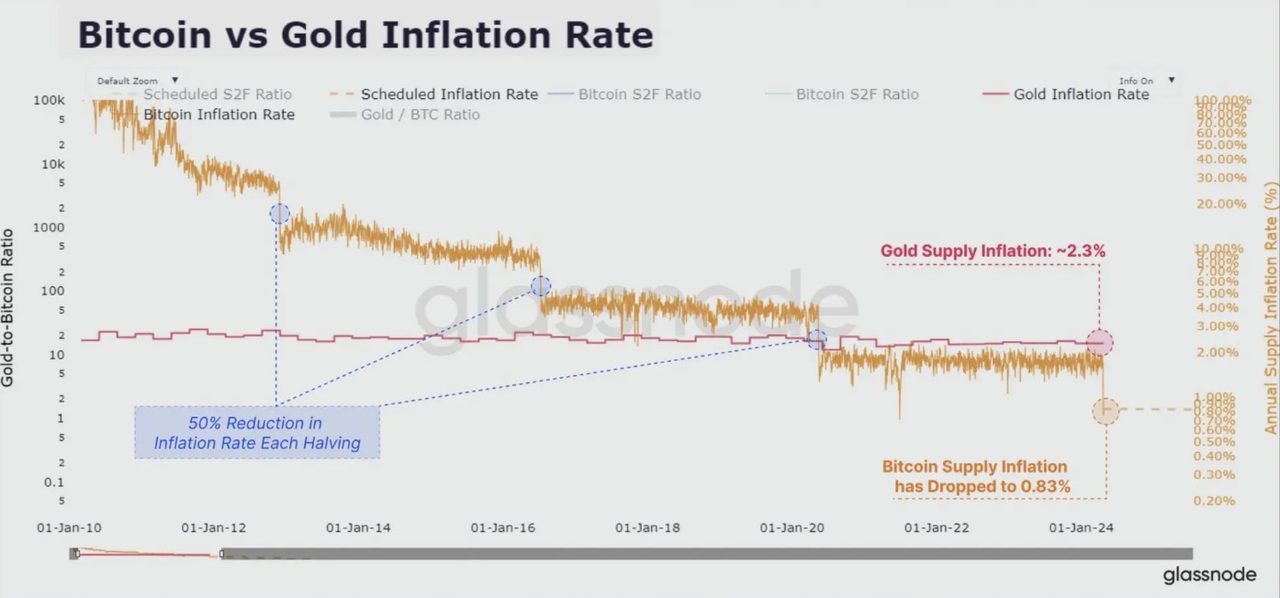

In discussing the impact of BTC’s latest halving cycle, Glassnode noted that ‘for the first time in history, Bitcoin’s steady state issuance rate (0.83%) has become lower than Gold’s (~2.3%), marking a historic handover of the title of scarcest monetary asset.’

Glassnode’s report suggests that Bitcoin’s (BTC) inflation rate is now officially lower than gold. The development effectively makes the pioneer cryptocurrency the scarcest major asset on the planet.

Will Bitcoin (BTC) rally since it is now scarcer than gold?

Historically, the cryptocurrency market has entered bull runs following BTC halving events. A similar pattern could play out this time around. However, the crypto market appears to be undergoing another downturn.

BTC is facing a 3.5% correction on the daily chart, an 8.9% correction on the 14-day chart, and an 8.5% decline on the monthly chart. The dip could be because of investor concerns fueled by the Iran-Israel conflict, fears of inflation, and expectations of interest rate hikes.

Despite this, there is a chance that Bitcoin (BTC) could soon enter a bull run. According to CoinCodex, BTC is likely to hit a new all-time high soon. The platform predicts that BTC could hit $85,033 by May 22, 2024. Hitting $85,033 from its current levels would represent an approximate 32.24% increase.

Changelly, on the other hand, is more bullish on Bitcoin (BTC). The platform predicts that BTC will hit a new all-time high of $74,381 by April 26, 2024. Furthermore, the platform predicts that BTC could rally to $87,121 by May 20, 2024.