The 2nd 2024 annual general meeting of shareholders (AGM) of FIT was held online on April 26 – Screenshot

|

Stock Price Does Not Reflect True Value

In response to a shareholder’s question about FIT’s stock price being much lower than its par value, General Director Nguyen Van Ban stated: “Stock prices are influenced by many factors, not just the value of the company. Currently, FIT’s stock price does not reflect the true value of the Group.”

Mr. Ban further explained that the reasons for this include the subdued stock market in the past year, declining liquidity, economic difficulties, high inflation, and a tight monetary policy. Combined with political tensions both domestically and internationally, investors have become more cautious in allocating their investment resources.

Divestment from Cap Padaran Mui Dinh Does Not Mean Withdrawal from Real Estate

According to FIT’s General Director, the post-COVID-19 recession has had a significant impact on the real estate sector, particularly resort real estate – the model that the Cap Padaran Mui Dinh project was developing. This was the main reason why FIT had suspended investment and divested from the project to avoid affecting its other resources. He emphasized that FIT invests in many sectors and is not betting on this project for stable and solid development that has been built up over many years.

“Withdrawing from Cap Padaran Mui Dinh does not mean that FIT will withdraw from the real estate sector. Instead, it is just a change in investment strategy to adapt to current market conditions. In the future, instead of investing in large-scale projects, FIT will invest in mid-range and high-end segments with a primary focus on practicality”, Mr. Ban shared about future plans.

Foreign Ownership Limit Not Yet Possible

In response to a question about why the foreign ownership limit could not yet be lifted, Mr. Ban said that the Enterprise Law and the Securities Investment Law stipulate that certain business sectors will have their foreign ownership limits controlled. Since FIT invests in multiple sectors, some of which fall under this category, the foreign ownership limit cannot be lifted at this time.

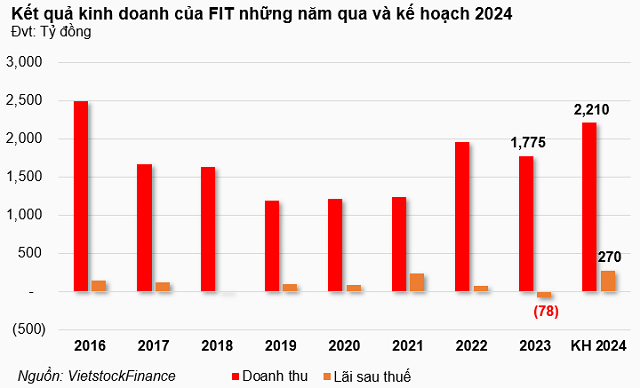

Following a challenging 2023, FIT decided not to distribute dividends in 2023 as the Company did not achieve its business targets and made a loss.

In the first quarter of 2024, FIT achieved revenue of VND 413 billion, a 20% increase year-on-year, but its pre-tax profit was only VND 78 billion, a 64% decrease. Despite this, General Director Nguyen Van Ban commented that the results were in line with the plan set for 2024.

For the full year of 2024, FIT sets a revenue target of over VND 2,210 billion, a 25% increase compared to 2023 and the highest level since 2017. In terms of profit, the Company aims to turn its 2023 loss into a post-tax profit of over VND 270 billion, the highest since 2016.

Welcoming New BOD and Supervisory Board Members

The AGM approved the resolutions to dismiss and appoint additional members to the Board of Directors (BOD) and Supervisory Board for the 2023-2028 term. Accordingly, two executives, Mr. Pham Tuan Son – BOD member and Ms. Ngo Thu Trang – Head of the Supervisory Board, were dismissed from their positions. Prior to this, both Mr. Son and Ms. Trang submitted their resignations on March 25 and 26, respectively, citing personal reasons.

On the other hand, two individuals were elected to fill the vacancies: Ms. Nguyen Ngoc Mai as a BOD member and Ms. Nguyen Thi Thu Huong as a Supervisory Board member.