UPDATE

The 2024 Annual General Meeting of Shareholders (BMI) was held virtually on the morning of April 24, 2023. Photo: Khang Di

|

Pre-tax profit target set at 377 billion VND

BMI stated that with the gradual slowdown in late 2023, the decline in motor insurance (down 1.9%), health insurance growing by a mere 0.3%, and these two products accounting for 58.5% of the total market share; coupled with the impact of Decree 67 on compulsory fire insurance (which could reduce by up to 25%).

In 2024, if the management mechanisms of authorities tighten further, particularly for insurance underwriting through the internet, insurance underwriting through agency channels in general, and credit institutions in particular, the insurance market’s overall growth prospect will also be significantly affected.

In addition to these general challenges, in 2024, Bao Minh will face additional difficulties, particularly in restructuring its human insurance business segment, in which the health insurance business was not profitable in 2023.

Therefore, BMI‘s management assessed that the 2024 business plan needs to be developed cautiously, focusing on improving service quality, minimizing risks, controlling receivables and expenses, and ensuring efficiency, without pursuing revenue at all costs.

Specifically, the company will strengthen underwriting of traditional business lines in member units and minimize dependence on large customers. It will restructure its health insurance business, reduce the proportion of this business within the human insurance segment, and increase the proportion of traditional human insurance business.

BMI aims to reduce the claims ratio for the business line compared to 2023, especially for health insurance, motor insurance, and property insurance. Concurrently, it will control the combined ratio (claims ratio plus expense ratio) at no more than 96% of the total net earned premium revenue of the entire company.

|

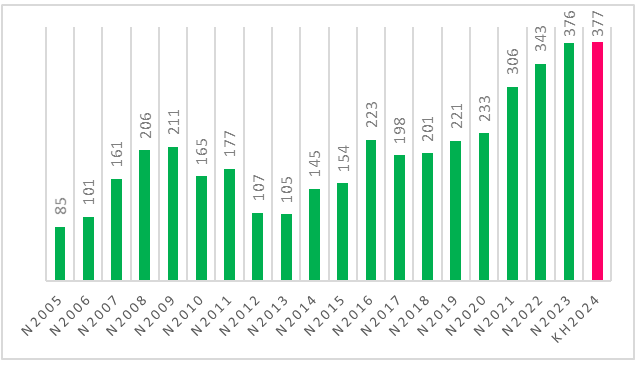

BMI‘s pre-tax profit plan in 2024. Unit: Billion VND

Source: VietstockFinance

|

Based on the above business orientation, BMI has set revenue targets for 2024 to grow by nearly 3% compared to its 2023 performance, with an absolute figure of VND 6,800 billion. Of this, direct insurance revenue will be nearly VND 5,825 billion (up 5%), reinsurance revenue will be nearly VND 663 billion (up 4%), and revenue from financial activities and real estate investment will be VND 313 billion (down 26%).

As such, BMI projects its pre-tax profit for 2024 to reach VND 377 billion, equivalent to its actual performance in 2023. The minimum ROE is 10% and the minimum dividend payout is also 10%.

Dividend to be paid by shares to increase capital

In 2023, BMI achieved total revenue of VND 6,630 billion, up 5% year-on-year and fulfilling over 98% of its plan. Pre-tax profit reached over VND 376 billion, up 14% year-on-year and meeting the target.

With the achieved results, BMI plans to pay a 2023 dividend of 15% (VND 1,500 per share), of which 5% will be in cash (equivalent to VND 54 billion) and 10% in shares. Cash dividends for 2023 are expected to be distributed in the second quarter of 2024.

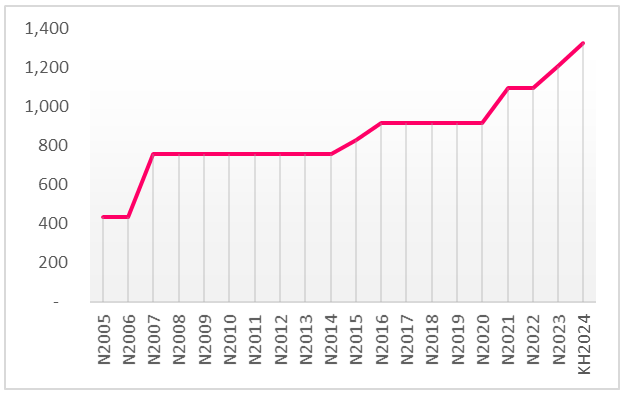

Earlier, Resolution 2022 of BMI‘s Annual General Meeting of Shareholders approved a 5-year business strategy (2021-2025), which included a roadmap to increase the charter capital from surplus equity and other funds belonging to equity capital to VND 1,500 billion by 2025.

According to BMI, considering the company’s current business needs and scale, the purpose of the capital increase is to ensure it meets the requirements and conditions to expand its business operations, enhance its financial capacity, increase its competitiveness in the market, strengthen its bidding capabilities, and comply with regulations on solvency margin.

BMI‘s capital increase will increase the number of shares outstanding in the market, enhance liquidity, and improve brand quality and value.

Accordingly, BMI‘s Board of Directors submitted to shareholders a plan to issue nearly 12.1 million shares to pay the 2023 dividend, with an implementation ratio of 10% (a shareholder owning 10 existing shares will receive 1 new share). The issuance is expected to take place in the second to fourth quarters of 2024.

|

BMI‘s capital increase process. Unit: Billion VND

Source: VietstockFinance

|

After the completion of the issuance, BMI’s charter capital will increase by VND 121 billion, from VND 1,206 billion to over VND 1,326 billion.

Discussion:

Target: Top 3 in non-life insurance market

How does Bao Minh position its market share in non-life insurance?

Chairman Dinh Viet Tung: Bao Minh currently does not operate in life insurance, only in non-life insurance. Therefore, the target of reaching the top 3 is for the non-life insurance market. In fact, when the 2021-2025 plan was initially set, we aimed for Bao Minh to reach the top 3 in non-life insurance by the end of 2025. However, in recent years, Bao Minh has developed very rapidly and has achieved the target two years ahead of schedule.

However, there are currently two insurance giants operating above Bao Minh, namely PVI and Bao Viet. To be honest, the gap between the top 3 position and the top 2 position is very large, so our target is to reach the top 3 at minimum, which means maintaining the top 3 position in 2024-2029.

Although we have set such a target, in the course of our operations, we will make every effort to seize opportunities to achieve a higher position, as the gap to the top 2 and top 1 positions is currently very wide.

The cash dividend has been cut to 5% in 2022, which is much lower than in previous years. The 2023 dividend is also proposed to be 5% in cash. The reduction in cash dividends has reduced shareholders’ benefits. It is proposed to increase the minimum dividend payout to 10% or higher, like in previous years. It is also proposed to reduce the proportion of share dividends.

General Director Vu Anh Tuan: The ratio of 5% in cash and 10% in shares is a plan that the management and the Board of Directors have calculated carefully, based on the business performance in 2023. The short-term plan targets in 2024, as well as the long-term strategy, have been approved by the General Meeting of Shareholders.

Paying dividends in shares will directly contribute to the value of the shares that shareholders are holding. This can be seen as a long-term investment by shareholders in the company, enhancing its competitiveness. In fact, in recent years, businesses in the market have been engaging in a race for capital size. Increasing capital size will benefit insurance companies in many ways, from increasing their competitiveness in large bidding