Dabaco Vietnam Corporation Targets Significant Revenue and Profit Growth in 2024

Hanoi, Vietnam, April 28, 2024 – Dabaco Vietnam Corporation (stock symbol DBC) held its annual General Meeting of Shareholders (GMS) on April 27, attended by 294 shareholders and authorized representatives, representing 53.59% of the company’s charter capital.

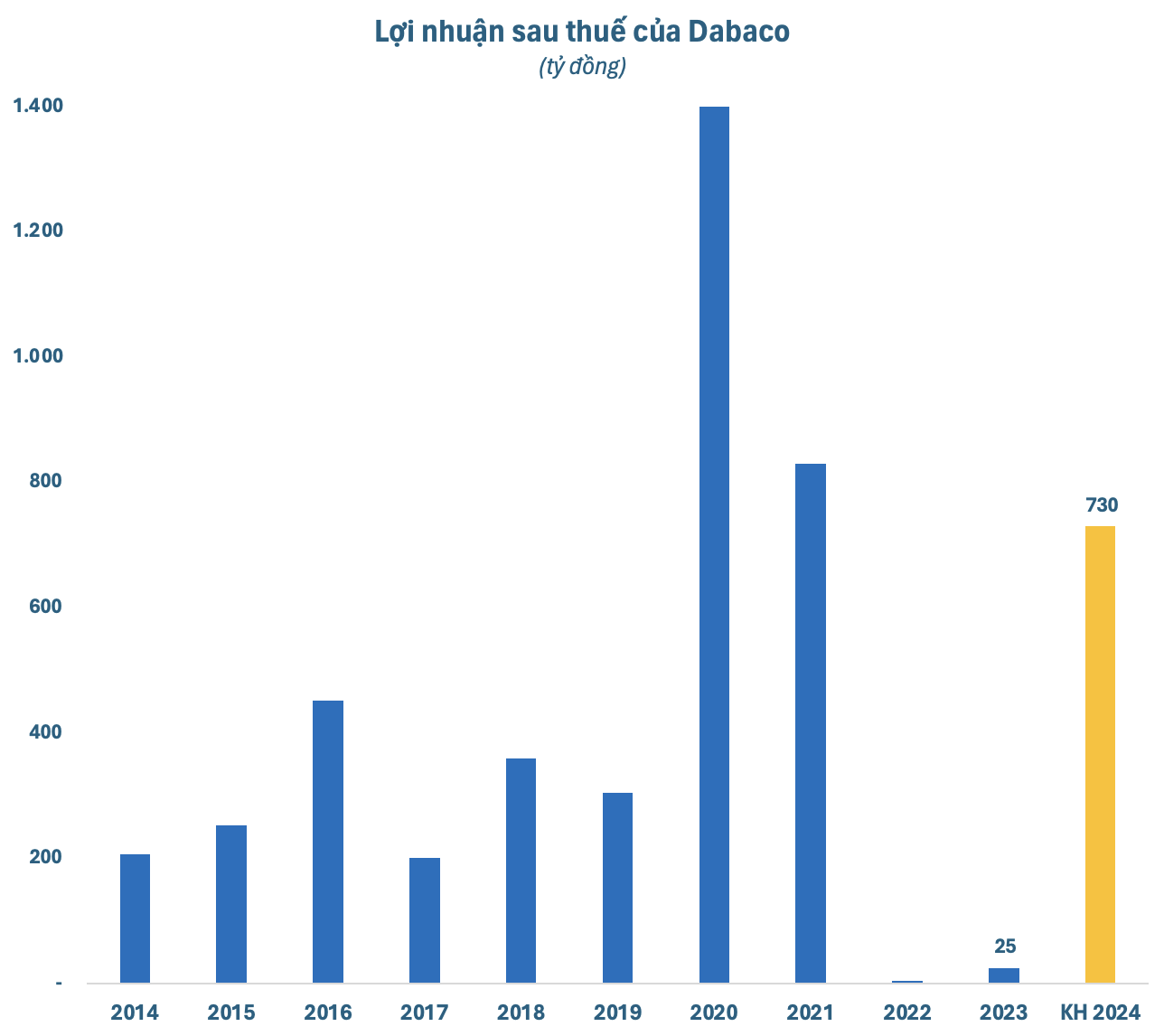

At the meeting, shareholders approved the 2024 business plan, which targets a revenue (including internal revenue) of VND 25,380 billion, representing a 14% increase compared to last year’s performance. The net profit target is estimated at VND 729.8 billion, 29 times the result achieved in 2023.

Dabaco plans to implement various funding options this year, which were approved by shareholders at the GMS:

Dabaco will issue 12 million shares under the Employee Stock Option Plan (ESOP) at a price of VND 10,000 per share to attract and incentivize employees who have made significant contributions and have a long-term commitment to the company. The issuance target is employees who have made positive contributions to the company’s business operations. ESOP shares will be subject to a 12-month transfer restriction from the closing date of the offering.

In addition, Dabaco will offer 80.67 million shares to existing shareholders at a price of VND 15,000 per share (in a 3:1 ratio) to replenish the company’s business operations. Shares offered to existing shareholders will not be subject to any transfer restrictions.

The execution is expected to occur in 2024, after the approval of the State Securities Commission. Dabaco expects to raise over VND 1,330 billion from the two share issuances. The proceeds will be used to invest in Dabaco Vegetable Oil Co., Ltd. to implement the Dabaco Soybean Pressing and Refining Plant Construction and Investment Project.

Upon completion of the two share issuances, Dabaco will proceed with a private placement of 48.4 million shares (equivalent to 20% of the number of shares outstanding at the time of the 2024 annual GMS) to a strategic investor. The shares offered in the private placement will be subject to a 3-year transfer restriction from the closing date of the offering.

The expected offering price will not be less than VND 28,000 per share, corresponding to a minimum fundraising amount of VND 1,355 billion. Dabaco will use these new funds to invest in a breeding farm for producing and trading high-quality piglets and commercial pigs in Dong Thinh commune, Ngoc Lac district, Thanh Hoa province (over VND 930 billion), and to repay bank loans for the High-Tech Pig Breeding and Commercial Farm Project in Thach Thanh district, Thanh Hoa province (approximately VND 425 billion).

Speaking at the GMS, Nguyen Nhu So, Chairman of the Board of Directors, stated that Dabaco’s selected strategic investor is a foreign investor with expertise in agriculture who can leverage existing strengths and complement the group’s shortcomings.

“If Dabaco had agreed to issue shares to mere financial investors, the offering could have been completed long ago. Dabaco does not lack funds and can raise them from various sources. If money were the only concern, I could have acquired the shares offered in this issue. Financial investors who do not understand agriculture can be a headache. The strategic investor must bring global advancements to us,” emphasized the Chairman of Dabaco.

Vaccine Progress Exceeds Expectations, Commercial Release Scheduled for Q3 2024

Regarding the group’s business performance, Chairman Nguyen Nhu So shared details of Dabaco’s operations in recent times and the direction for the upcoming period.

Amidst the challenging pandemic situation, Dabaco made a bold decision to import 10,000 piglets in 2023. Each piglet cost around USD 8,000. “If we had not dared to import pigs last year, Dabaco could have faced a difficult situation this year,” affirmed the Chairman of Dabaco.

Mr. So also disclosed that the group recently imported another batch of piglets, which arrived in Vietnam on April 24. The high-quality piglets have significantly improved productivity for Dabaco. “In our 28-year history, the group has never had such high productivity in our pig herd, surpassing the United States, Canada, and on par with Europe,” shared the Chairman of Dabaco.

Dabaco currently has approximately 50,000 sows and aims to reach 60,000 sows. The group operates partly under the “contract farm” model in collaboration with farmers. The implementation of the livestock law will reduce the scale of this model, necessitating investment in centralized farms as capital assets. Mr. So stated that Dabaco is striving to secure land by 2025, or no later than 2026, to establish a farm to raise 58,000 to 60,000 sows.

Regarding the progress of the factories, the Chairman of Dabaco said that the group expects to complete the second phase of the oil pressing plant around May of next year. The vaccine plant is targeting the completion of testing by May 20 of this year and will undergo GMP assessment.

“The commercial release is expected to be announced early in Q3 2024. The results have exceeded expectations,” said the Chairman of Dabaco about the progress of the vaccine plant, which many shareholders are eager to learn about. “Earlier, on January 2, 2024, Dabaco successfully registered for management with the government. During the peak of the pandemic, in January 2024, the group made a decision to allow internal vaccinations, and the protection recorded to date is 100%. Twenty days ago, the group’s scientific and technical council proposed vaccinating approximately 500 sows.”

Shareholder Questions Addressed by Chairman Nguyen Nhu So at the GMS

Regarding the first quarter profit, the outlook for the second quarter, and the end of the year?

The Chairman of Dabaco stated that the 2024 plan has been carefully and meticulously developed. The production cost is only VND 48,000-51,000/kg. The target sales price is VND 52,000/kg. However, from March to April, the price has fallen short of this target due to the impact of last year’s pandemic. Despite this, Mr. So also predicted that pork prices will remain high as demand continues to outpace supply, and it will take at least 18 months to address the supply shortage.

Dabaco’s first-quarter 2024 profit reached around VND 70 billion. Mr. So emphasized that the 20